Pennsylvania Car Insurance

- Requirements for Pennsylvania Drivers

- Minimum Auto Insurance Requirements in Pennsylvania

- Are Any Auto Insurance Laws Specific to the state of Pennsylvania

- Ways to Lower Your Auto Insurance in Pennsylvania

- Are Requirements for Part-Time or Full-Time Pennsylvania Residents?

- Pennsylvania Rates Compared to National Average

Pennsylvania is a state located on the northeastern part of the U.S. Hershey, PA is known as the Chocolate Capital of the United States, and Philadelphia is known for its delicious Philly steak sandwiches, which are copied almost worldwide. The state is also filled with historical landmarks, making this state a sightseer’s delight. It also makes the streets constantly congested with traffic, which is why auto insurance is so important here. Learn what Pennsylvania law requires of drivers as well as how to find the best rates on auto insurance.

Summary of Auto Insurance in Pennsylvania

Pennsylvania is a no-fault insurance state. In a no-fault state, your insurance will pay for medicals expenses for you and your passengers when you’re in an accident regardless of who was at fault. No-fault insurance was designed to decrease the number of car accident-related lawsuits, but it’s not always that simple. Pennsylvania’s insurance gives you the option of a limited or a full tort. Here is how they work

- Limited tort gives you a limited right to sue. Unless your injuries are severe, you can only sue for medical expenses from the accident

- Full tort gives you the unlimited right to sue. You can sue for medical expenses, pain and suffering, and loss of wages. The premiums on full tort insurance are more expensive than the limited tort.

Pennsylvania auto insurance companies offer various types of auto insurance. Some types like collision, comprehensive, towing and rental are optional while others are required by the state. Below are all the types of car insurance offered by the various Pennsylvania insurance companies.

Collision

This pays for damages to your car caused by an accident.Comprehensive

This pay for damages to your car that happened in a non-collision manner such as theft, vandalism, storms, falling objects or animals.Uninsured motorist

This helps pay your medical expenses if you’re in an accident with a driver without insurance.Underinsured motorist

This helps pay medical expenses if you’re in an accident with a driver who has insurance but not enough to cover your expenses.Bodily injury liability

This pays for medical bills and expenses for another person from an accident that you caused and also provides legal expenses if you are sued.Property damage liability

This pays for damage you caused to another person’s property.Rental

This pays the cost of a rental car while your car is being repaired.Towing

This pays the towing fee when your car needs to be towed after an accident or if it breaks down on the road.Funeral expense

This helps pay for funeral expenses.

Although though the state does not require you to carry collision or comprehensive coverage, the lender may require it if you have a car loan and the car is used as security for the loan. Drivers who have new cars often choose collision and comprehensive coverage even if they don’t have a loan because it ensures them that their vehicles can be repaired or replaced if they’re damaged in an accident. Both of these two coverages require drivers to pay deductible, which is the amount the driver must pay on a claim before the insurance company will pay anything.

Requirements for Pennsylvania Drivers

Despite Pennsylvania being a no-fault state, drivers are still required to purchase liability insurance. Drivers in Pennsylvania are required to carry the following types of coverage.

- Bodily injury liability

- Property damage liability

- Uninsured motorist

- Underinsured motorist

- First party benefits medical payments.

In Pennsylvania, you’re required to have proof of insurance anytime you’re driving. If you’re pulled over by law enforcement, you must be prepared to provide proof of insurance. The following are acceptable proof.

- An insurance card from the insurance company

- A copy of your policy’s declaration page

- An insurance binder

- A signed letter from your insurance agent on their letterhead

- A copy of your completed Pennsylvania Assigned Risk Plan application.

Failure to have car insurance can result in the following penalties,

- Fines of at least $300

- 3-month license suspension

- 3-month registration suspension

- $91 reinstatement fee

- Impoundment of car

Minimum Auto Insurance Requirements in Pennsylvania

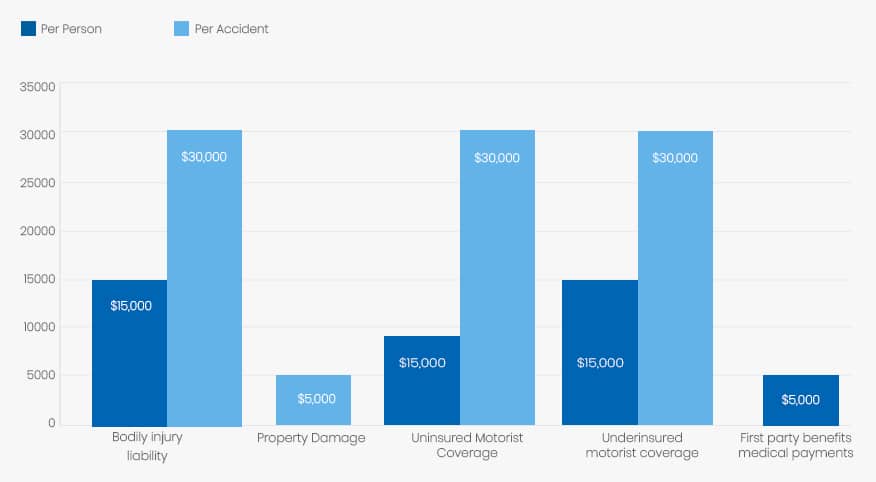

Pennsylvania drivers are required at least the minimum amounts listed below.

| Coverage | Minimum |

| Bodily injury liability | $15,000 per person |

| Bodily injury liability | $30,000 per accident |

| Property Damage | $5,000 per accident |

| Uninsured Motorist Coverage | $15,000 per person |

| Uninsured motorist coverage | $30,000 per accident |

| Underinsured motorist coverage | $15,000 per person |

| Underinsured motorist coverage | $30,000 per accident |

| First party benefits medical payments | $5,000 per person |

It should be noted that these are the minimum amounts you must purchase to be legal in Pennsylvania. You have the option to purchase higher amounts. Insurance companies recommend drivers carry higher amounts of liability coverage. When purchasing liability insurance, you may be able to purchase a single package of $35,000, which meets all the liability requirements depending on the insurance company.

