ON THIS PAGE

- San Diego Auto Insurance

- What is Required for San Diego Drivers?

- Cheap Auto Insurance in San Diego

- The Difference Between Liability and Full Coverage in San Diego

- Difference Between the two and cost examples

- Ways to Lower Your Auto Insurance Rates in San Diego

- Factors That Affect Your San Diego, CA Car Insurance Rate

San Diego Auto Insurance 101

San Diego, being a large city in a state that is often considered one of the worst states for driving, insurance is definitely going to be an important consideration. While tourists might take the bus or the trolley, if you live in the city you’re likely going to need to drive a car. Thus, you’ll need to make sure you have insurance to cover your responsibilities on the road. This page is dedicated to helping San Diego drivers have a better understanding of insurance and to provide a guide to some of the lowest automobile premium rates in their area.

What is Required for San Diego Drivers?

San Diego drivers, and California drivers generally, are required to carry automobile insurance that will cover any liability they might have in an accident. You must have an automobile insurance policy that, at a minimum, covers the other party should you be found at-fault in an automobile accident.

Specifically, California law states that your coverage should cover the first $15,000 of damages for the bodily harm of the other party. If there are two or more injured people in the other vehicle, your policy is required to cover the first $30,000 of the total bill. No matter the total cost each individual’s medical bills, the injured parties must split the money. As for the other car or whatever property you may have injured, your policy should cover up to $5,000.

Keep in mind that you might have to carry a comprehensive policy in some circumstances. When you finance or lease an automobile, you will likely be required to carry one of these policies so that your car is covered for any sort of accident. Since the car is not officially yours, your lender or lessor needs to know that the asset is covered, no matter the source or cause of any damage.

Cheap Auto Insurance in San Diego

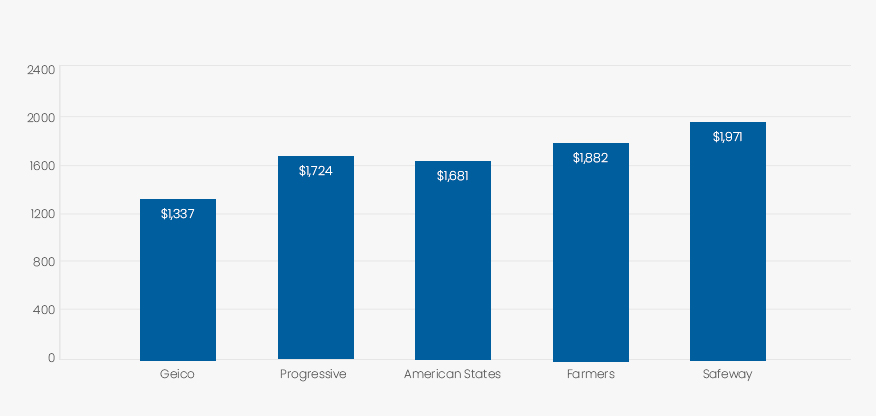

For Young Newer Drivers Unmarried Male, No Violations – Liability/Full Coverage

Unmarried men in San Diego must carry a liability policy as a minimum standard for driving in California. These policies will cover damages in the event of an accident, but only for the injured party, not the at-fault driver. California liability policies cover property damages up to a total of $5,000 and medical bills are covered for up to a total of $30,000 for multiple individuals.

