Having car insurance coverage for your vehicle can help you protect you as you take to the open road. It removes your risk and gives you the tools you need to reduce your financial burden when involved in a car accident. Understanding your car insurance coverage is essential to staying safe when on the road and protecting yourself and others shouldany car accidents occur. This information will allow you to understand your auto insurance coverage and help you make the best choice when selecting a car insurance company to work with.

What is car insurance?

Car insurance is designed to protect you should you ever become involved in a car accident. This contract between you and your insurance company provides that they will cover any liability you have in the crash. When you consider the vehicle damage and possible injury that may happen in a car accident, car insurance is a safeguard to protect you from having to pay large sums to settle these accident cases. Car insurance also protects you should your vehicle be stolen or damaged by vandalism.

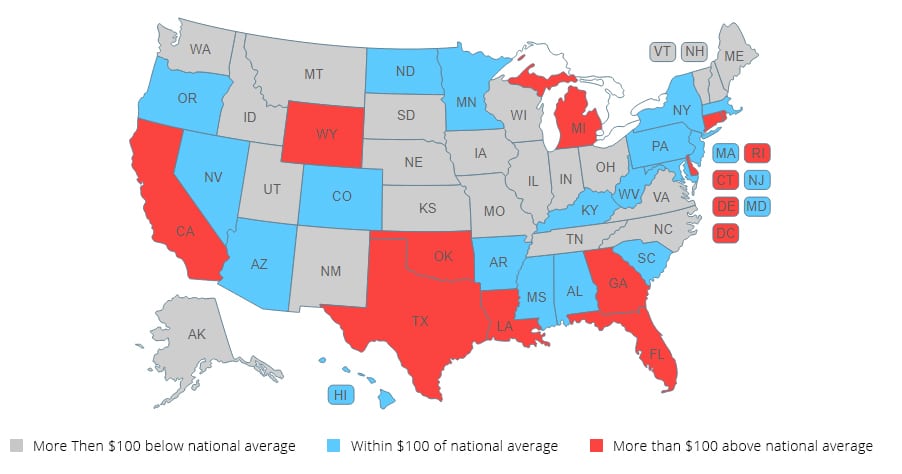

Your Insurance Rates by State

Where you live and your lifestyle will affect your insurance rates. Here are examples of the three most and least expensive states for car insurance for a 35 year old married man:

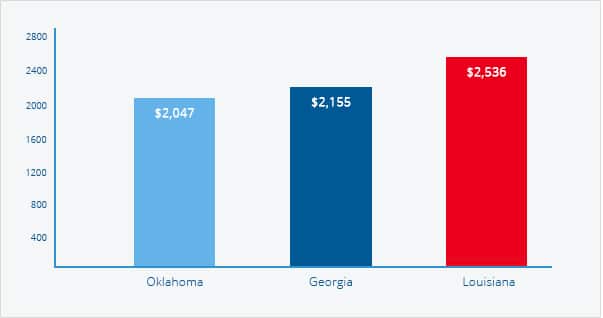

The top three states with the highest car insurance rates:

| States | Highest Car Insurance Rates |

|---|---|

| Louisiana | $2,536 |

| Oklahoma | $2,047 |

| Georgia | $2,155 |

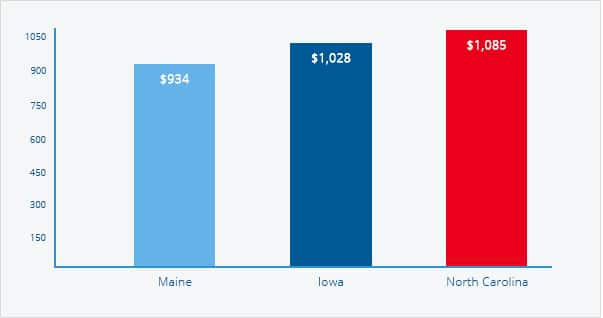

The top three states with the highest car insurance rates:

| States | lowest Car Insurance Rates |

|---|---|

| North Carolina | $1,085 |

| Iowa | $1,028 |

| Maine | $934 |

Types of auto insurance

There are several types of car insurance to consider as a motorist. Each type of auto insurance protects you in a different way, offering coverage for a variety of scenarios. Some types of auto insurance to consider are:

-

Liability:

With liability insurance, you have insurance coverage for any type of accident where you are at fault. This covers property damage as well as injury damage with limits set at the time that you agree to your policy. These limits are the amount that your insurance company will pay to another driver for property damage and injury as well as covering any legal fees that you could incur to settle your case. You are responsible for any monetary settlement beyond the insurance coveragefor bodily injury and property damage as set by your policy.