Are Any Auto Insurance Laws Specific to the state of Pennsylvania?

Drivers with little driving experience, poor driving records or those who have too many claims may be denied insurance coverage for the open market because they’re considered high-risk drivers. These drivers have the option to purchase insurance through the Pennsylvania Assigned Risk Plan. The premiums are higher, but they meet the state’s requirements.

While many factors are used to determine your Pennsylvania auto insurance rates, insurance companies in this state are not allowed to use the following.

- Age

- Race

- Size of family

- Nationality or ethnic group

- Religion

- Job

- Place of residence

Ways to Lower Your Auto Insurance in Pennsylvania

Insurance companies use certain data and personal information about and your household members when selling your insurance policies. Knowing the factors that contribute towards your premiums may make it easier for you to lower your premiums. These factors include:

- Amount of coverage you choose

- Your deductibles (the lower your deductible, the higher your premium)

- Car’s year, make and model

- Your driving record

- Your credit scores

- Miles you drive

- Vehicle use

Almost all insurance companies offer discounts as a way to not only save their customers money but also to entice you into purchasing insurance from them. Many drivers are amazed at the difference discounts can make on their insurance bill. Below are some examples of some discounts you may receive.

- Multiple car discount

- Multiple policy discount

- Safety feature discount

- Good driver discount

- Full pay discount

- Auto pay discount

- Auto renewal discount

- Good student discount

Be sure to ask your insurance agent in Philadelphia, PA not only what types of discounts they offer but also which ones may apply to you. When you’re in the market for Pennsylvania auto insurance, don’t grab the first policy you find. Make some phone calls, visit insurance companies or even research online, but always shop around until you get the best possible rates.

Are Requirements Different for Part-Time or Full-Time Pennsylvania Residents?

The auto insurance requirements are the same for part-time (temporary) and full-time residents of Pennsylvania. If you’re moving into Pennsylvania, you’re required to register your vehicle within a certain number of days. You must show proof of insurance at this time. Part-time residents must follow the insurance requirements from the state in which their vehicle is registered.

Pennsylvania Rates Compared to National Average

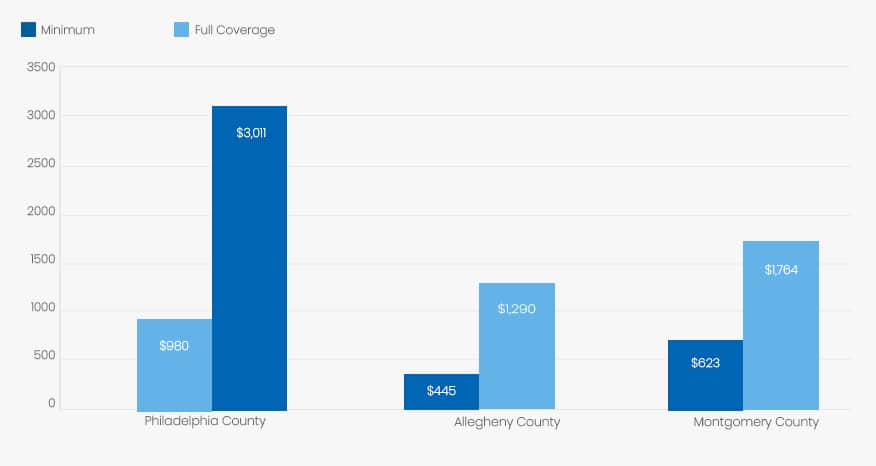

Pennsylvania rates for auto insurance vary a lot depending on where you live. This can be seen in the below example of three counties. While Philadelphia has very high rates, other cities in the state are only half as much. Overall, the average annual rate for auto insurance is about $1,522, which is quite a bit more expensive than the national average of around $900 to $1,000. Pennsylvania is ranked as the 12th most expensive state for car insurance.

Average Rates in Top Three Pennsylvania Counties

Auto insurance rates can change just by going from one county or city to the next. I researched auto insurance for a married female with a good driving record. I got rates for this 45-year old woman from three different counties. As you read my findings, take note of the huge difference between Philadelphia County and Allegheny County.

| County | Minimum Coverage | Full Coverage |

| Philadelphia County | $980 for state minimum liability | $3,011 for full coverage |

| Allegheny County | $445 for state minimum liability | $1,290 for full coverage |

| Montgomery County | $623 for state minimum liability | $1,764 for full coverage |

Conclusion

Very few people want to move or make other drastic changes just to get lower rates on our car insurance. However, we can make the most of our good driving records by shopping around for the best rates and utilizing every discount we can. With so many possibilities available in the way of insurance savings, imagine having all that extra cash just from saving on premiums! In addition to saving money, you’ll also have the peace of mind knowing you’re protected while driving in Pennsylvania.