ON THIS PAGE

- Fresno Auto Insurance

- What is Required for Fresno Drivers?

- Cheap Auto Insurance in Fresno

- The Difference Between Liability and Full Coverage in Fresno

- Difference Between Full and Liability Coverage

- Ways to Lower Your Auto Insurance Rates in Fresno

- Factors That Affect Your Fresno, CA Car Insurance Rate

Fresno Auto Insurance 101

Auto insurance is a necessity for all California drivers. Even in the desert heat of Fresno drivers need to carry policies that cover their responsibilities on the road. Drivers even have responsibilities to the finance companies who help them purchase new cars and there are special insurance rates for them, too.

What is Required for Fresno Drivers?

Drivers in Fresno, CA must all be insured with a sound policy that will cover damages in the case of an accident. The minimum threshold for an insurance policy is that it covers any damage or injuries incurred in case you are at fault in an accident that involves your automobile. The law thus ensures that your damages will be covered in case someone hits your car or otherwise injures you with their automobile, and vice versa.

Thus, you need to make sure that you have the minimum insurance policy available – an automobile liability policy. It’s important to remember that with a liability policy you will have to shoulder any damages done to your car if you are at-fault in an accident. There are cases where you will not be allowed to carry such a bare-bones policy, however. For instance, if your car is currently financed, your bank or lender will insist that you carry a collision policy that will cover your car regardless of fault.

Cheap Auto Insurance in Fresno

For Young Newer Drivers Unmarried Male, No Violations – Liability/Full Coverage

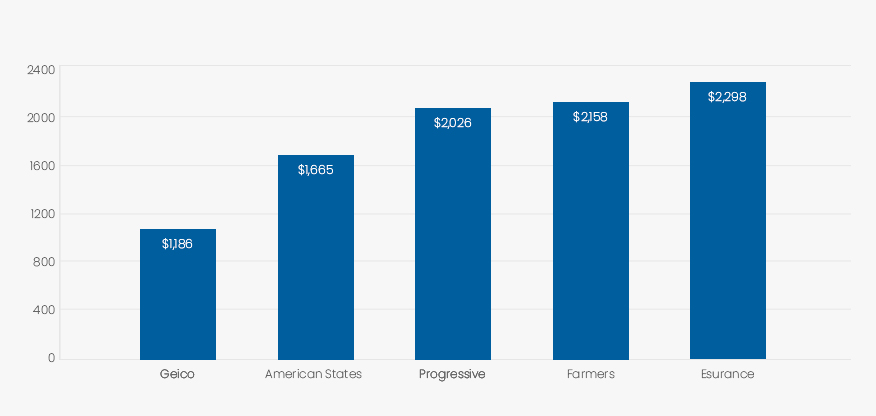

We have analyzed insurance companies that operate throughout California. We sought the lowest rates and here we display the top five carriers that offer both low rates and quality coverage. In the following chart, we have profiled the insurance rates for a young, unmarried male living in Fresno. Note that rates for other California cities will vary, but these can be used as a general benchmark.

