What is No Fault Insurance?

No fault insurance is a term used to describe a type of vehicle insurance that allows you to be paid by your insurer for damages no matter who was at fault in an accident. The proper term for no fault is personal injury protection (PIP). In some states PIP is required but it is not available in all states, so where you live will determine whether or not you need no fault insurance on your policy.

Basically, with no fault insurance the motorist is not allowed to sue for damages unless the case meets certain criteria called a “threshold,” meaning the injuries must be above a specific amount. According to the Insurance Information Institute (III) these thresholds are designed to reduce delays and costs in claims payments and make the process run smoothly.

No fault insurance was introduced in the 1970’s with the goal of eliminating the proof of fault required for insurance claims. Essentially, without no fault a claim is paid by the insured motorist who was more than 50 percent at fault for causing an accident. Claim payouts can be delayed if an accident case is contested in court because it’s unclear which party caused the accident or one insurer sues the other party for damages. At fault insurance also affects the policy holder in regards to their responsibility of paying or not paying the deductible that is set in their policy if it depends on the person who caused the accident.

No fault insurance affects medical costs, not vehicular damages. In other words it pays for the cost of injuries, which is why it is called Personal Injury Protection (PIP) for you and any passengers in your vehicle. This is a specific amount as outlined in your policy and may include lost income, household expenses, and childcare costs if you are unable to work.

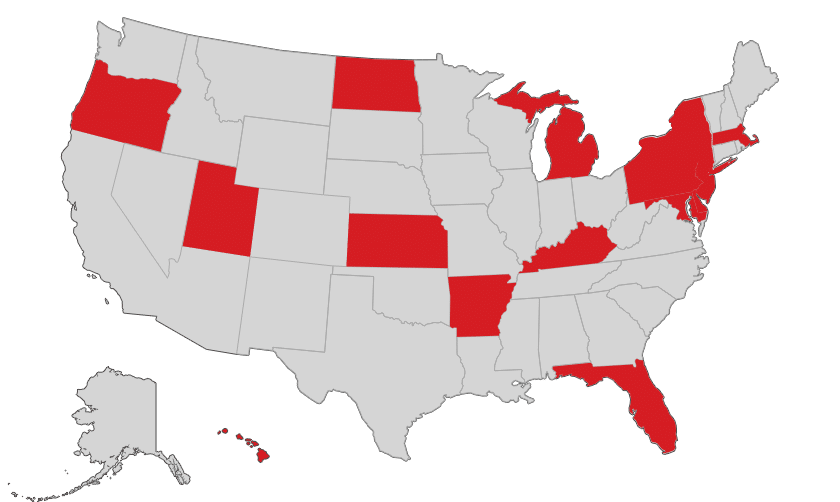

States that are No Fault

As of 2017 the following states require drivers to carry no fault insurance on their vehicle policy:

-

Arkansas

-

Delaware

-

Florida

-

Hawaii

-

Kansas

-

Utah

-

Kentucky

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

New Jersey

-

New York

-

North Dakota

-

Oregon

-

Pennsylvania

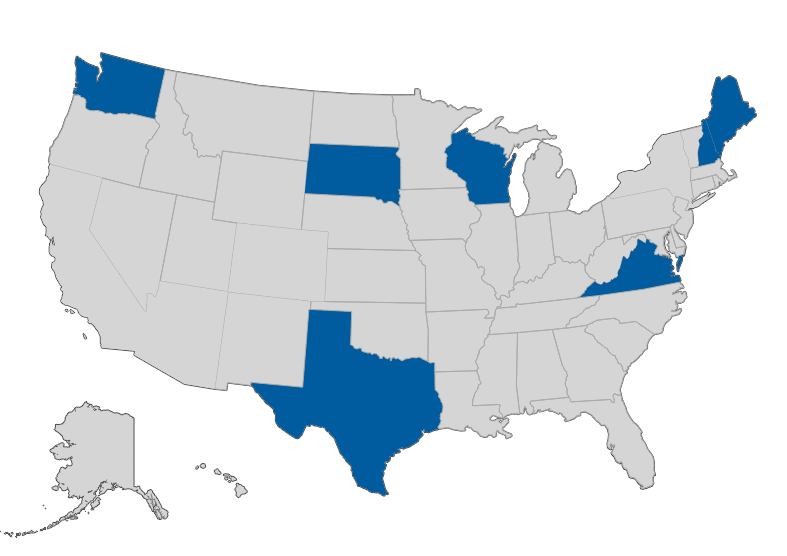

In addition, no-fault insurance is an optional purchase in these states:

-

District of Columbia

-

New Hampshire

-

South Dakota

-

Texas

-

Virginia

-

Washington

-

Wisconsin

What does No Fault Cover?

Typically there is a limit set on medical costs and if treatments for your injuries go above that limit you may sue the party at fault for excess medical fees.

