Michigan Car Insurance

- Requirements for Michigan Drivers

- Minimum Auto Insurance Requirements in Michigan

- Are Any Auto Insurance Laws Specific to the state of Michigan?

- Ways to Lower Your Auto Insurance in Michigan

- Are Requirements Different for Part-Time or Full-Time Michigan Residents

- Michigan Rates Compared to National Average

Known as the Great Lakes State, Michigan is known for many things. The state’s largest city, Detroit, is known as the car capital of the world. Michigan was the first in several categories, including developing the first air-conditioned car, having the largest Holstein herd, and creating Kellogg’s cereal. Another interesting fact about Michigan is their exceptionally high auto insurance. Learn what is required of Michigan drivers in terms of auto insurance coverage as well as ways you can save on your premiums.

Summary of Auto Insurance in Michigan

Michigan auto insurance policies offer drivers several types of coverages.

Collision

Collision pays for damages to your car when you hit into an object or another car.Comprehensive

Comprehensive pays for damage to your car caused by something other than a collision, such as storms, deer or falling objects.Personal injury protection (PIP)

PIP pays for any accident-related injuries you suffer.Property protection insurance (PPI)

PPI pays for damages you cause to another’s property like buildings or parked cars.Residual bodily injury/property damage liability insurance (BI-PD)

BI/PD will cover your legal costs if you are sued for an accident that meets certain criteria. BI/PD also pays for injuries and damages you cause to others.Uninsured/underinsured motorist coverage

This provides you with coverage from an accident from a driver that has no insurance or an insufficient amount.Towing and labor

This pays to have your car towed if it was involved in an accident.Rental

This pays the fee for a rental car after an accident.

Michigan also has three types of collision coverage.

Limited collision

Your insurance will pay for accident-related repairs to your car if you were less than 50 percent at fault after your deductible is paid. If you are more than 50 percent at fault, you will have to pay for all the repairs.Standard collision

Your insurance will pay for all the repairs once you’ve paid the deductible.Broad form collision

Your insurance will pay for all accident-related repairs to your car whether you were more or less than 50 percent at fault, but will waive the deductible if you were less than 50 percent at fault.

Requirements for Michigan drivers

The Michigan Department of Insurance and Financial Services regulate Michigan auto insurance. Their insurance is a very complex and extensive system with many coverages, conditions and variables.

As one of a dozen no-fault states, Michigan requires drivers to purchase no-fault car insurance, which covers accident-related injuries and damages regardless with no regard as to who was at fault. The no-fault insurance does not cover damages to your car. Their basic no-fault insurance includes the following.

- Personal injury protection

- Property protection

- Residual bodily injury/property damage liability insurance

Michigan drivers can coordinate their PIP coverage with their health insurance. In this case, the health insurance will be the primary payer and the PIP insurance only pays after the health insurance has paid their limit. If an accident makes you unable to work, your PIP coverage will pay up to 85 percent of your normal pay for up to three years with the limit set at $5,452 per month.

The insurance company pays for the PIP portion of your insurance policy, and they are also responsible for paying up to $500,000 in medical coverage.

Personal Property Insurance or PPI will pay up to $1 million for damages you cause to another’s property or their legally parked car. Michigan’s no-fault insurance laws are designed to protect you from being sued after a car accident. However, it will not protect you if the following conditions exist.

- You caused an accident where another person was killed or seriously injured.

- The accident you were involved in was with someone not living in Michigan and the vehicle was not registered in Michigan.

- You were involved in an accident in a state other than Michigan.

- You were more than 50 percent at fault for a car accident that caused uninsured damages to another vehicle.

If you’re sued for an accident where one of the above situations existed, your BI/PD insurance would cover your legal expenses and pay for injuries and damages to others.

Michigan does not have an automated system that tracks which cars are or are not insured. Drivers are expected to show proof of insurance when they register their vehicles and if they’re pulled over by law enforcement. Drivers caught driving without Michigan auto insurance may face the following consequences.

- Fines of $200 – $500

- Up to 1 year in jail

- 30-day license suspension

- Possible lawsuit and held liable for accident-related injuries and damage

Minimum Auto Insurance Requirements in Michigan

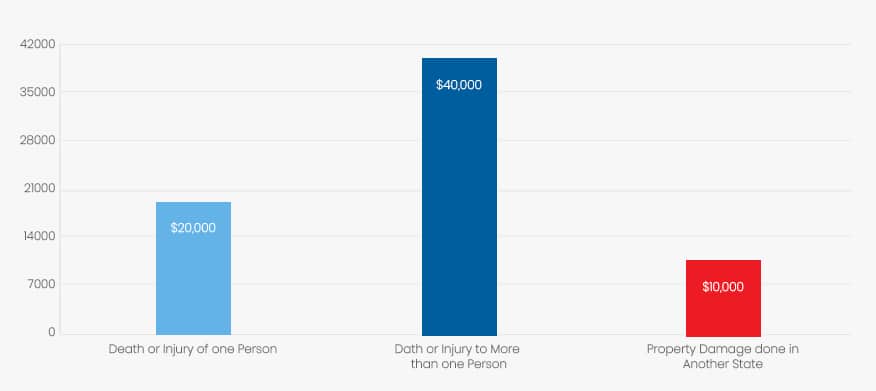

Michigan requires that drivers carry at least the following amounts of BI/PD insurance.

| Coverage | Minimum |

| Death or Injury of one Person | $20,000 |

| The Death or injury to more than one person | $40,000 Per Accident |

| Property Damage done in another state | $10,000 |

Worth noting is that the $10,000 minimum amount for property damage is only for out-of-state claims. The PPI insurance covers drivers in the state of Michigan, and Michigan drivers must carry at least $1,000,000 in PPI insurance.

