Virginia Car Insurance

Virginia is a state located on the southeastern part of the U.S. Its known for its picturesque mountains and somewhat scary tunnels. Virginia’s close proximity to the capital also make it an attractive tourist site, keeping the highways flowing at all times. All these factors make it necessary to carry good auto insurance. Continue reading to learn the auto insurance requirements in Virginia and learn how you can get the best rates.

Summary of Auto Insurance in Virginia

When it comes to car insurance, states are either at-fault or no-fault states. Virginia is an at-fault state. What this means is that if you are involved in a car accident caused by you, you are liable to pay for damages to the other party. The other party can also choose to sue you for damages. Below is a list of various types of car insurance offered in Virginia.

Collision

This pays to have your car repaired from an accident where you hit into something. This requires a deductible.Comprehensive

This pays for damages to your car by something other than collision such as storms, falling objects, animals, etc. This requires a deductible.Bodily injury liability

This pays for medical expenses to others that were injured in an accident you caused. It also helps with legal expenses if you’re sued.Property Damage liability

This helps you pay for damages caused by you to another’s property.Medical Expenses

pays your accident-related medical bills and any passengers in the vehicleUninsured/underinsured Motorist Coverage

This helps pay your expenses if you’re in an accident and the other driver has no insurance or an insufficient amount.Rental Car

This pays for you to rent a car while yours is being fixed.Accident Forgiveness

this guarantees that your insurance premiums will not increase after your first accident even if it was your fault

What is required for Drivers in Alabama?

The coverage types listed above are not all required. Virginia state law requires drivers to carry the following types of auto insurance

- Bodily Injury

- Property Damage

- Uninsured motorist bodily injury

- Uninsured motorist property damage

Collision and comprehensive are both optional coverages. They are often purchased by individuals who own newer vehicles and by lenders when the vehicle is used as collateral. Even if the car doesn’t have a lien on it, comprehensive and collision coverage can help you pay to have a car repaired or replaced. The cost of these two coverages is minimal when you consider the cost of cars and trucks today.

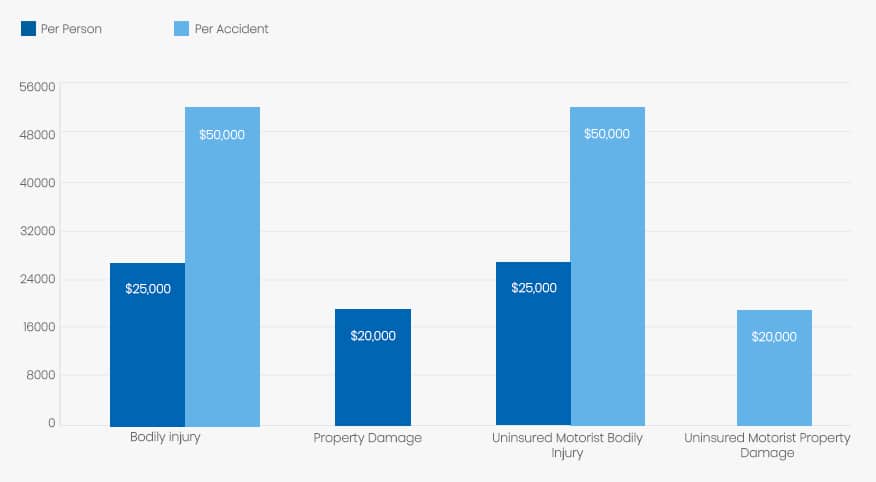

Minimum Auto Insurance Requirements in Virginia

Virginia drivers are required by law to carry at least the following types and amounts of car insurance.

| Coverage | Minimum |

| Bodily injury | $25,000 Per Person |

| Bodily Injury | $50,000 Per Accident |

| Property Damage | $20,000 Per Accident |

| Uninsured Motorist Bodily Injury | $25,000 Per Person |

| Uninsured Motorist Bodily Injury | $50,000 per accident |

| Uninsured Motorist Property Damage | $20,000 per accident (hit-and-run accidents require a $200 deductible.) |

Many people are confused by the liability limits. If you cause an accident to other individuals, your bodily injury limit of $25,000 is the maximum amount your insurance will pay per person. If there is more than one person involved in the accident, the insurance will only pay a total of $50,000 for the accident whether two people were involved or five. Your uninsured motorist coverage amounts must match the amounts of your liability coverage.

This is why it’s so important to purchase an adequate amount of car insurance. While 25/50/20 is what the state requires, you do have the option of purchasing more liability insurance so you’re well protected against a lawsuit. Drivers caught driving without car insurance may get the following penalties.

- Driver’s license suspension

- Vehicle registration suspension

- License plate suspension

If this happens, you will have to meet the following conditions for reinstatement.

- Pay a $500 Reinstatement fee

- Pay a Driver’s license Reinstatement Fee

- Pay Fines from $145 to $220

- File and SR-22 form for Three Years

Are Any Auto Insurance Laws Specific to the state of Virginia?

When your register a vehicle with the Virginia DMV, you must show proof of financial responsibility. If you choose to not carry auto insurance, you must pay a $500 uninsured motorist fee. This fee allows you to drive legally and without insurance for one year. Keep in mind, however, that paying this fee does not protect you in the case of an accident. It only makes you legal to drive in Virginia. If you cause a car accident, you can be held liable and sued by the other party.