Besides medical costs no fault insurance will also pay for damage done to property (other than vehicles) belonging to others, such as buildings and fences. It will pay for vehicle damage if you hit a car that is parked properly but not when a vehicle is being driven.

Although the specific coverage varies from state to state a no fault policy in most cases will only allow injured parties to apply for damages that aren’t covered by your personal health insurance. That means if your health benefits cover all medical costs for injuries your no fault insurance pays nothing but if there is a deductible on your health care insurance it will most likely be covered by your no fault policy.

Depending on the state you live in your no fault insurance will allow you to seek damages for pain and suffering damages only in case of serious injury which is defined in one of two ways:

- A qualitative verbal threshold states specific categories of injuries that are considered serious, such as permanent disability or disfigurement. This removes any incentives to exaggerate damage amounts but on the other hand has the possibility of a broad interpretation that can lead to overcompensation in some cases.

- A quantitative monetary threshold states the victim must reach a specific amount spent on medical treatment before a tort can be considered. The downside of this method is that it can lead to medical providers as well as the insured to exaggerate costs. It can also be a disadvantage if inflation raises costs without the policy being adjusted accordingly.

How does no Fault Car Insurance Work?

No fault covers the medical expenses of the passengers and driver in the insured vehicle when an accident occurs. Here’s an example of an accident in a state with no fault insurance:

Vehicle A is driven by Bob, who is driving alone and in a rush to get to work on time. Vehicle B is being driven by Larry, who is driving his son and a neighbor child to school.

Bob in vehicle A runs a stop sign and hits vehicle B. Bob is injured, as are Larry and the two children in vehicle B.

Because they live in a no fault insurance state Bob’s insurance will pay for all of his medical expenses. Although the accident was not his fault the same holds true for Larry: his insurance will pay for the medical expenses of himself, his son, and the neighbor child who was a passenger in the car. There is no dispute over who caused the accident, so each driver will be paid in a timely manner by his own insurer.

Let’s look at the same scenario in an at-fault insurance state to give you an idea of the difference:

Although Bob in vehicle A ran a stop sign, there is no adult witness other that Larry in vehicle B. Because of the damages to the cars the police ticket Bob for causing the accident, so Larry can file a claim against Bob’s insurance carrier for medical costs for himself and the two children.

Larry’s insurance company requests copies of all medical treatment bills before they will issue payment. Several bills are in dispute, and Larry must file a lawsuit and spend months in the court system before the payments are made.

As you can see, no fault insurance simplifies the process for medical payments by streamlining the steps required for treatment payments. If you have no fault insurance all you need to do is submit the claim to your own insurer and they’ll do the rest.

How much is no Fault Insurance?

The cost of your no fault insurance will depend on many factors such as your age, driving experience, and any previous driving infractions you may have had. That being said, by looking at the following chart from the National Association of Insurance Commissioners (NAIC) you can see that no fault insurance is in effect in seven out of the top ten most expensive states for vehicle insurance in 2017:

| Rank | Most expensive states | Average expenditure |

| 1 | New Jersey | $1,263.67 |

| 2 | Michigan | 1,227.36 |

| 3 | New York | 1,205.03 |

| 4 | Louisiana | 1,192.92 |

| 5 | District of Columbia | 1,192.45 |

| 6 | Florida | 1,140.84 |

| 7 | Delaware | 1,125.74 |

| 8 | Rhode Island | 1,106.08 |

| 9 | Massachusetts | 1,035.52 |

| 10 | Connecticut | 1,031.70 |

Recent Developments in No Fault Car Insurance

The biggest complaints about no fault insurance are the generally higher cost as well as the high opportunity for fraudulent claims. According to the Detroit Free Press the following changes have been made in no fault insurance state (primarily Florida and New Jersey):

Pursuing fraud cases aggressively

Adding deductible and co-pay amounts to no fault medical policies

Adding deductible and co-pay amounts to no fault medical policies

Using arbitration instead of courts for disputes between medical providers and insurance companies

Establishing fee schedules for medical providers

Limiting attorney compensation fees in legal disputes concerning no fault cases

Limiting or shortening the time limit for seeking treatment after an accident

Three states are actively working on changing or repealing no fault insurance requirements:

In November 2017 a bill to reform Michigan’s no fault insurance was defeated, despite a June 2017 report by the Insurance Alliance of Michigan that found a full 70 percent of registered voters support no fault insurance reform.

In January 2018 Florida’s House is scheduled to vote on an attempt to end the state’s no-fault auto insurance system and is expected to easily pass.

A new regulation issued by the New York State Department of Financial Services (DFS) is designed to cut abuses and costs for the state’s no fault insurance law. The new regulation will put limits on the amounts reimbursed for healthcare services outside the state. This will reduce inflated claims and should also reduce litigation and premiums.

