About Costco

Costco is a membership warehouse club, providing a large selection of wholesale items at bulk pricing. The organization was founded in 1976 under the Price Club name and has now grown to a multi-billion dollar business operating in eight countries. Interestingly, Costco is the first company ever to grow from zero to $3 billion in sales in less than six years. Costco specializes in food and household items, but many consumers are not aware the company also offers a wide range of ancillary services. These include optical services, pharmacies, travel packages, self-storage, hearing aids, tire service centers, truck rental, mortgage services, and finally…home and auto insurance.

Rates for Insurance Rating

Pros

Longterm Stability is Excellent

Variety of Discounts and Ability to Stack Discounts

Unique Coverage Options

Satisfaction Rating

Claims Rating

Shopping Rating

Offerings Rating

Stability Rating

What does Costco Auto Insurance offer?

Costco’s auto insurance policies are offered and underwritten by Ameriprise Auto & Home Insurance. The coverage offered by Costco through Ameriprise includes:

Comprehensive Coverage:

This pays for damages to your car that were not caused by a collision.Collision Coverage:

This covers damage that is caused by a collision with a vehicle or other object. It also covers collisions with objects that are not moving such as poles or objects in the road.Bodily Injury Liability Coverage:

If you hit another vehicle and the collision causes death, sickness, or injury, this coverage may pay the cost of legal expenses, jury award, or settlement if you are found to be at fault for the accident.Property Damage Liability Coverage:

This covers the cost of damage you may cause to others’ property such as parked cars, mailboxes, or a house.Uninsured and Underinsured Motorists Coverage:

If you are injured in an accident and the other driver does not have insurance or does not have enough coverage to pay your expenses, this will help fill the gap.Safe Driving Discount:

Costco rewards drivers who have not been in an accident for the past three years with a discount. This discount is honored regardless of whether you were covered by their policy or by a different insurance company during that time period. If your record remains free of accidents that were your fault for six years, you will receive another discount.Accident Forgiveness:

If you have been a customer for more than three years and are involved in your first at-fault accident, you will not be charged extra for the accident.Defensive Driver Discount:

If you take an approved driving course through your local DMV you can earn an additional discount on your car insurance.Loyalty Discount:

You can save money on car insurance by insuring both your home and your car through Costco. If you also buy an umbrella policy, you will save even more.Good Student Discount:

Drivers under 25 can earn a discount for maintaining a “B” average or better in school.Towing/Roadside Assistance Coverage:

If your battery dies, you blow a tire, you run out of gas, or your car needs to be towed to a nearby mechanic, someone will meet you on the road to help.Car Safety Feature Discount:

If your car has anti-lock brakes, air bags, automatic seat belts, or anti-theft devices, you may be eligible for savings on your policy.Tenure Discount:

If you are a Costco auto insurance customer for more than three years, you will pay less than new customers who are shopping for similar policies.Windshield Repair:

If your windshield is damaged and can be repaired (rather than replaced), Costco will waive your deductible. This is a free feature included in every policy.Convenient Claims Reporting:

Report claims 24 hours a day, 7 days a week over the phone, or online for certain types of claims. You can also pick your own repair facility, and drive a rental car while your vehicle is repaired.Online Account Management:

Policyholders can make the following online changes to their account: change payment methods, update checking or account information, pay a one-time bill, download documentation such as ID cards or declaration pages, add, remove, or replace vehicles, change address, add or remove drivers, add or remove leasing/finance companies, update driver’s license number, update education, update VIN.Flexible Payment Options:

Costco’s auto insurance policies run for six months and can be paid either in one lump sum, or in five monthly installments. Choosing the five-month option will come with a small fee. Interestingly, customers are not able to pay in six equal installments. The five-month payment plan is followed by a one month “payment holiday” in which no payment is due.Student Away Discount:

If a driver on your policy attends school more than 100 miles away and only drives the insured vehicle when home for weekends or breaks, you may qualify for a discount.Education Discount:

This is a special discount for students who complete more than four years of post-high school education. You will also qualify for this discount you have a student in your family who meets the requirement.Multi-Car Discount:

You will be eligible for a lower rate if you insure more than one car through Costco.Accident Travel Expense Coverage:

If you are in an accident more than 100 miles from home and the car must be towed to a repair shop, Costco will contribute to your out-of-pocket expenses for travel or accommodations while you are away from home.Rental Reimbursement Coverage:

If you need a rental car after an accident, this pays for your daily rental charges up to a specified amount. This coverage is optional.Medical Expense Coverage:

This can help pay for medical bills, doctor’s visits, hospital stays, and medication if you are injured in an accident.Personal Injury Protection Coverage:

This may pay for medical expenses, lost wages, or funeral expenses for passengers in your vehicle or pedestrians in the case of an accident.New Car Replacement and GAP Insurance Coverage:

New Car Replacement Coverage allows you to replace your vehicle with the same make and model at a total price of up to 110% of the Manufacturer’s Suggested Retail Price as long as you have owned your car for less than a year and it has 15,000 miles or less on it. GAP Insurance Coverage may pay the difference between the value of your vehicle and the amount of your auto loan.

Keep in mind that the specific details of each policy will vary based on the amount of coverage you buy. Each state’s laws regarding car insurance are different, so not all of the features described above may be available in your state.