Ways to Lower Your Auto Insurance in Virginia

It’s not just one thing that determines your Virginia auto insurance rates. Many factors go into determining what you’ll pay for car insurance. Some things like marital status and location may not be factors you want to change just for lower rates. However, many of the factors are within your control and can be changed. The following factors help determine your rates for car insurance.

- Age

- Gender

- Marital status

- Geographic location

- Miles you drive annually

- Type of vehicle (make, model and year)

- History of claims

- Credit Scores

- Driving Record

- Insurance coverage

- Deductible (Higher deductibles mean lower premiums)

Even with the most favorable factors working on your side, you may still be paying a higher price than you care to pay for your insurance. Discounts can make a big difference in your final costs. Most insurance companies will give you discounts if you meet the criteria. When shopping around for auto insurance, and you should shop around, ask the agents what kind of discounts they offer and which ones are applicable to you. Below are some discounts you may get on your Virginia auto insurance.

- Good Student Discount

- Good Driver Discount

- Anti-theft Device Discount

- Safety Devices Discount

- Multiple-car Discount

- Bundling Discount (home and car with same company)

- Defensive Driving School Discount

Drivers sometimes underestimate the difference discounts can make on the final price they pay for car insurance. Don’t hesitate in asking potential insurance companies what they can do for you in the way of discounts.

Every year hundreds of vehicles are stolen, and this can make a difference in what you pay as well. Vehicles that are more attractive to car thieves will produce higher insurance rates. Below are the ten most stolen vehicles in Virginia in 2016 according to the National Insurance Crime Bureau.

- 2002 Honda Accord

- 2016 Toyota Camry

- 2004 Ford full size pickup

- 1998 Honda Civic

- 2015 Nissan Altima

- 2003 Chevrolet full size pickup

- 2015 Toyota Corolla

- 2008 Chevrolet Impala

- 2002 Ford Explorer

- 2015 Nissan Sentra

This list is not meant to deter you from getting these particular vehicles but more to make you aware. Many companies will give you discounts when you have anti-theft devices installed in the vehicle.

Are Requirements Different for Part-Time or Full-Time Virginia Residents?

The requirements regarding insurance are the same for full- or part-time residents of Virginia. When you move into Virginia, you must register your vehicle within 30 days. When you register your vehicle, you will be asked to sign a form stating that you have insurance. If you don’t have insurance, you will be required to pay the uninsured motorist fee. Individuals who are only in Virginia on a temporary basis are required to follow the insurance laws in the state where their car is registered.

Virginia Rates Compared to National Average

Auto insurance rates fluctuate a lot in Virginia. As a rule, cities closer to Washington, D.C. tend to see higher rates. You may find yourself paying $1,500 in one city and $800 in another, which is a large difference. Overall, Virginia auto insurance rates are some of the lowest. This state is among the top ten in terms of having the cheapest car insurance. The national average for insurance is just under $900 annually while the average in Virginia is about $800.

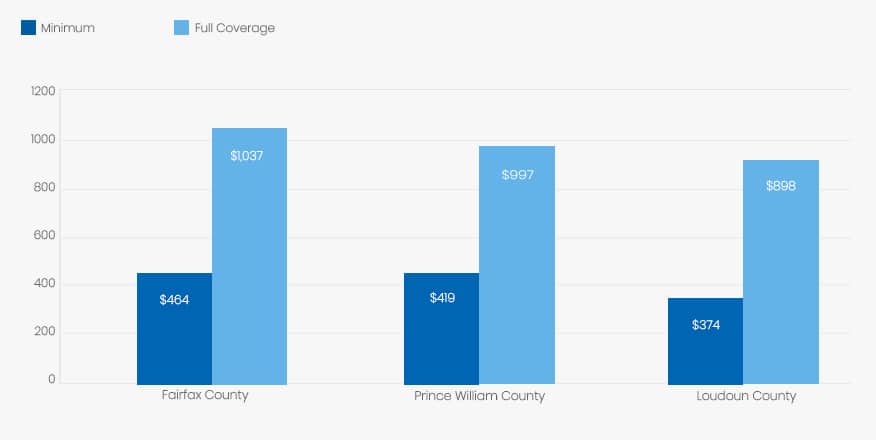

Average Rates in Top Three Virginia Counties

Below you will find the car insurance rates for a 45-year old married woman with a safe driving record. The rates are taken from three different counties in Virginia. You can see the difference location can make in your premiums. The rates below are an average and are for both full coverage and the state’s limited liability amount.

| County | Minimum Coverage | Full Coverage |

| Fairfax County | $464 for state minimum liability | $1,037 for full coverage |

| Prince William County | $419 for state minimum liability | $997 for full coverage |

| Loudoun County | $374 for state minimum liability | $898 for full coverage |

Conclusion

Knowing what type of insurance, you’re required to have and what is available is the first step towards purchasing a policy that not only meets the state’s requirements but also offers you the coverage you need. Shopping around for good auto insurance rates will guarantee you the best possible premiums. Driving safely and responsibly will almost guarantee you keep the same affordable rates and will make driving in Virginia enjoyable.

Sources:

- http://www.law.virginia.edu/html/insider/settled_automobiles.htm

- https://www.nicb.org/sites/files/2017-11/2016-Hot-Wheels-Report