Massachusetts Car Insurance

- Requirements for Massachusetts Drivers

- Minimum Auto Insurance Requirements in Massachusetts

- Are Any Auto Insurance Laws Specific to the state of Massachusetts

- Ways to Lower Your Auto Insurance in Massachusetts

- Are Requirements for Part-Time or Full-Time Massachusetts Residents?

- Massachusetts Rates Compared to National Average

Although only 14 counties make up the Bay State, Massachusetts is the most populous state in the New England region. Years ago, many settlers built their colonies in the bay, giving it the nickname Bay State. Today that bay area is filled with industry and many traveled highways. All these drivers must carry auto insurance, so it’s important to know what’s required in this state.

Summary of Auto Insurance in Massachusetts

Massachusetts auto insurance companies offer many types of policies. Some of the coverage types are required and some are optional. They include the following.

Bodily injury liability

This protects you from liability if you cause an accident that requires payment for medical expenses, lost wages, etc.Property damage liability

This protects you from a lawsuit for damage done to someone else’s property.Personal Injury Protection (PIP)

This protects you and your passengers if you’re involved in an accident regardless of who caused the accident.Collision

This pays to have your vehicle repaired or replaced if it’s damaged from an accident where you hit into something.Comprehensive

This pays to have your vehicle repaired or replaced when it was involved in an accident that was not a collision, such as falling objects, storm damage, theft or vandalism.Rental reimbursement

This pays the cost of a rental vehicle while your vehicle is being repaired after an accident.Bodily Injury Uninsured/underinsured motorist coverage

This pays for damages stemming from an accident where the other driver either had an insufficient amount of insurance or had not insurance at all.

Comprehensive and collision coverage also includes a deductible, which is the amount you must pay on a claim before the insurance company pays anything. If your car is damaged and requires $5,000 in repairs, and you have a $500 deductible, your insurance company will pay $4,500 and you pay $500.

Requirements for Massachusetts Drivers

Although collision and comprehensive coverage is not a required in Massachusetts, you’ll need to purchase this coverage if the vehicle is used as collateral on an auto loan. Even if there is no loan on the car, most owners choose full coverage so ensure their car is protected in case of an accident. Below are the coverages drivers are required to carry in Massachusetts.

- Bodily Injury to Others

- Personal Injury Protection (PIP)

- Uninsured Auto Bodily Injury

- Property Damage to Others

Minimum Auto Insurance Requirements in Massachusetts

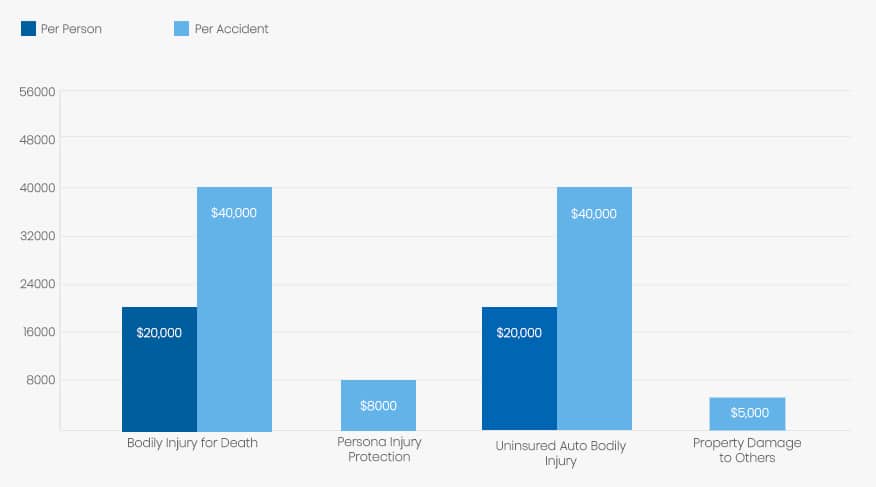

Drivers in Massachusetts are not only required to carry certain types of auto insurance but are also required to carry certain limits. Although you can purchase higher amounts of liability coverage, below are the minimum amounts you must purchase to legally drive in Massachusetts.

| Coverage | Minimum |

| Bodily Injury to Others | $20,000 per person |

| Bodily Injury to Others | $40,000 per accident |

| Personal Injury Protection | $8,000 per accident, per person |

| Uninsured Auto Bodily Injury | $20,000 per person |

| Uninsured Auto Bodily Injury | $40,000 per accident |

| Property Damage to Othersy | $5,000 per accident |

All licensed drivers living in your home who are related to you must be listed on your auto insurance policy. If you have household members who don’t drive, they can be excluded from your policy if you sign an exclusion form. In Massachusetts, drivers are not required to carry proof of insurance such as insurance cards. Your proof of insurance is on your registration so as long as your vehicle is registered, you should be good.

Are Any Auto Insurance Laws Specific to the state of Massachusetts?

In an attempt to decrease or prevent traffic accident, the Massachusetts Safe Driver Insurance Plan (SDIP) requires that unsafe drivers pay higher premiums while safe drivers receive discounts on their auto insurance. The SDIP utilizes a merit-based rating system that gives points to good drivers and surcharge points to unsafe drivers who have received tickets or been in at-fault car accidents.

The more surcharge points you have, the higher your premiums will be. Massachusetts car insurance companies have the choice of using the SDIP system or imposing their own credit-code system where they assign code numbers to good drivers. The code numbers help determine what rates drivers will have to pay.

Massachusetts is one of several no-fault insurance states. This means that if you’re in accident, regardless of who caused the accident, your insurance company will up to $8,000 of your medical bills. These payments are referred to as First-Party Benefits.