Customer Satisfaction

A report by the National Association of Insurance Commissioners in 2017 reported that at the time of writing there had been six complaints logged by consumers against Ameriprise Insurance Co. regarding automotive coverage:

Four complaints were received regarding private passenger coverage.

One complaint was received regarding collision coverage.

One complaint was received regarding rental reimbursement.

The reasons documented for those complaints are as follows:

Policy cancellation

Marketing misrepresentation

Claim adjuster handling

Unsatisfactory settlement/offer

Denial of claim

Premium notice/billing

Delays/no response

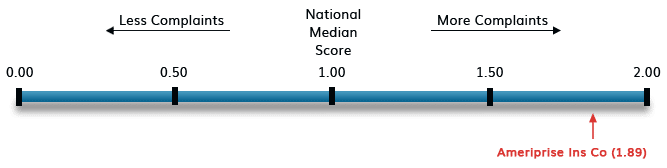

A 2016 Complaint Ratio Report by the National Association of Insurance Commissioners shows that the ratio of Ameriprise’s U.S. Market Share of closed complaints compared to the company’s U.S. Market Share of premiums was quite high at 1.89, with a median of 1.0 and a maximum of 2.0.

Neither the J.D. Power 2017 U.S. Auto Claims Satisfaction Study nor the 2017 Insurance Shopping Study ranked Ameriprise among the top 25 award recipients. However, Ameriprise only makes up .02% of the U.S. auto insurance market.

Claims Processing

The claims process begins by calling Ameriprise. However, if you have been in an accident and no one was injured, you may be able to file a claim online. Here is an outline of what the claims process looks like:

Tell Ameriprise what happened.

This will include details such as your name, address, and policy number, along with the names, addresses, phone numbers, and insurance information of others that were involved. Be prepared to explain what happened, what was damaged, who was involved, when and where the accident occurred, and whether or not there were injuries.Next, you will be assigned a claims representative.

This person will confirm your coverage and deductible, as well as the details of the claim.Within one business day, you will hear from a claims adjuster.

You may hear from a claims adjuster with specialized expertise if your claim requires in-depth review.Send a copy of your police report, photos, and medical authorization forms.

The police report and photos will help Ameriprise corroborate the details of your story. If you have a “before” photo, you will be asked to send that along with photos of the damage after the accident.Choose a repair facility.

Costco car insurance offered through Ameriprise allows you to go to any facility you choose.Rent a vehicle so that you can get around while your car is being repaired.

If this is included in your policy it will be covered up to the limit you specified. Ameriprise can help you with the rental and reimbursement process in this case.

Company Stability

A.M. Best, which provides news, credit ratings and financial data products and services for the insurance industry, gave the Ameriprise Auto and Home Insurance Group an “A” (Excellent) rating. The “A” rating is the third highest of A.M. Best’s 15 ratings for financial strength, stability and soundness of operating performance.

Ameriprise has been partnered with Costco to provide discounted car insurance to members for 15 years. The organization currently insures around 350,000 Costco members. Ameriprise Auto and Home Insurance Group is a subsidiary of Ameriprise Financial, a 120 year old organization with more than $750 billion in assets under management. Ameriprise Financial has more than 2 million clients across its three primary business segments of Advice & Wealth Management, Asset Management, and Annuities and Protection.

Value for Price

Ameriprise is financially stable and part of Costco, another stable company. If you're a loyal policyholder, you may be eligible for additional savings and rewards including cheaper premiums the longer you remain with Ameriprise. Financially, Ameriprise is a secure bet. However, consumers have complained about aspects of the claims process including time it took to pay for their claims. Checking with Costco about what is available to you along with an idea of how long you intend on sticking with Ameriprise could provide the benefits that you may not find elsewhere, simply for being a customer.

Who is this best for?

Ameriprise car insurance through Costco is a satisfying choice for people who want to stack discounts. In addition to offering rate reductions just for being a Costco member, Ameriprise also offers discounts for safe driving, bundling other types of insurance with your car insurance, car safety features, tenure, good students, insuring multiple cars, reaching a certain educational level, taking a DMV driving course, and more. There are also a number of unique things you can insure against, such as a breakdown while on vacation and the cost of a rental car.

Costco car insurance through Ameriprise might be a good fit for those looking for both unique coverage options and special discounts.

What to look out for

Some Ameriprise customers have expressed dissatisfaction with Ameriprise, stating that the company has quickly raised their insurance rates shortly after extending coverage. Others complained that the customer service at Ameriprise was lacking and that the claims process is slow.

At the time of writing, Ameriprise Auto & Home Insurance had received 1.5 out of five stars based on 168 Yelp reviews, and 3.8 out of five stars based on 92 Better Business Bureau reviews. It’s parent company, Ameriprise Financial, received 1.2 out of five stars based on 51 reviews on Consumer Affairs.

Conclusion

Costco’s auto insurance is provided through Ameriprise Auto & Home Insurance, which offers a great deal of unique discounts and coverage options. Although some customers of Ameriprise have reported rate increases and difficulty getting claims processed, there may be several financial benefits to insuring your car through Costco. In addition to saving money just for being a Costco member, you will also save if you’re a student, have students in your household, maintain a safe driving record, bundle your home insurance with your car insurance through Ameriprise, and remain a customer for three years or more.