As for future considerations, the advent of driverless vehicles will most likely soon have to be addressed as they will have an impact on claims in no fault insurance states.

Pros and Cons of No Fault Insurance

There are both advantages and disadvantages to no fault insurance, so here’s a look at both sides of the coin:

Pros:

You’ll spend less time filing claims and following up on them because you’ll only have to deal with your own insurance company.

Claims are paid in a timely manner with no fault because there’s less chance of a dispute or lawsuit.

You won’t have to lose time from work for repeated court appearances in order to collect on your claim.

You don’t have to worry about suing another driver in order to collect for medical costs (except perhaps in major accidents) because your own policy covers the injuries regardless of who was at fault or if the other driver had no insurance.

Cons:

There is no option to sue an at fault driver for damages such as pain and suffering unless the accident is major and the injuries are extensive.

The cost of no fault insurance is higher in most states.

Your policy costs may go up if you have an accident claim, even though you were not at fault.

No fault will only pay to the limit of your policy, so if you have major injuries your costs may be above the cap.

Fraud:

Perhaps the biggest con for no fault insurance is just that: a con. Dishonest people can make a lucrative career by staging accidents and claiming injuries that are hard to prove, such as back pain or soft-tissue injuries. Here are some sobering facts about insurance fraud in no fault states:

The Coalition against Insurance Fraud reports staged-crash criminal rings were responsible for 18 percent of personal injury protection claims in 2012, and added $5.6 billion to $7.7 billion in excess payments to injury claims.

The Insurance Research Council reported in March 2014 that the average loss for bodily-injury claimants was $10,541 in 2012; a hike of four percent.

In New York a full 23 percent of accident injuries have the appearance of fraud, with over half of those accidents occurring in Queens or Brooklyn.

An average two-car family in Florida pays almost $100 more in auto premiums because of no-fault fraudulent claims.

After Massachusetts cracked down on widespread staged-crash fraud rings larger chiropractic clinics in the worst areas saw decreases in both billings and clinic counts by up to 90 percent.

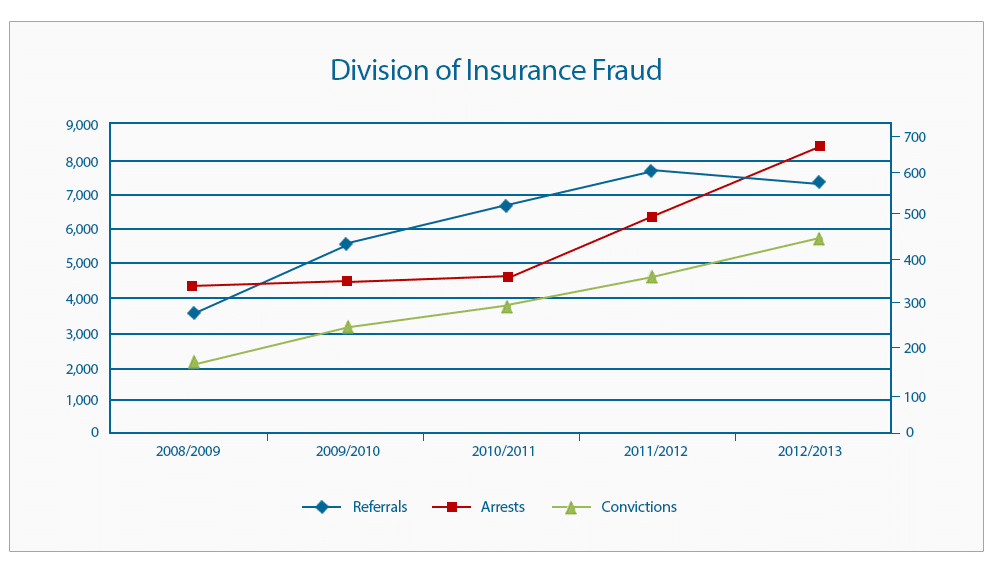

The Florida Division of Fraud (DIF) has experienced a sharp increase in the number of cases involving no fault fraud, as shown in the following chart:

Why do you need no Fault Insurance?

Simply put, if you live in one of the states listed above you need no fault insurance because the law requires it: you cannot legally plate and drive your vehicle without purchasing the required no fault policy, so it’s not an option to consider. In states where no fault is optional you might consider purchasing this type of policy because it protects you from lawsuits for medical costs in case of an accident and also makes the claim process smoother and faster.

A no fault insurance policy will also protect you:

If you are in an accident caused by an uninsured driver or a hit-and-run accident.

It may be an excellent choice if you have teenaged or other inexperienced drivers on your policy.

If you often have passengers in your car, such as carpooling kids to soccer games.

You have no health insurance, or your health insurance has a high co-pay or deductible.