| Unmarried Male - Licensed 1-2 Years | 10,000 Miles - Liability Only |

| Geico | $1,186 |

| American States | $1,665 |

| Progressive | $2,026 |

| Farmers | $2,158 |

| Esurance | $2,298 |

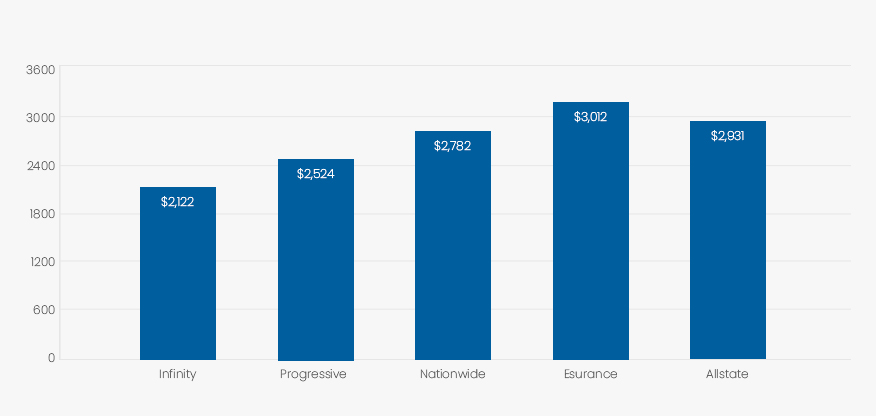

When we took a look at how young men fared in the full-coverage market, we found that their rates were significantly higher. This is naturally due to the increased value of their policies. We analyzed rates from all comparable companies and policies and here are the lowest premiums you will find for young, unmarried men in Fresno. The same man in another city is sure to pay more or less for full-coverage automobile insurance depending on the population density and general risk associated with that city or even zip code.

| Unmarried Young Male | Full Coverage |

| Infinity | $2,122 |

| Progressive | $2,524 |

| Nationwide | $2,782 |

| Esurance | $3,012 |

| Allstate | $2,931 |

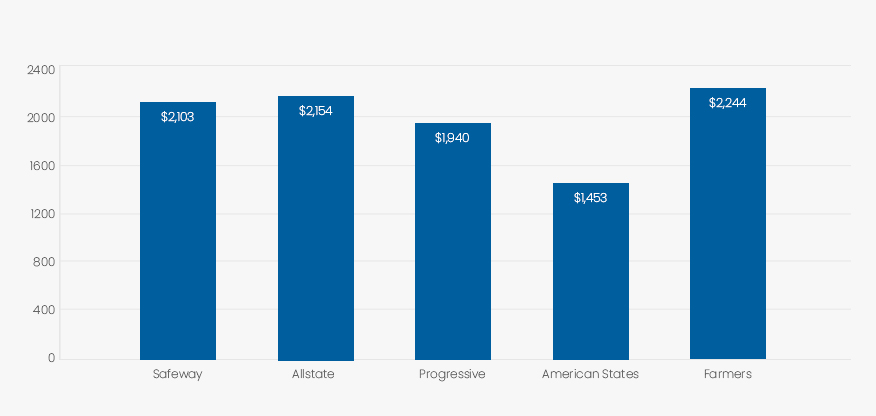

For Young Newer Drivers Unmarried Female, No Violations

Young women tend to pay lower premiums for their automobile insurance than their male counterparts. Thus, women in general pay far less for liability insurance than any other policy holder. When we analyzed insurers and liability policies across California, we found that the following premiums were some of the lowest for unmarried Fresno women with no traffic violations.

| Unmarried Young Female | Liability Coverage |

| Safeway | $2,103 |

| Allstate | $2,154 |

| Progressive | $1,940 |

| American States | $1,453 |

| Farmers | $2,244 |

Married Couple, Licensed 13/10 Years, No Violations – Liability/Full Coverage

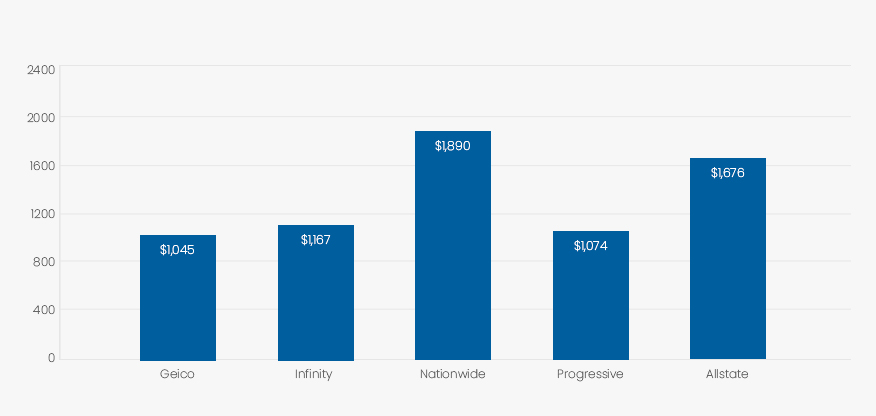

Married couples who have held driver's licenses for over ten years and who have no moving violations pay very low premiums for their liability insurance policies. Actuarial scientists find that people in this sort of demographic are very low risk, thus they are rewarded. We found all the insurance data for couples in California and here, below, are some of the best liability rates for married people living in Fresno. Keep in mind that rates will vary across the state.

