ON THIS PAGE

- Arizona Auto Insurance 101

- What is required for drivers in Arizona?

- Minimum Requirements for Arizona Auto Insurance

- How are Arizona's Insurance Rates so Affordable?

- Average Minimum Liability Rate in the Three Largest Counties

- Ways to Lower Your Insurance Rates in Arizona

- What if I do not live in Arizona full-time?

Arizona Auto Insurance 101

Wherever you reside in the United States, you are required to have an acceptable amount of car insurance to legally operate a motor vehicle. If you are living in or planning to move to Arizona you are in luck as Arizona auto insurance has an excellent low liability requirement compared to other states. In fact, Arizona’s minimum liability requirement is about 25 percent lower than the national average.

A low liability rate is great news for drivers who can only afford the bare minimum in coverage, but if you have room in the budget it can never hurt to carry an ample amount of coverage to protect yourself and your family. While the majority of the state’s residents will not have to contend with snow, those living in the desert still face the dangers of dust storms, flash floods, and monsoons.

What is required for drivers in Arizona?

Pursuant to Arizona Revised Statute 28-4135, Arizona requires auto insurance on any motor vehicle driven in the state. You are required to carry proof of insurance, which must be presented to the officer if you are pulled over. if you cancel your insurance or stop making payments, your insurance company will notify the Arizona Motor Vehicle Division that you no longer have coverage. You will then be required to show proof of insurance to the Motor Vehicle Division to prove you are covered. Failure to do so will result in a canceled insurance hit on your license plate, which is a citable offense pursuant to Arizona Revised Statute 28-4148. If you go long enough with canceled insurance the violation will escalate to a mandatory insurance suspension, which can result in your plate being confiscated, and eventually your license suspended. The bottom line is if you are going to be driving, be sure you are covered with at least the minimum requirements.

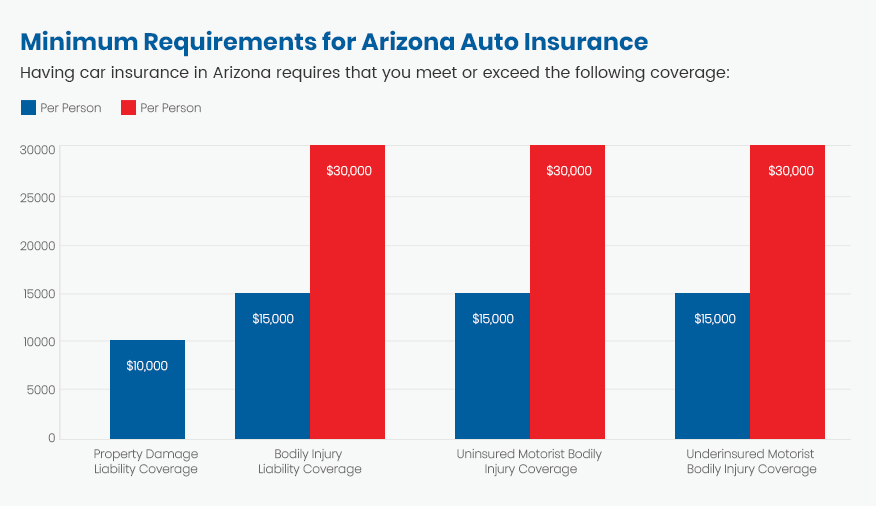

| Coverage | Minimum |

| Bodily Injury Liability Coverage | $15,000 per person / $30,000 per accident |

| Uninsured Motorist Bodily Injury Coverage | $15,000 per person / $30,000 per accident |

| Underinsured Motorist Bodily Injury Coverage | $15,000 per person / $30,000 per |

| Property Damage Liability Coverage | $10,000 |

How are Arizona's Insurance Rates so Affordable?

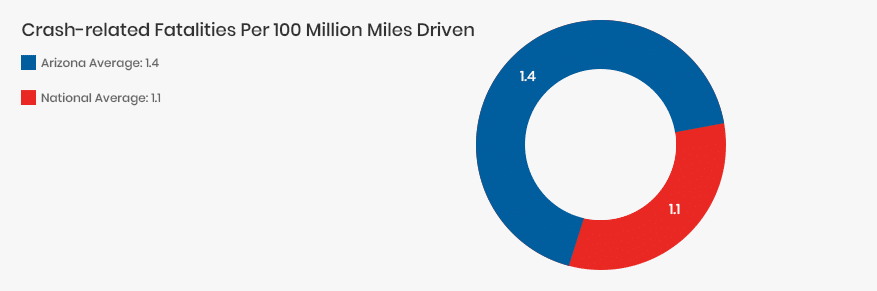

Arizona’s collision percentage is slightly greater than the national average, however, aforementioned insurance rates are an average of 25 percent lower. Arizona has 1.4 crash-related fatalities per 100 million miles driven in comparison to 1.1 deaths as a national average. Thankfully consumers pay about $380 less annually than the average insurance customer. The lower average cost is likely a direct result of the low liability requirement.