| Unmarried Male - Licensed 1-2 Years | 10,000 Miles - Liability Only |

| Geico | $1,337 |

| Progressive | $1,724 |

| American States | $1,681 |

| Farmers | $1,882 |

| Safeway | $1,971 |

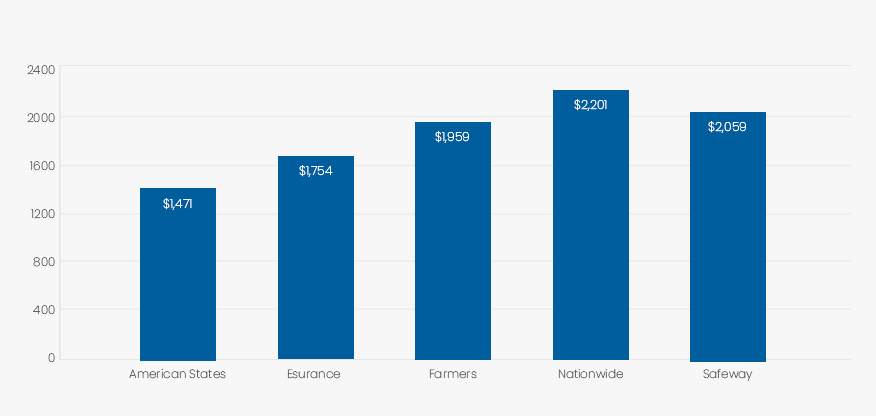

For Young Newer Drivers Unmarried Female, No Violations – Liability/Full Coverage

Unmarried women have some of the lowest premium rates, particularly for their liability policies. These rates are based on actuarial tables that take many factors into account including age, type of car, and gender. Below are some of the very lowest rates for women drivers in San Diego. There may be higher or lower rates throughout Southern California, but these should stand as a good baseline. If you’re offered coverage that is significantly cheaper than this from a company you don’t recognize, make sure you double check everything on the policy before signing up with them.

| Unmarried Women | Liability policy |

| American States | $1,471 |

| Esurance | $1,754 |

| Farmers | $1,959 |

| Nationwide | $2,201 |

| Safeway | $2,059 |

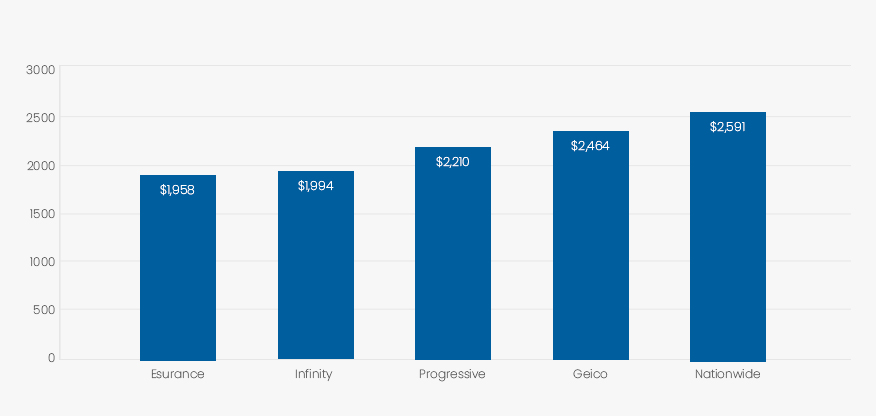

When women purchase new cars through a financing arrangement with a bank or other lender, they need to carry a comprehensive automobile insurance policy. San Diego women who lease their automobiles also need full coverage, as do those who simply appreciate the peace of mind in knowing that any damage to their cars will be covered even in a non-traffic accident. Below, we have listed some of the lowest rates for San Diego women who carry full automobile insurance.

| Unmarried Women | Full Coverage Policy |

| Esurance | $1,958 |

| Infinity | $1,994 |

| Progressive | $2,210 |

| Geico | $2,464 |

| Nationwide | $2,591 |

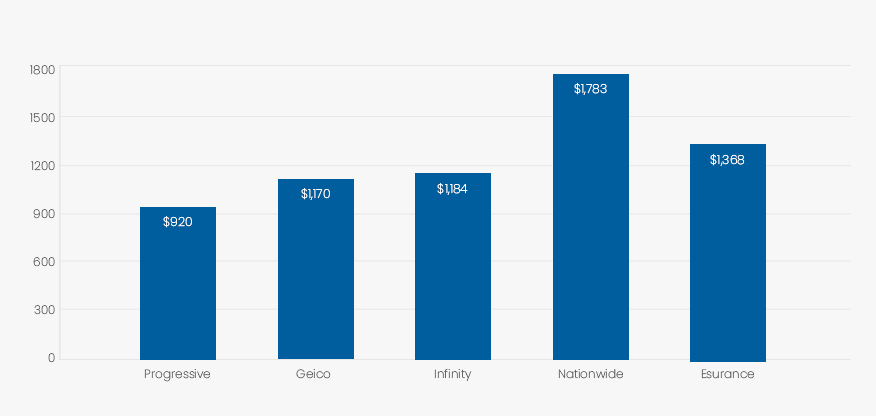

Married Couple, Licensed 13/10 Years, No Violations – Liability Only

Married couples can save a lot on their automobile liability insurance premiums. We gathered data from all of the major automobile insurers in California and found the lowest premium rates of all of them. Take a look at the following table and research the best possible coverage for you and your spouse, or domestic partner. Keep in mind that if one party has infractions on their driving record, rates will be higher. The following numbers reflect no violations for either partner.