| Married Couple | Liability Coverage |

| Geico | $1,045 |

| Infinity | $1,167 |

| Nationwide | $1,890 |

| Progressive | $1,074 |

| Allstate | $1,676 |

When married couples finance or lease a new car, they must pay for full coverage. Some may even take out full-coverage policies for cars they own outright. Nevertheless, rates for full coverage are higher than those for liability. One way to reduce automobile insurance rates is to bundle that policy with your homeowner's insurance, but even if you don’t, you’ll want to get the best possible policy for you. While we don’t have number of full-coverage policies for married couples in Fresno, check out our tips below for how to get yourself a lower policy.

Unmarried Male, Licensed 9-15 Years, 1 At-Fault Accident

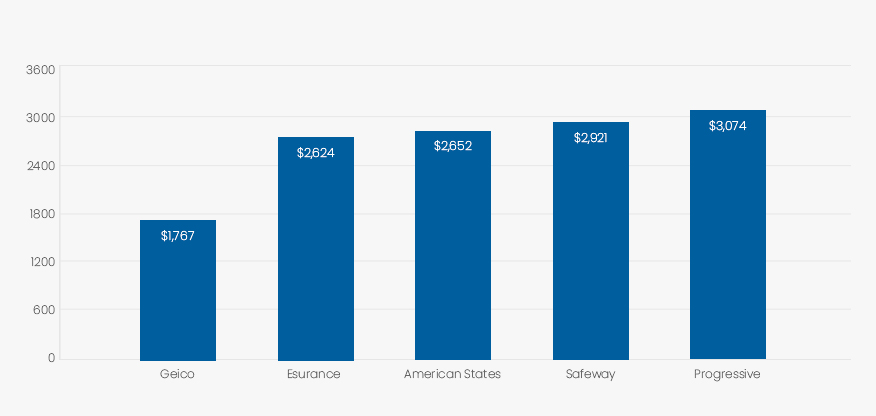

Unmarried men pay slightly higher rates for liability coverage than their female counterparts, and they pay even more if they have an at-fault accident on their records. When insurance companies have to pay out on a claim, that policy often sees higher rates for several years. This is because the driver is deemed a higher risk. We researched insurance rates for men living in California and here are some of the lowest rates for unmarried men with an accident who live in Fresno.

| Unmarried Men | Liability Coverage |

| Geico | $1,767 |

| Esurance | $2,624 |

| American States | $2,652 |

| Safeway | $2,921 |

| Progressive | $3,074 |

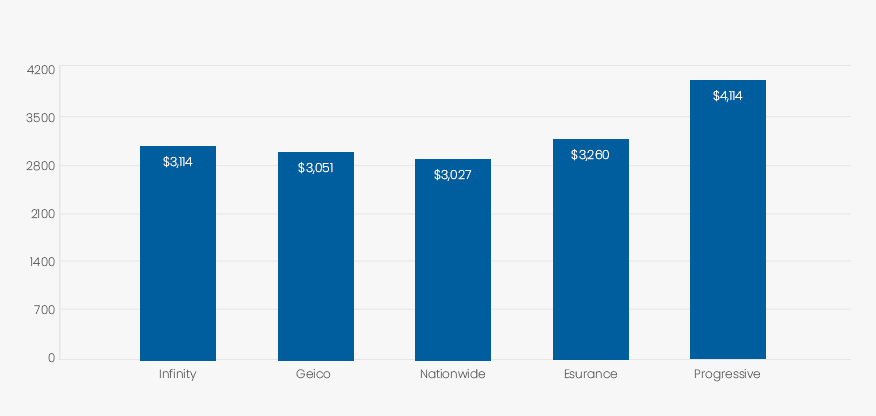

Young men who are driving a leased or financed vehicle must carry full coverage. If they have an at-fault accident on their records, their policy premiums rise even beyond the accident-free baseline. We have aggregated all the automobile policy prices for California and below are some of the lowest premiums for unmarried men who have one accident and live in Fresno.

