What is Required for Tucson Drivers?

There are certain rules to consider before driving in the Grand Canyon State of Arizona. These are rules that every driver must follow, whether you are driving a car, a motorcycle, a moped, or even a golf cart. Specifically, let’s talk about insurance.

Here is what you should know before getting behind the wheel and firing up that engine:

Arizona is an “at-fault” state, meaning that, in the case of an accident, someone has to be declared responsible. In addition, drivers must always carry proof of insurance and be ready to provide it to law enforcement officers if pulled over or involved in an accident.

It is mandatory that all Arizonians and anyone else who drives on Arizona roads, carry — at least — liability insurance that will cover:

$15,000 to one person per accident for injury/death

$30,000 to more than one person per accident for injury/death

$10,000 to property per accident for damage

Although some experts suggest a 100/300/50 policy, which would cover:

$100,000 to one person for injury/death

$300,000 to multiple people for injury/death

$50,000 in damage to property

Cheap Auto Insurance in Tucson

To help you make your decision, we viewed the insurance rates of numerous insurance companies’ available in the state of Arizona and narrowed our results down from the 20 available insurers, to just 10 companies who can offer you everything you need to get you out on the road.

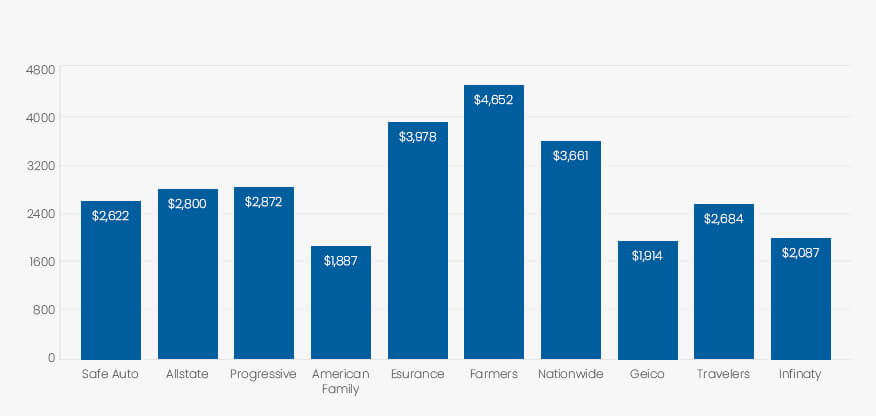

A. For Young Newer Drivers - Unmarried Male – Liability/Full Coverage

As you can see by the chart – the rates vary between the company, location, demographics, circumstances, and amount of coverage, whether it is liability only or full-coverage. We added in several profile drivers in Arizona to compare the differences in price. The first chart shows the cheapest insurance rates for a young single male.