| Married Couple | Liability Premiums |

| Progressive | $920 |

| Geico | $1,170 |

| Infinity | $1,184 |

| Nationwide | $1,783 |

| Esurance | $1,368 |

When married couples purchase a new car with a financing arrangement, or even lease a new car, the backing financial institution may require that they carry a comprehensive automobile insurance policy. Some couples also carry full coverage policies on cars they own outright, as they like the peace of mind that comes knowing that even if a tree falls on their cars that they can make a claim against their comprehensive policy.

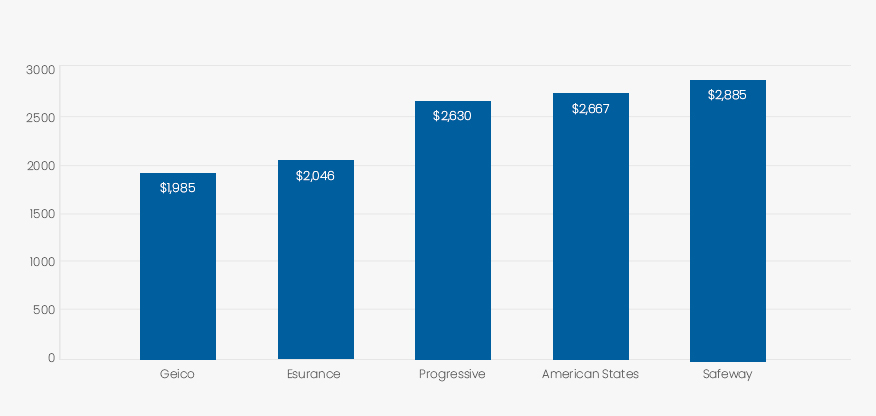

Unmarried Male, Licensed 9-15 Years, 1 At-Fault Accident – Liability/Full Coverage

Unmarried men tend to pay higher premiums in general. Their rates go even higher when they have a recent accident on their driving record. Note that these drivers can still achieve their former low rates if they maintain a clean driving record, attend a defensive driving school, and/or drive a sensible, non-sports car. We did a full analysis of California automobile insurance policies and we found the following rates, which are among the lowest for unmarried men with an accident on their record driving in San Diego.

| Unmarried Men | Liability Policy |

| Geico | $1,985 |

| Esurance | $2,046 |

| Progressive | $2,630 |

| American States | $2,667 |

| Safeway | $2,885 |

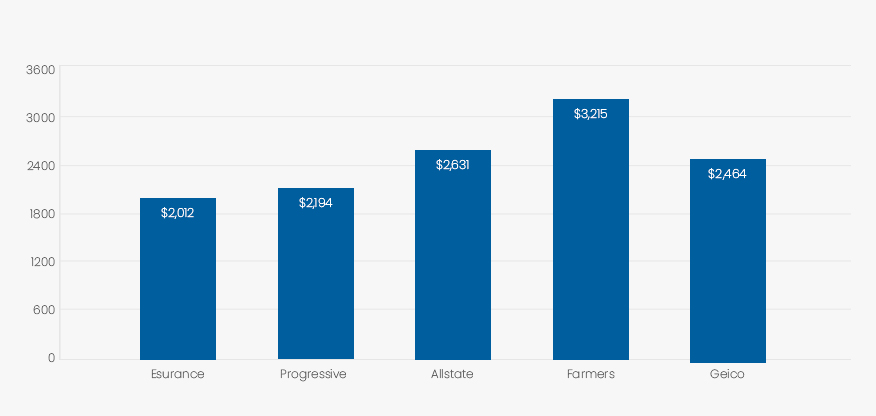

Full coverage policies are usually called comprehensive coverage by insurance professionals. Regardless, these policies cover a driver's car in addition to any other drivers he might collide with. The policyholder's car is also covered in the case of an uninsured motorist, hit-and-run accident, or non-vehicular incidents such as a tree falling or other acts of nature. Comprehensive automobile insurance is most often carried when drivers are financing or leasing a new car. Below are some of the lowest rates for fully insured unmarried men from San Diego who have one at-fault accident.

