New Mexico Car Insurance

- Requirements for New Mexico Drivers

- Minimum Auto Insurance Requirements in New Mexico

- Are Any Auto Insurance Laws Specific to the state of New Mexico

- Ways to Lower Your Auto Insurance in New Mexico

- Are Requirements for Part-Time or Full-Time New Mexico Residents?

- New Mexico Rates Compared to National Average

Known as Wine Country, New Mexico is a state with many interesting attributes. If you’re on top of Capulin Volcano, you can see five other states. New Mexico was also home to Doc Holliday and the origin to Smokey the Bear. It’s not only an interesting state to live but also a great spot for vacationers, making car insurance a necessity as well as the law. Continue reading and learn all about the legal requirements for car insurance in New Mexico as well as ways you can lower your premiums.

Summary of Auto Insurance in New Mexico

There are hundreds of automobile insurance companies in New Mexico. While that may seem like a large number, large insurance companies underwrite many of them. If you’re looking for full coverage auto insurance, you’ll find that most companies will offer the following types of coverage.

- Collision coverage will help pay to have your vehicle repaired after xit is damaged from you collided into another vehicle or object.

- Comprehensive coverage pays to replace or repair your vehicle when it is damaged from a non-collision accident such as storm damage, falling objects, animal kills, theft and vandalism.

- Medical payment coverage helps pay for accident-related expenses such as funeral or medical bills and legal bills for lawsuits.

- Bodily injury liability coverage helps pay for damages you or a family do to others in an accident. These may include pain and suffering, medical expenses, funeral expenses, lost wages or legal counsel for lawsuits.

- Property damage liability coverage pays for damage to another person’s property by you or a passenger in your vehicle.

- Uninsured/Underinsured motorist coverage helps pay for damages caused by a driver who either doesn’t have any insurance or has an amount insufficient to pay expenses from damage.

When you purchase a policy that includes comprehensive and collision, you will have to pay a deductible each time you submit a claim. The deductible is the amount you pay before the insurance company pays their portion.

For example, if your vehicle requires $4,000 in repairs, and you have a $1,000 deductible, you will pay the $1,000 and the insurance company pays $3,000. The lower your deductibles, the higher your premiums will be on your policy.

Requirements for New Mexico Drivers

The coverages listed above are not all required by New Mexico drivers. Below is the type of insurance coverage drivers are required to carry to legal drive on New Mexico roads.

- Bodily Injury

- Property Damage

- Uninsured/Underinsured Motorist Coverage

Surprising as it may be, approximately 30 per cent of accidents in New Mexico are caused by drivers not carrying auto insurance despite the legal requirements. This is the reason why New Mexico auto insurance companies are required to offer drivers uninsured and underinsured motorist coverage and inform them of the rates for this coverage. If you don’t want uninsured/underinsured coverage, you can sign a waiver stating that you don’t wish to purchase this coverage.

When you purchase your auto insurance policy, your insurance company is required to send verification to the Insurance Identification Database (IIDB). According to the state’s Mandatory Financial Responsibility Act, you are required to carry proof of insurance with you Any time you are driving your vehicle. Proof of insurance can be in the following forms.

- A valid insurance card

- A copy of your insurance policy

- A letter from your insurance company (with letterhead) verifying coverage

Your proof of insurance must not only be with you at all times but must also has provide the following information.

- Name of the Insurance Company

- Your Policy Number

- Effective Date of Policy

- Expiration Date of Policy

If your insurance lapses and you receive a Notice of Noncompliance from the Division of Motor Vehicles, you must get the insurance reinstated immediately. If the IIDB doesn’t receive notification within 30 days, your vehicle’s registration will be suspended.

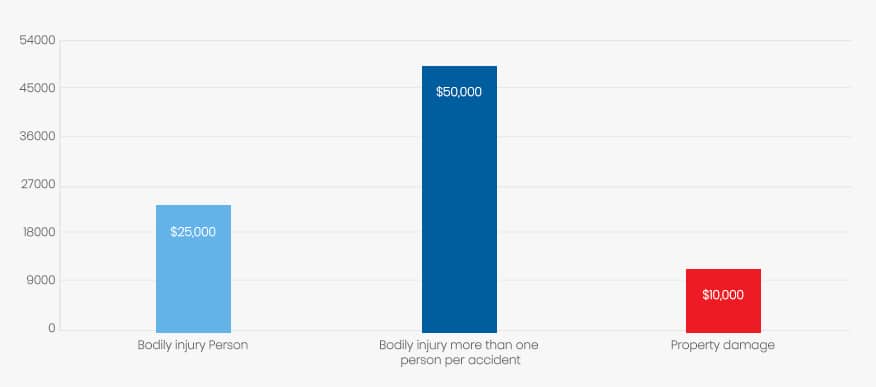

Minimum Auto Insurance Requirements in New Mexico

To legally drive in New Mexico, you are required to carry at least the following amounts of liability insurance.

| Coverage | Minimum |

| Bodily injury | $25,000 Per Person |

| Bodily injury | $50,000 for more than one person per accident |

| Property damage | $10,000 per accident |

On your policy, those amounts will be listed as 25/50/10. Although the amounts listed above are the minimum amount you must carry, you have the option of purchasing higher amounts. In fact, the insurance industry recommends that you purchase at least $100,000 bodily injury per person and $300,000 bodily injury per accident. This would be listed as 100/300/10. Most settlements for auto accidents result in payouts of six figure amounts.