| Unmarried Young Male | Liability Only |

| Safe Auto | $2,622 |

| Allstate | $2,800 |

| Progressive | $2,872 |

| American Family | $1,887 |

| Esurance | $3,978 |

| Farmers | $4,652 |

| Nationwide | $3,661 |

| Geico | $1,914 |

| Travelers | $2,684 |

| Infinaty | $2,087 |

| Unmarried Young Male | Full Coverage |

| Allstate | $2,671 |

| Progressive | $3,564 |

| American Family | $2,004 |

| Esurance | $4,512 |

| Farmers | $5,879 |

| Nationwide | $2,382 |

| Geico | $2,168 |

| Travelers | $3,256 |

| Infinaty | $3,186 |

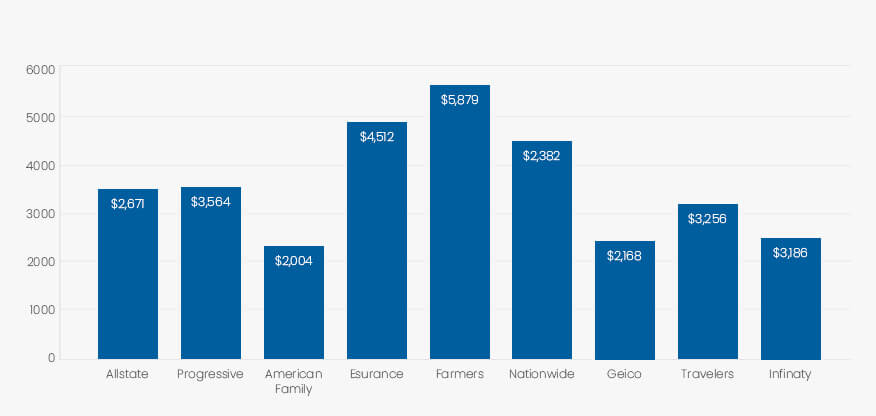

B. For Young Newer Drivers Unmarried Female – Liability/Full Coverage

Young females are usually more cautious drivers than males who tend to be more risk takers, prone to aggressive behavior. In fact, according to the National Highway Traffic and Safety Administration (NHTSA), men of all ages have much higher accident rates than females of all ages. Therefore, the rate for female drivers, are significantly lower than the rates for male drivers in every city in Arizona by all companies that offer insurance.

You can see how female and male insurance rates compare by taking a look at the first four charts above.