Payments can also be made using Massachusetts’s Third-Party Benefit system. These payments can be made for lost wages, death or disfigurement, or pain and suffering. Drivers at fault can be sued for third-party benefits in Massachusetts.

Drivers who are considered high-risk by insurance companies may be turned down when they apply for insurance. To ensure that all drivers have insurance, the Massachusetts Auto Insurance Plan offers insurance for these drivers.

In most states, your insurance premiums are based on a group of factors like age, marital status, type of vehicle, etc. Massachusetts has specific laws regarding what can and cannot be used to determine rates.

Ways to Lower Your Auto Insurance in Massachusetts

In Massachusetts, auto insurance companies can use the following factors to determine what rate you’ll pay for car insurance.

- Your age

- Years you’ve been driving

- Where you live

- Make and model of your vehicle

Insurance companies in Massachusetts are not allowed to use the following factors to determine your rates.

- Your gender

- Your race

- Credit score

- Marital status

- Your job

- If you’re a homeowner

Auto insurance companies in this state tend to put a lot of emphasis on the factors they can use because of the many that can’t be used. Because of the different restrictions on what can and cannot be used, Massachusetts drivers tend to rely more on discounts to get savings on their premiums.

Insurance companies all offer discounts of some kind; however, they don’t all offer the same discounts. The best way to do an accurate comparison of insurance company’s is to ask what discounts each company offers. Some examples of discounts you may find include the following.

- Vehicle safety feature discount

- Hybrid vehicle discount

- Teen driver discount

- Multi-policy discount

- Preferred payment discount

- New customer discount

- Good student discount

- New graduate discount

- Senior discount

When drivers purchase new vehicles, they often contact their insurance agent to see what type of premiums will come with that vehicle. We often think it’s based on its color, if it’s a sports car or expensive to fix. While these factors may make a difference, some vehicle are also more prone to theft, which can also put them in a higher category.

- 1997 Honda Accord

- 1998 Honda Civic

- 2015 Toyota Corolla

- 2005 Toyota Camry

- 2000 Dodge Caravan

- 2015 Nissan Altima

- 1999 Honda CR-V

- 2004 Ford full-size pickup

- 2000 Jeep Cherokee/Grand Cherokee

- 2007 Chevrolet full-size pickup

Increasing your deductible can also give you lower premiums.

Are Requirements Different for Part-Time or Full-Time Massachusetts Residents?

Insurance requirements are the same for full-time and part-time or temporary residents. It is possible for a resident of another state to apply for temporary Massachusetts plates as long as the registration from the driver’s home state is valid. Since all the states require drivers to carry insurance on their vehicles, the car will be insured in the state in which the driver lives. Therefore, the individual will not have to purchase Massachusetts auto insurance.

Massachusetts Rates Compared to National Average

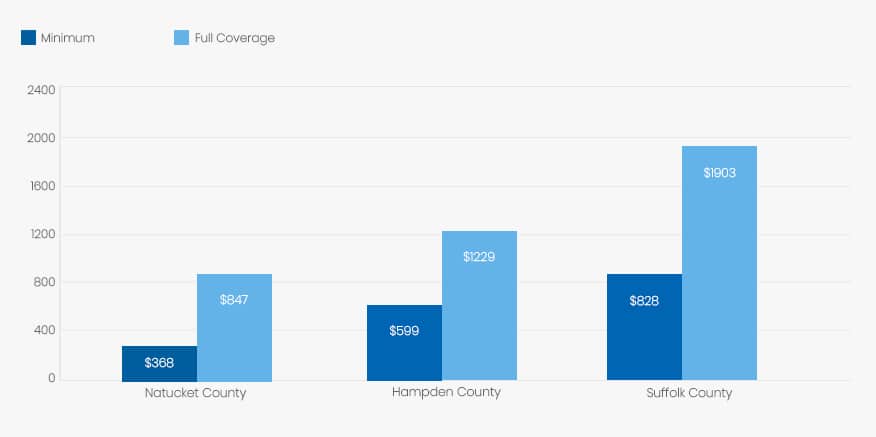

Massachusetts auto insurance rates may fluctuate from county to county but are lower than in many other states. The average annual insurance premium in Massachusetts is $1,191, and the national average is $1,355.

Average Rates in Top Three Massachusetts Counties

Massachusetts car insurance rates appear to fluctuate from county to county with higher rates typically in the larger counties. Using the example of a married woman who is 45 years old and a safe driver, I’ve compiled the auto insurance rates she would pay in three different counties. The annual rates listed below are for both full coverage and the state’s minimum amount of liability.

Summary

Not enough can be said about the importance of carrying auto insurance. Whether you’re purchasing it because it’s required by law or are purchasing full coverage by choice, auto insurance offers monetary protection on what may be the second largest purchase you make. It can also protect you from lawsuits that can take everything you’ve worked hard to obtain. It’ definitely well worth the cost for the peace of mind it can provide.

| County | Minimum Coverage | Full Coverage |

| Nantucket County | $368 for state minimum liability | $847 for full coverage |

| Hampden County | $599 for state minimum liability | $1,229 for full coverage |

| Suffolk County | $828 for state minimum liability | $1,903 for full coverage |

Take note of the difference between Nantucket County and Suffolk County. Where you live really does make a difference in Massachusetts.

Conclusion

Whether you live in Boston and need car insurance or tucked away in a little cabin in Nantucket, you’re going to need car insurance if you plan to drive on Massachusetts roads. Providing yourself with the best possible insurance policy can offer protection for you, your family and your vehicle. Shopping around, doing your research and being a safe driver is the best way you can save money on your auto insurance. As long as it’s something you have to have, you may as well get the best possible deal.