Are Any Auto Insurance Laws Specific to the state of New Mexico?

According to New Mexico state laws, property damage coverage requires a $250 deductible. If another driver causes the accident, you should be reimbursed the deductible when the other person’s insurance pays your insurance company.

If a vehicle owner’s registration is suspended due to not having insurance, the owner must return the plates and registration to the DMV within ten days of getting the Notice of Suspension letter.

Drivers who are considered at-risk drivers, whether from many claims, speeding tickets or too many accidents, may not be able to purchase auto insurance from the open market. However, they have the option of purchasing auto insurance Assigned High Risk Insurance Plans. While the premiums are going to be higher, the driver is ensured that he or she will have insurance

Ways to Lower Your Auto Insurance in New Mexico

Regardless of how much we pay for car insurance, we always seem to feel we’re paying too much. What many don’t realize is that there are several factors that help determine our New Mexico car insurance.

- Your age

- Your gender

- Your marital status

- Your driving record

- Your credit scores

- Your geographic location

- What kind of vehicle you drive

- Purpose of driving and miles you drive

While some factors appear to be “cut in stone” like age and gender, others can be changed to get better rates. If you know you’ll be shopping for insurance, you may want to check your credit scores and attempt to improve them. Most insurance companies also offer discounts for many things. Ask different companies what discounts they offer and which ones apply to you. Some possible discounts include the following.

- Good student discount

- Senior discount

- Safe driver discount

- Auto-payment discount

- Safety device discount

- Auto renewal discount

- Multiple-vehicle discount

- Multiple-policy discount (home and auto insurance with same company)

- Defensive driver course discount

It can’t be stressed enough the importance of shopping around with different insurance companies to get the lowest possible rates. Discounts can also be used as great bargaining tools to get an insurance company to try to match a competitor. This will prove to be especially helpful if you have a good driving record. Check out insurance rates in Albuquerque here.

Are Requirements Different for Part-Time or Full-Time New Mexico Residents?

The insurance requirements are the same for part-time and full-time residents in that they are required to carry insurance any time they are driving on public roads. This is the case in all the states. However, some special conditions may apply regarding car insurance and where it’s purchased.

If you are living in another state but your car is registered in New Mexico, you must still have auto insurance on it, and you must submit the insurance verification to the IIDB. This might apply to someone working in another state or in the military but stationed elsewhere. Each time your policy comes up for renewal, you will need to ensure that your insurance company submits verification to the IIDB

New Mexico Rates Compared to National Average

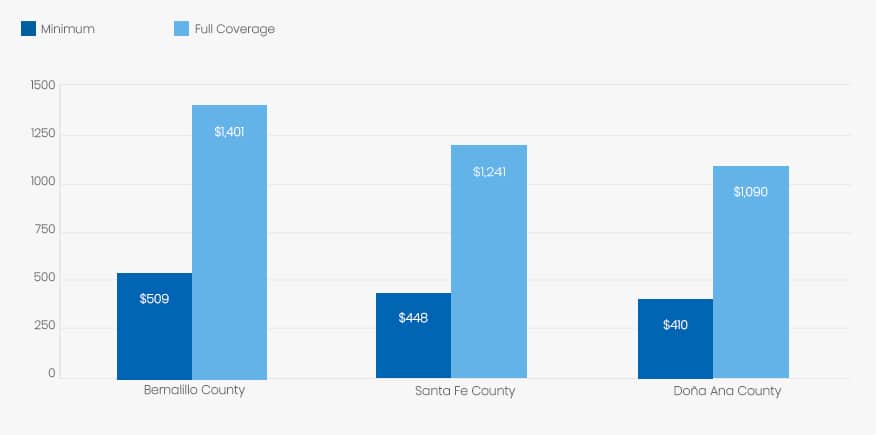

New Mexico rates for car insurance average about $1,253 annually, which is slightly below the national average of $1,355. Rates can vary from one city to the next, but overall their rates are in the middle when ranking the rates of all the states.

Average Rates in Top Three New Mexico Counties

As mentioned above, different factors affect the rate you’ll pay for car insurance. To demonstrate this, you can look at the rates below from three different counties in New Mexico. These rates are all for a married woman who is 45 years old and has a good driving record. You can see how much they vary in just these three counties.

| City | Minimum Coverage | Full Coverage |

| Bernalillo County | $509 for state minimum liability | $1,401 for full coverage |

| Santa Fe County | $448 for state minimum liability | $1,241 for full coverage |

| Doña Ana County | $410 for state minimum liability | $1,090 for full coverage |

Conclusion

Now that you’re armed with all the information you need on New Mexico car insurance, you’re probably ready to start shopping around and comparing prices. The importance of comparison shopping and asking about discounts cannot be overemphasized. The lower your insurance premiums, the better coverage you’ll be able to purchase. Above all, continue to be a safe driver, and you’ll continue to get the lowest rates possible.

Sources:

- http://www.mvd.newmexico.gov/vehicle-insurance.aspx

- http://www.rmiia.org/auto/steering_through_your_auto_policy/Auto_Insurance_New_Mexico_Requirements.asp