| Unmarried Young Female | Liability Only |

| Safe Auto | $2,235 |

| Allstate | $2,208 |

| Progressive | $2,604 |

| American Family | $1,831 |

| Esurance | $3,213 |

| Farmers | $4,514 |

| Nationwide | $2,835 |

| Geico | $1,834 |

| Travelers | $2,214 |

| Infinaty | $1,966 |

| Unmarried Young Female | Full Coverage |

| Allstate | $2,135 |

| Progressive | $3,254 |

| American Family | $1,870 |

| Esurance | $3,658 |

| Farmers | $5,657 |

| Nationwide | $2,644 |

| Geico | $2,166 |

| Travelers | $2,634 |

| Infinaty | $2,767 |

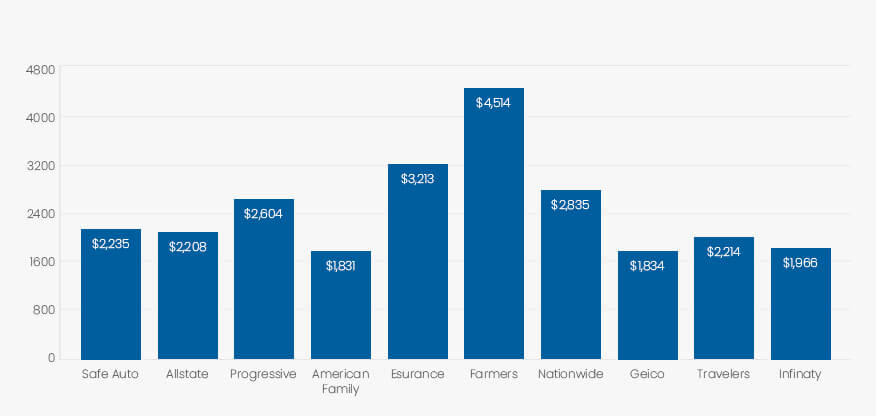

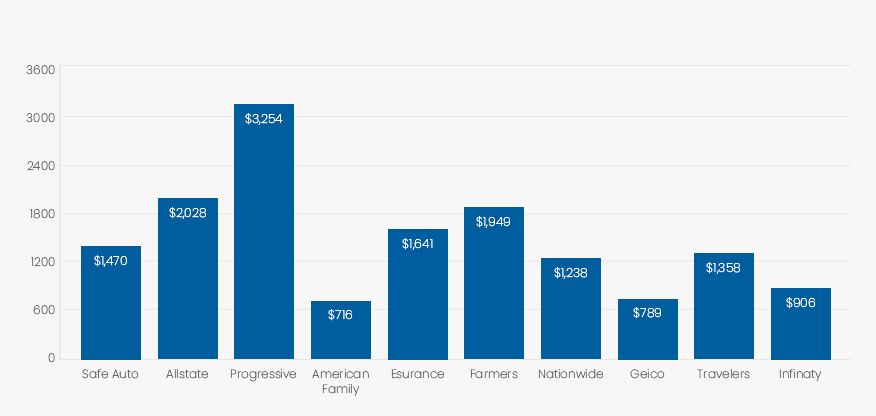

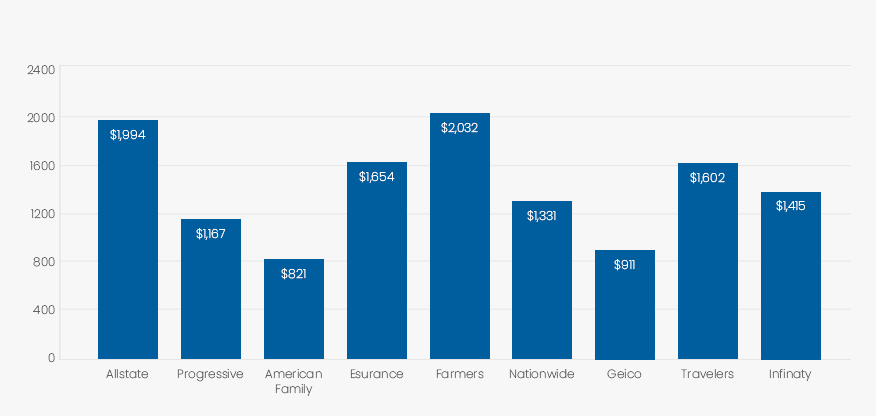

C. Married Couple Middle Age - 40's - No Accidents – Liability/Full Coverage

In our analysis, we also included liability and full coverage costs of insurance for a married, middle-aged couple who are in their 40’s and never had an accident where they were at fault. You can view the rates we found in the charts above; chart 5 shows liability-only rates for married middle-aged couples and chart 6 shows the rates for full-coverage auto insurance for middle-aged couples without any at-fault accidents.

In viewing the charts above you can see that, of the 10 listed rates in Tucson, Arizona American Family has the cheapest. In contrast, Progressive is rather high compared to the others on the list.