Drivers who are using their vehicles as collateral on a car loan are also required to carry collision and comprehensive insurance. The lender and not the state require this.

Are Any Auto Insurance Laws Specific to the state of Michigan?

Michigan drivers unable to obtain auto insurance due to poor driving records can purchase policies through the Michigan Auto Insurance Placement Facility (MAIPF).

Michigan drivers injured in car accidents where there was no car insurance can receive personal injury protection from the Michigan Assigned Claims Program (MACP).

All Michigan drivers are required to pay a fee to the Michigan Catastrophic Claims Association (MCCA). This guarantees that all insured drivers will have unlimited medical coverage if they’re injured in an accident. The only exception is if the car is not driven and only covered by comprehensive coverage.

Michigan is the only no-fault state that offers unlimited medical care under the PIP portion of the insurance. Want to learn more about insurance rates in your city, check out Detroit rates here.

Ways to Lower Your Auto Insurance in Michigan

You can lower your premiums by increasing your deductibles or lowering your coverage. Many insurance companies offer discounts to eligible candidates. These discounts may include the following.

- Accident- and Claim-free

- Multi-car discount

- Bundling discount (home and auto with one company)

- Safety devices in vehicle

- Good student discount

Michigan law requires the following discounts be given.

- 10 percent discount to drivers 55 and older who have completed a defensive driving course

- Multi-car discountA 5 percent discount on the comprehensive coverage to drivers who drive a vehicle with an anti-theft protection device installed in the vehicle.

Are Requirements Different for Part-Time or Full-Time Michigan Residents?

The requirements are the same for full-time and part-time Michigan residents. You are not considered a resident of Michigan until you have a Michigan driver’s license. Once individuals apply for their license, they must show proof of the required amounts of Michigan car insurance.

Michigan Rates Compared to National Average

Michigan has the nation’s highest car insurance rates for 2017 and has for the past few years. Two reasons for this are the Michigan’s mandatory high no-fault insurance requirements and the high amount of insurance fraud. Approximately 10 percent of all no-fault claims are fraudulent, according to the Michigan Insurance Fraud Awareness Coalition.

This fraud costs Michigan residents between $100 and $200 each year in premiums. The average annual cost for insurance in Michigan is $2,394 while the national average is only at $1,318. While the average for Michigan is $2,294, drivers in some Michigan cities experience much higher insurance premiums. Drivers in Detroit may pay premiums from $5,000-$6,000 annually.

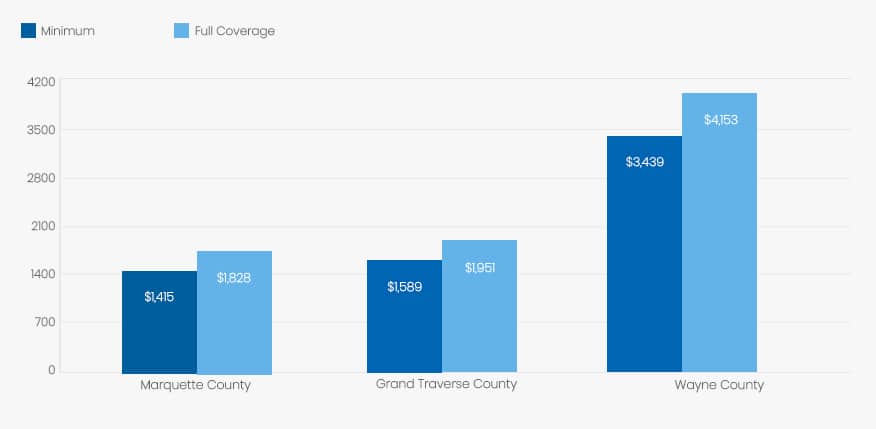

Average Rates in Top Three Michigan Counties

To give you an example of how the Michigan car insurance rates can fluctuate from county to county, I’ve provided rates for a 45-year old, married woman with a good driving record. Take note on the differences between Marquette County, which is up in the Upper Peninsula, and Wayne County, which is in the southern part of the state.

| City | Minimum Coverage | Full Coverage |

| Marquette County | $1,415 for state minimum liability | $1,828 for full coverage |

| Grand Traverse County | $1,589 for state minimum liability | $1,951 for full coverage |

| Wayne County | $3,439 for state minimum liability | $4,153 for full coverage |

In Summary

Living and driving in Michigan can be very costly even if you carry only the legal required amounts of liability insurance. It makes it apparent how important it can be to have a good driving record and to utilize methods that make you eligible for discounts off your premiums. Whether you carry insurance may not be a choice, but getting the very best rates is something you can try to achieve.