The state of Louisiana mandates that any vehicle operated in the state has the following minimum required liability coverage amounts:

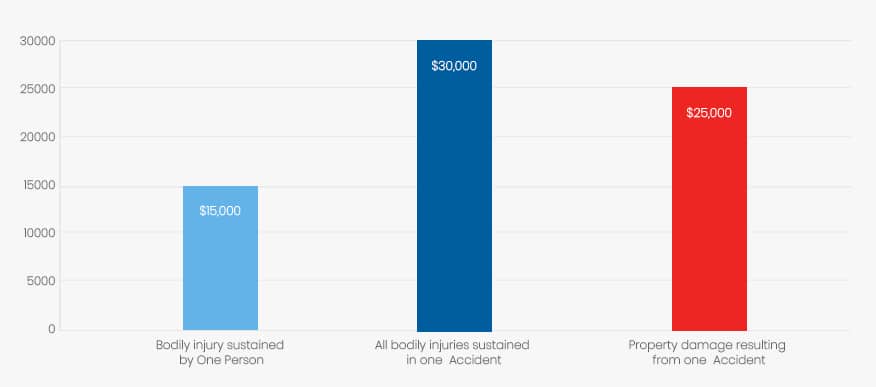

On a vehicle weighing a gross 20,000 pounds or less:

| Coverage | Minimum |

| Bodily injury sustained by one person | $15,000 |

| Bodily injury sustained by one person | $30,000 |

| Property damage resulting from one accident | $25,000 |

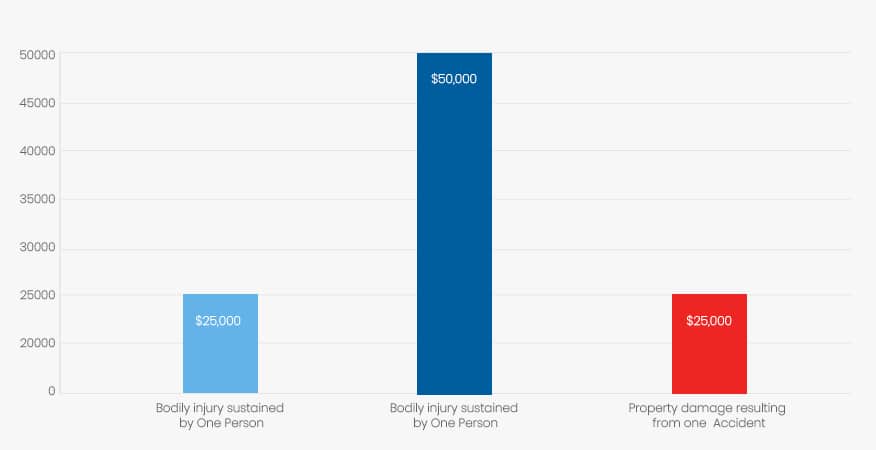

On a vehicle weighing between a gross 20,001 and 50,000 pounds:

| Coverage | Minimum |

| Bodily injury sustained by One Person | $25,000 |

| All Bodily Injuries Sustained in one Accident | $50,000 |

| Property Damage Resulting from one Accident | $25,000 |

*This may be replaced with a single combined limit of at least $75,000 of coverage

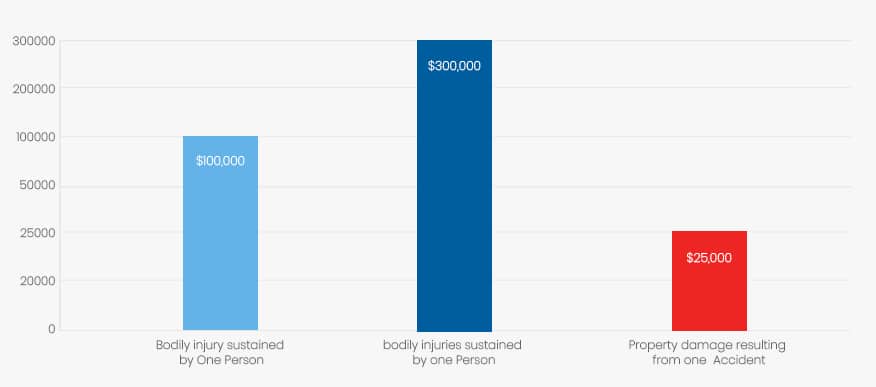

On a vehicle weighing over 50,001 pounds

| Coverage | Minimum |

| Bodily injury sustained by one person | $100,000 |

| All bodily injuries sustained in one accident | $300,000 |

| Property damage resulting from one accident | $25,000 |

*This may be replaced with a single combined limit of at least $300,000

You have some alternatives

The Louisiana Office of Motor Vehicles requires that vehicles either provide proof of these policy limits on their coverage, be granted as self-insurer with the U.S. Department of Transportation, be qualified as self-insurer with the state of Louisiana, or present proof of regulation by the Public Service Commission prior to registering or renewing the registration of any vehicle.