| Unmarried Men | Full Coverage Policy |

| Esurance | $2,012 |

| Progressive | $2,194 |

| Allstate | $2,631 |

| Farmers | $3,215 |

| Geico | $2,464 |

The Difference Between Liability and Full Coverage in San Diego

What is Liability-Only

A liability-only policy is one that will only cover the other party in case you are found to be at-fault in an accident. This will cover other vehicles, buildings, or people. Under California law, as well as the law of most states, a liability-only policy is the minimum coverage for all car owners. In fact, you can be cited and fined for driving without insurance.

Liability-only policies are only allowed for drivers whose vehicles are not part of any financing or lease arrangement. Since these polices represent the minimum level of coverage, they are usually the cheapest. However, keep in mind that drivers with liability-only policies are exposed to risk if weather, an uninsured motorist, or a hit-and-run driver damages their car.

What is Full Coverage

Full Coverage is not a tern with specific meaning in insurance, but it does typically refer to a comprehensive automobile policy. Under a comprehensive policy, both your car and any other vehicle, property, or person hit by your vehicle will be covered in the event of an accident. Thus, if your car is damaged due to a weather event, an uninsured motorist, or a hit-and-run collision, it will be covered under the stipulations of your policy.

Additional cities in California you can check out.

Difference Between the two and cost examples

Liability and Full coverage policies have many distinctions but the chief one is that under a liability policy your car is not covered. If you are in an accident and are found at-fault, your liability policy will cover the other driver and her passengers. A full coverage policy, on the other hand, covers damage done to your car as a result of a wide range of accidents, even if you are at-fault.

These policies also differ when it comes to premium payments. For instance, if you are an unmarried male in San Diego with a liability policy from Safeway Insurance, your premiums will be approximately $1,971. On the other hand, another unmarried San Diego man with no accidents and full coverage will pay up approximately $3,528 to drive a sensible Honda Accord.

Ways to Lower Your Auto Insurance Rates in San Diego

-

Don’t Speed

If you are caught speeding, your license will accrue points. With each additional point, your insurance company considers you more of a liability and so will charge you more for insurance. Stick to local in-town limits and use your cruise control on the highway to avoid excessive speed. -

Shop Around

Different insurers charge different premiums for virtually the same policies. Since the essential service is often identical from company to company, you are sure to save money by comparing rates from multiple companies. -

Avoid Accidents

When you are at fault in an accident, law enforcement will add points to your license. Further, the other party is likely to file a claim against your policy. When insurers pay out on claims, they typically raise the premiums for those policy holders. -

Bundled Insurance Packages

If you have renter’s insurance or are a homeowner, you may be able to add your automobile to the policy. This also goes for other vehicles or even health insurance. Insurance companies love to bundle policies and offer incentives for customers to do so. You will only have one premium payment to make, which makes things easy, and you’ll save money, as well. -

Insure Multiple Cars

If you own multiple cars, your per-car rates are bound to be lower if you put them all on the same policy. You can also include a car owned by your spouse or domestic partner. You could also add your partner to health insurance or cover their recreational vehicles under your policy.

Factors That Affect Your San Diego, CA Car Insurance Rate

Insurance companies factor in many variables when determining your automobile insurance rate. They look at your age, type of car, marital status, gender, and driving record, among other factors. Age is a factor because actuaries have found that older drivers tend to be safer drivers, whether due to experience or caution.

Your type of car is also important. For instance, cherry red convertible sports cars in particular might have the highest insurance rates. On this note, be aware that you might pay a lower premium for driving the sedan version of a sporty, high-horsepower vehicle. Still, what matters most is how you drive your hot-hatch or family wagon.

That’s because your driving record is perhaps the biggest single factor in your insurance rate. It is certainly the one that you have the most control over. That is, the longer you can maintain an incident-free driving record, the lower your rates are sure to be. Incidents can be anything from a minor speeding ticket to a reckless driving charge to being at-fault in a major automobile accident.