Average Minimum Liability Rate in the Three Largest Counties

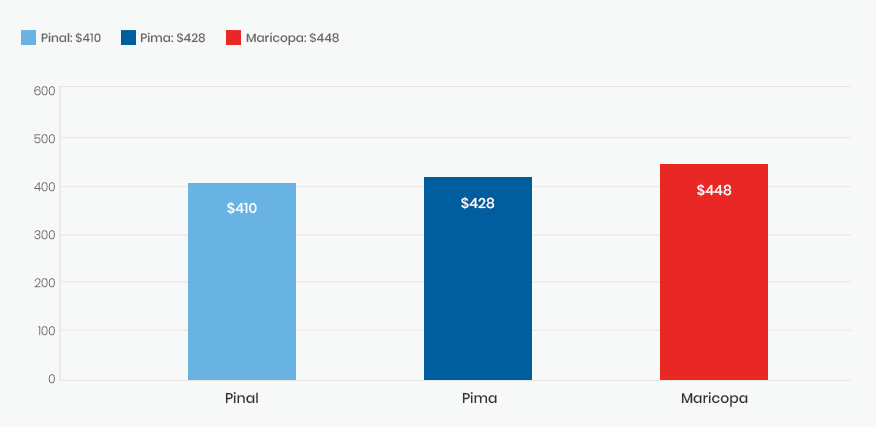

We got quotes from a leading insurance provider using a hypothetical control of a married 45-year-old woman (spouse not insured) in the three largest counties in Arizona by population. The following limited liability quotes were found for six-month premiums and no discounts:

Ways to Lower Your Insurance Rates in Arizona

Even though Arizona has some of the lower car insurance rates in the country, it’s never a bad idea to learn how to lower your rates even more.

Drive Less Often

The lower the number of miles you drive annually the lower your insurance premium is going to be. Less time on the road means less risk of an accident resulting in a claim for the insurance company. If you change your driving habits and are driving less frequently be sure to let your insurance company know to increase your savings.

Choose the Right Vehicle

Insurance companies determine part of your vehicle premium by the worth of your vehicle and how expensive it would be to replace in the event of a total loss situation. They also take into consideration the safety rating of the vehicle and the likelihood of reckless driving. A van or SUV is far less expensive to insure than a sports car. A sports car driver is far more likely to speed and get into an accident than a van transporting a family and premiums reflect this. In addition to safety ratings, new safety features such as pre-collision systems, pedestrian detection, lane departure alerts, blind spot monitors, and automatic high beams may lower your premium.

Choose to Live in an Affordable Zip Code

Insurance companies examine the collision rate and risk factors of the area code you live and drive in primarily. If you live in a rural area or a location with a high crash percentage you are going to pay more. Rates can vary up to $50 or more depending on where you live, so if you are moving it would not be a bad idea to do some research.

Let Your Insurance Provider Know When You Finish College or Get Married

You are considered less of a risk when you get married or earn a college degree. Be sure to inform your insurance provider of these changes to ensure you do not miss any savings. The older you get the less of a risk you are considered and you will see your premium go down.

Take a Safe Driver’s Course

There are classes offered that can lower your rates upon completion, ask your insurance provider for details. discount offers

Ask About Discounts and Bundle

See what discounts you qualify for such as multi-line and safe drivers. If you bundle additional policies such as renters or life insurance you can find additional savings.

Let your Insurance Company Monitor your Driving

Some insurance companies will install a tracker to monitor a sample of your driving and if you drive safely enough, you can qualify for an additional discount.

What if I do not live in Arizona full-time?

State law states if you reside in the state at least seven months, have a job that is non-seasonal in nature, or have children attending local schools, you need to have your motor vehicle registered with an Arizona plate. If you’re not an Arizona resident, make sure your car is registered in the state of your primary residence and to that state’s minimums.

Now that you know what to look for, the best way to find a policy that matches your coverage and financial goals is to research and compare rates. Some insurance companies may still require you to call in to receive a quote, but most will allow you do this online. Take the time to compare rates and coverage and select the one that offers the most coverage for the lowest rate. After you select a company it is still not a bad idea to shop around again and compare rates every couple of years. Do your due diligence in researching and comparing quotes and you will have peace of mind knowing you are protected, covered, and have saved money.