-

Collision:

Collision insurance covers the damage that occurs to your vehicle in an accident whether or not another driver was involved. This part of your insurance policy has a deductible that you must pay before your collision coverage kicks in. This means that if your collision coverage is $1500 and your deductible is $500, then you have a total of $1000 in collision insurance coverage after you pay your $500 deductible, assuming that your insurance company approves the claim.

-

Comprehensive:

There are times when your vehicle may be damaged by something other than a car accident. You may have a tree fall on your car or experience hail damage from a storm. The collision coverage portion of your insurance policy covers these types of damages and has a deductible that must be paid prior to receiving coverage for your property damage claim.

-

Uninsured/Underinsured Drivers:

If the other driver that you are involved in a car accident with does not have insurance coverage or does not have enough insurance coverage to cover the full extent of treating your injuries or property damage, this part of your insurance policy will cover the remaining costs. This can also protect you if you are injured,or your vehicle is damaged by a hit and run driver.

-

Roadside Assistance:

Your insurance company may offer you the option to add roadside assistance to your auto policy. This offers you roadside assistance should your vehicle have a flat tire, dead battery or other car problem that leaves you stranded on the side of the road. You can simply call your roadside assistance provider to help you in an auto emergency and they will get you back on the road to your destination.

-

Rental Car Assistance:

Having your vehicle repaired after a car accident can be an inconvenience for any driver. Your insurance company offers you the option to add rental car assistance to your auto insurance policy, so you have a vehicle to drive while yours is getting repaired for several days. This usually works out to a certain dollar amount per-day that your policy will cover.

How does auto insurance work?

Your auto insurance is designed to help you financially should you be involved in a car accident. It will cover your losses so that you can move forward with your life without any financial hardship to cover the burden of damages that are sustained.

With auto insurance, you are removing your risk when on the road as your insurance company will assume liability for any injury or damages that occur during a car accident. If you don’t have auto insurance coverage, you assume the risk and are financially responsible for paying for any property damage and injury that happens in a car crash.

How are rates determined?

An insurance company uses a variety of factors in determining the rate for your auto insurance policy. These factors include:

-

If you are driving a new or used vehicle

-

Your vehicle safety rating

-

Your age

-

Your gender

-

Your gender

-

Your zip code

These factors help an insurance company determine the rate to charge you for your auto insurance policy as they determine your probability of getting into a car accident and filing a claim. Some insurance companies offer discounts to drivers that display good driving habits or have multiple policies that also cover their home.

Additional resources

Depending on your circumstances, you may need to find a different auto insurance policy that fits your needs.

- If you need car insurance with bad credit

- If you need car insurance with a bad driving record

- If you need car insurance after a DUI

- If you need high risk car insurance

- If you need car insurance with no down payment

- If you need car insurance for veterans

- If you need car insurance with discounts

- If you need car insurance for college students

Is auto insurance required?

There are laws within 47 states of the U.S. that require all drivers to have auto insurance coverage. Depending on where you live, you may be required to carry a minimum of liability coverage as part of your auto insurance policy. There are some states that also require you to hold collision and comprehensive coverage as a driver. Failure to comply with the auto insurance requirements in your state could result in a fine or jail time if you are unable to prove you have the required coverage to be on the road. Your insurance company can help you understand the auto insurance requirements you need to follow for the state you live in.

What does auto insurance cover?

Having auto insurance helps protect you from being financially responsible for any property damage that occurs to your vehicle in a car crash. It also pays for any necessary medical treatment that you would need should you be injured in a car accident. Depending on the type of insurance coverage you have, your insurance also provides monetary coverage for another driver if you are at fault in an accident. This prevents you from having to pay out of pocket for these property damages and medical costs that could be significant, depending on the severity of the crash you were involved in.