| Married Couple – No Accidents | Liability Only |

| Safe Auto | $1,470 |

| Allstate | $2,028 |

| Progressive | $3,254 |

| American Family | $716 |

| Esurance | $1,641 |

| Farmers | $1,949 |

| Nationwide | $1,238 |

| Geico | $789 |

| Travelers | $1,358 |

| Infinaty | $906 |

| Married Couple – No Accidents | Full Coverage |

| Allstate | $1,994 |

| Progressive | $1,167 |

| American Family | $821 |

| Esurance | $1,654 |

| Farmers | $2,032 |

| Nationwide | $1,331 |

| Geico | $911 |

| Travelers | $1,602 |

| Infinaty | $1,415 |

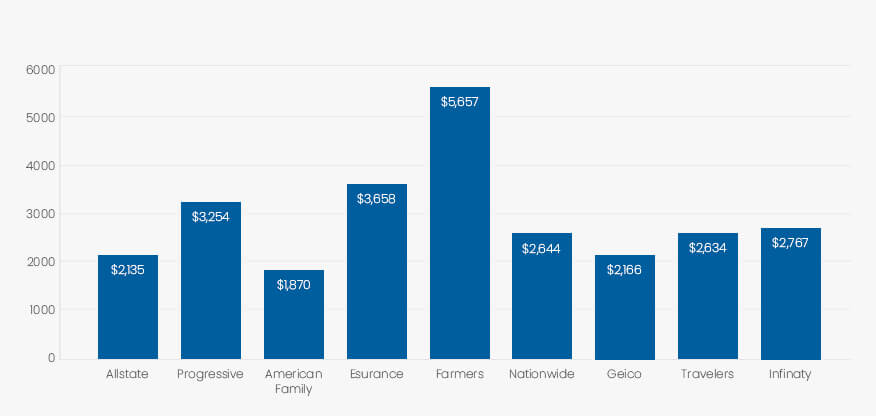

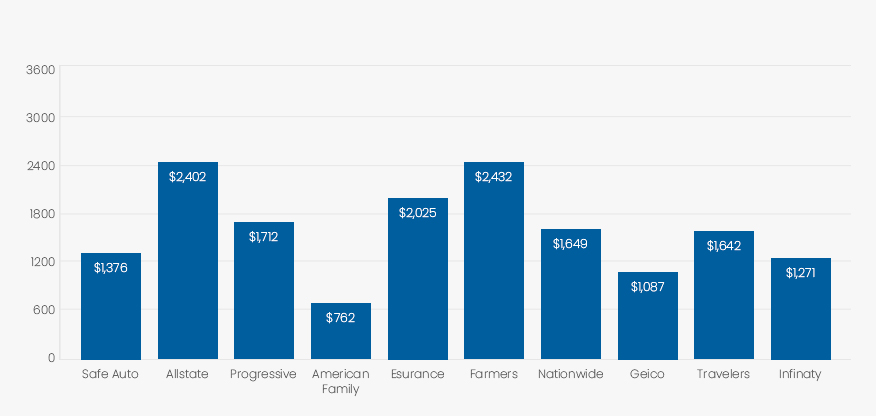

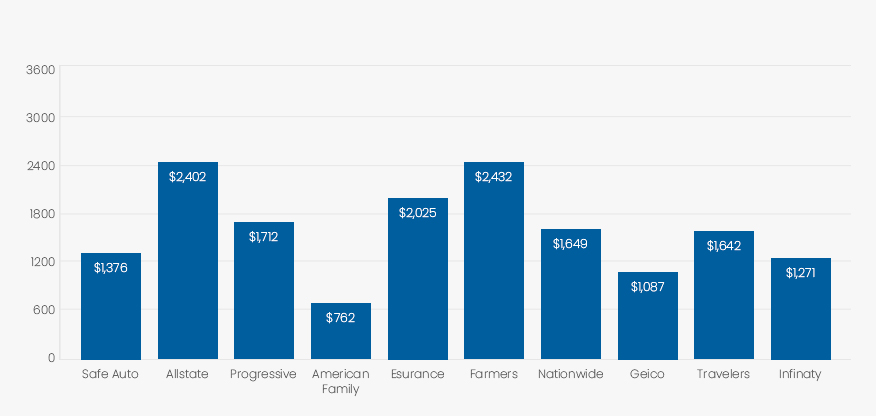

D. Married Couple Middle Age - 40's - With at Fault Accidents – Liability/Full Coverage

Charts 7 and 8 show the rates for 40-year-old married couples who were the cause of an accidents in the past. While chart 7 is for liability insurance rates only, chart 8 is for full-coverage rates. Notice the difference between those who had accidents compared to those who didn’t, the rates for those with no accidents is much lower than for those with at-fault accidents. For example, the Geico rate for liability insurance for a 40-year-old married couple without accidents in Tucson, Arizona is $789 where the rate for liability insurance for the same couple would be $1,087 if they had any previous accidents where they were at fault.