| Unmarried Men | Full Coverage |

| Infinity | $3,114 |

| Geico | $3,051 |

| Nationwide | $3,027 |

| Esurance | $3,260 |

| Progressive | $4,114 |

The Difference Between Liability and Full Coverage in Fresno

What is Liability-Only

Liability-only policies cover any damage you do as a driver, or which results from your automobile. These policies meet the minimum requirement for drivers in Fresno, California and are generally the cheapest. That is because the policy does not cover your car. Thus, if an uninsured driver hits your car, and is at fault, any damage you incur must be repaired at your expense. You will also be unable to make a claim if your car is damaged due to weather or as a result of some other non-driving incident.

What is Full Coverage

Full coverage is not a category used by insurance companies. Rather, it is a colloquial term used to describe policies that cover both you and other drivers. Thus, if you are in a collision with an uninsured motorist, you can make a claim to repair damage to your car. If your car is injured by some other sort of accident or even vandalism, you can claim those repairs, too.

When you purchase a car on a financing plan, your lender will probably insist that you cover the car with a comprehensive policy that will cover any damage. Even if you purchase a car outright you might want to purchase a comprehensive policy so that your beautiful car remains pristine for as long as possible.

Additional cities in California you can check out.

Difference Between Full and Liability Coverage

The difference between full and liability coverage is quite dramatic. With liability, insurers gamble that they will only have to pay for one car in an accident. With a comprehensive or full coverage policy, insurance companies know that they are taking on more liability exposure and so their rates reflect the increased risk. In the case of a comprehensive policy, they might even have to cover claims for damages that don’t arise from a traffic incident.

For example, Safeway Insurance charges young, single Fresno men $3,582 for full coverage, yet the same young man’s rates might be as low as $2,029 if he only has liability. The ~$1,500 difference might seem like a great savings, however if a tree falls on the car, that young man might wish his car had more coverage.

Ways to Lower Your Auto Insurance Rates in Fresno

-

Avoid Accidents

Each time you are at fault in an accident, your insurance company must pay out to cover your liability. Thus, your rates are definitely going to rise any time you cause an accident. The longer you are able to maintain a driving record clean of accidents, the more favorable your policy will be in the eyes of insurance companies. -

Don’t Speed

Insurance rates are set relative to the risk you pose as a driver. Since speeding is positively linked to accidents, and thus to insurance claims, your tickets will also result in higher insurance rates. -

Shop Around

Insurance is like any other business and so some will charge lower rates in order to gain more customers. Before you purchase a policy from the last company you saw on television, do some homework and determine which policy is the best for you, even if it’s not the least expensive. -

Comprehensive Insurance Packages

Typically, insurance companies insure multiple asset types. They write policies for homes, boats, renters, and they can also cover your health. If you package your automobile insurance with your home, boat, and health insurance, you will likely pay a bit less for your car insurance. -

Multiple Vehicles

If you have more than one car, combine them on the same policy. The more cars you add, the lower your rates will be on a per-car basis.

Factors That Affect Your Fresno, CA Car Insurance Rate

Fresno drivers are likely to see their insurance rates change over time. There can be many factors, both positive and negative, that impact your regular premiums. One key thing that all drivers face is aging. As you mature as a person and as a driver, your insurance rates are likely to fall. Typically, older drivers are safer drivers. They are less likely to drink and drive, speed, or take unnecessary risks on the road.

Your rates are also dependent, in part, on the type of car you drive. Fresno drivers who love high-powered sports cars will likely spend more for automobile insurance than those who drive less-exciting SUVs and sedans.

Rates are also tied to the deductible on the policy. If you carry collision or comprehensive (full) coverage and opt for a higher deductible, your premiums could be lower. That is, if a tree hits your car, you will pay more up front for the damage to offset the lower premiums you’ve been paying over time.