Researching an auto insurance company

Finding an insurance company that provides that auto coverage you are looking for at a rate you can afford, requires some effort and research on your part. Takes some time to look at online reviews for different insurance providers as this can give you a clear indication if you will be satisfied with the services that the provider you are looking to select offers. You also need to consider what your auto insurance needs are and make sure the auto insurance company you are looking to partner with can provide you with all the auto coverage you are looking to retain. Above all, you need to ensure your insurance company is an affordable option for your vehicle coverage. Your insurance company should have discounted rates that are able to fit within your total household budget.

Choosing the right auto insurance company

After you have done some research on the auto insurance company you are looking to work with, you need to ensure they have a strong financial capacity. This will ensure they are able to handle your accident claims without delay. You also need to understand if they use your credit score in determining your policy rate and if this will affect your total policy costs. Look at reviews online to determine if how satisfied other customers of the insurance company are and whether they would continue working with the company after their policy has expired. These online reviews are quite telling for what you can expect from an auto insurance provider that you are looking to work with.

Understanding your policy

There are several parts to your insurance policy that you need to understand. The declaration page outlines:

-

Who is covered

-

What is covered

-

How it is covered

-

How much is covered

-

How long it is covered

Your declaration page is vital to your insurance policy. It will give you all the information you need to know about your coverage. It typically spans a few pages and also includes:

-

How to file a claim

-

What the limits are for each policy section

-

What premiums are charged

The declaration page will also include your contact information,so you need to ensure that is accurate for complete coverage of your vehicle.

Find Car Insurance Rates By State

Filing a claim

Filing a claim with your insurance company should be a relatively straightforward and simple process. Depending on whether you were involved in a car accident or other type of vehicle damage can determine the steps you need to take to file your claim. Follow these steps after a car accident or another type of vehicle damage has occurred.

Get medical attention:

The first step in any car accident is to make sure that everyone involved in the crash is alright. If you or another driver has been injured, you need to get emergency medical attention to treat your injuries immediately after the car crash.

Call the police:

Once you have ensured that everyone is alright, you need to call the police and notify them of the accident. Depending on the severity of the accident and whether or not there were any injuries, the police will come to the scene to document the events of the crash. The police may also take your statement as well as the other drivers over the phone to file an accident report. This report is important to establishing fault in your car accident and will be used by your insurance company to determine what part of your policy covers the accident.

Exchange information:

Be sure to exchange information with the other driver in the car crash. You will need to get their name, address, phone number, insurance provider, policy number, driver’s license number and make and model of vehicles involved in the crash. This will provide you all the information you need to relay to your insurance provider when filing a car accident claim.

File an accident report:

Your state may require that you file an accident report with the DMV or proper authorities about your car crash. You need to submit the proper form for filing a car accident and make sure it is received by the deadline for filing. Failure to notify that the DMV or authorities in your state of a car crash could result in a fine and delay your insurance claim.

Call your insurance company:

Be sure to call your insurance company immediately after the accident to notify them that you are filing a claim for your car accident. They can help you during a car crash by providing you a place to have your car repaired, sending a towing company if necessary for your vehicle, or sending a rental car to pick you up if this is part of your policy. Waiting to call your insurance company could cause you to spend more money that would have been covered by your auto policy.

Work with a claims specialist:

Once your car accident claim has been filed, you will work with a claims specialist for your case. The claims specialist will help you with the repairs of your vehicle by providing the specific repair shops that you need to use to fix your car. They may physically review the damages on your car to determine if it can be fixed and help estimate the total cost of repairs. This claims specialist will be assigned to you for the duration of your insurance claim,and you will most likely work with them over the phone to complete your case.

Receive your claim payment:

Your claims specialist will provide you payment for your repairs once you have both agreed on the services necessary. In order to ensure you receive the maximum payment for your vehicle repairs, you need to follow the instructions of your claim adjuster and allow them to guide you in getting your vehicle repaired. If you try to undertake the repair of your vehicle on your own, you are violating your policy agreement and may not receive the total repair cost you have incurred from your car accident. Your claims adjuster will also help to facilitate your deductible payment if there is one and any other services you need to get back to driving your car on the road again.