| Married Couple – With Accidents | Liability Only |

| Safe Auto | $1,376 |

| Allstate | $2,402 |

| Progressive | $1,712 |

| American Family | $762 |

| Esurance | $2,025 |

| Farmers | $2,432 |

| Nationwide | $1,649 |

| Geico | $1,087 |

| Travelers | $1,642 |

| Infinaty | $1,271 |

| Married Couple – With Accidents | Full Coverage |

| Safe Auto | $1,376 |

| Allstate | $2,402 |

| Progressive | $1,712 |

| American Family | $762 |

| Esurance | $2,025 |

| Farmers | $2,432 |

| Nationwide | $1,649 |

| Geico | $1,087 |

| Travelers | $1,642 |

| Infinaty | $1,271 |

The Difference between Liability and Full Coverage in Tucson

What is Liability-Only

Liability insurance will pay for the injuries and/or damages that you cause to others in the case of a collision where you were at fault. In most cases, liability insurance will cost less than full-coverage insurance, but then again, they are both very different in what they cover. Liability is mandatory in all U.S. states, although how much liability you are required to have differs between states. Even if it wasn’t mandatory to have liability insurance, accidents can happen anytime and, if they do, you will need to be able to pay for the damages that you cause if you were the one to blame.

What is Full Coverage

Full coverage auto insurance in Arizona pays for your injuries and the damages made to your car as well as for others and isn’t just a specific type of a policy but it is instead liability, comprehensive insurance, and collision all combined. Full coverage insurance is not mandatory, but is good to have since it will help pay for your car to be fixed in the event of an accident that causes you injury or damage to your car, even if you were at fault. If the other person that collided with you was at fault, then their insurance will cover the damages to your car and your injuries. This is why there are laws requiring everyone to have insurance to cover the damages they cause.

Difference Between the two and cost examples

The main difference between having liability and full coverage insurance is that liability insurance will only pay for injuries to others and their damages that resulted from an accident where you were at fault, where full coverage will not only pay for the damages and injuries done to others but will also cover your injuries and auto damages that resulted from an accident that you caused as well. You can look at the charts to see examples of the difference in rates; the cost of liability for a young male driver in Phoenix is $5,010 but full coverage is $5,850.

Ways to Lower Your Auto Insurance Rates in Arizona

Of course, the best way to keep your auto insurance rates down is to drive safely and avoid accidents. The better your driving record, the lower your rates. However, there are also other ways to lower your rates.

Shop Around for the Best Price

Prices can vary significantly between insurance agencies so you will need to get a quote from each one. To prevent having to go to each site and put all your information in dozens of times, there are some sites where you can compare the rates of several agencies at once that you should take advantage of.

Bundle with other insurance plans

Most insurance agencies offer you a chance to bundle and get many of your insurance needs from one place; such as renters’ insurance, homeowners’ insurance, auto insurance, and more. You can also save when insuring more than one vehicle.

Reduce the Number of Miles you drive

Reducing the number of miles you drive will reduce your risk for accidents and therefore, your insurance rates. Besides that, it could do your body and your health good to walk sometimes.

Check the Insurance Costs for a Car Before Buying it

Before you buy a car, it is important that you check insurance costs first, as some car types can raise your insurance rates much more than others. Some of the things your premiums may be based on include the cars overall safety record, costs of parts and repairs, the price of the car, and theft likelihood.

Increase your Deductibles

The higher the price of the deductibles the less your rates will be. For example, if you were to increase your deductible from $200 to $500 it would reduce your comprehensive coverage and collision rates by 15-30%.

Watch your Credit Score

Did you know that many people check their credit report only to find several mistakes that can be fixed? Check your credit report often, because the higher your credit score the lower your insurance rates will be.

Factors That Affect Your Tucson, AZ Car Insurance Rate

There are many factors that affect your insurance rates, number one being your driving record and whether or not you have had previous accidents where you were at fault. Other things that can affect the amount you will have to pay for auto insurance are:

The company that ensures you

Not only the city and state you live in but the area (zip code) you reside in as well

Your age

Whether you are male or female

Your earnings

Marital status

Your credit score

Speeding tickets or other tickets you have incurred

How many years of driving experience you have

How many miles you drive regularly, including your commute to work

The year, make, and model of your vehicle

Where you park your car when not in use