Keep your proof of insurance up to date and always on hand when driving

Louisiana’s Department of Transportation and Development requires every driver to have this insurance with narrow exceptions. Also, be sure to keep your valid and current proof of insurance card on hand at all times when driving — you will need to present it if ever pulled over by the police or involved in an accident. Without it, you may receive a citation.

Ways Louisiana Insurance Requirements are Unique

A lapse in car insurance coverage is not a good thing In Louisiana

Any lapse in automobile insurance coverage in Louisiana automatically flags your driver’s license with the state, which will prevent you from renewing your registration. You may also be fined $50 for being without insurance for up to 30 days, $150 for longer than 30 days, and $300 for longer than 90 days.

New Orleans has some challenges

Since the city was mostly built prior to the invention of the automobile, it can be tricky to navigate certain areas. For many tourists and locals alike, walking or public transportation is often advised. Since its also set below sea level, it can tend to flood from time to time — a concern not only for buildings in the area, but also cars. Be sure to compare rates for your best price in the Big Easy, as they can range considerably!

How does Louisiana measure up on automobile insurance rates nationally?

Louisiana rates around 8th in the nation on premium, (although some estimates put them closer to the highest in the nation, having risen to $2500 in some cases since Hurricane Katrina) so you can expect to pay higher than the average amount for car insurance here. For example, the average driver can expect to see a rate of at least $967 on a combined average premium where the national average is around $817.

To get more specific, we compared drivers in the top 3 most populous Louisiana cities. By our research, using the tool on the Louisiana government website, an 18-year-old male with a 2011 Toyota Camry having had:

- One at-fault accident 18 months ago

- No other moving violations

- Uses his car primarily for commuting to work 30 miles round-trip

- Travels appx15,000 miles annually

Can expect to spend between $1400 and $4790 for a 6-month liability insurance policy in Baton Rouge, Louisiana. The same driver in Shreveport could expect to pay between $1100 and $6000, while in New Orleans, Louisiana the same driver could spend between $1600 and $11,500 on the same policy. The difference in rates based upon location in Louisiana is, as you can see, quite drastic.

Ways to Lower Your Rates in Louisiana

There are ways to lower your rates in Louisiana as several possible discounts may apply to you or your household.

Discounts may be given for a variety of reasons in Louisiana Some of them include:

Despite Alabama requiring all drivers to carry insurance, auto insurance companies do have the right to deny coverage to drivers they consider as high risk. These high-risk drivers can purchase their car insurance through the Alabama Auto Insurance Plan.

- Active military discounts

- Bundle discounts for multiple cars or multiple policies in one household

- Student-away-at-college discount for students attending college at least 100 miles away from home who leave their car at home while attending

- Homeowner discounts for responsible home ownership

- Paying in full discounts (pay in full up front rather than in installments)

- Claims-free or accident-free discounts, generally if you have not been in an at-fault accident or received a moving violation within a certain number of years

- Good grades driver discounts, usually for at least a B or 3.0 GPA, Dean’s List or Honor Roll students, or scores in the top 20 percent of national standardized tests

- Mature driver discounts, if driver is 65 years old or older

- Successful completion of an approved driver’s education program

- Anti-theft device discounts

- Anti-lock brake discounts

- Passive restraint discounts (for air bags, etc., usually factory-installed)

- Pay early discounts, generally used if paying a week or more before due date of policy renewals

In general, aside from applying discounts when possible, drivers who maintain a good driving record, remain sober, cautious and law-abiding and avoid texting at all times while driving, make sure their household members also remain responsible drivers, and keep their credit scores as high as possible can keep their premium rates low.

For more details, you may visit:

Louisiana Department of Public Safety Office of Motor Vehicles

Louisiana Department of Insurance Automobile Insurance Rate Comparison Guide

Louisiana Department of Insurance Consumer’s Guide to Auto Insurance