Alabama Car Insurance

- What is Required for Drivers in Idaho?

- Minimum Auto Insurance Requirements in Idaho

- Are Any Auto Insurance Laws Specific to the state of Idaho?

- Ways to Lower Your Insurance Rates in Idaho

- Are Requirements Different for Full-Time or Part-Time Residents?

- Where Idaho Ranks in Price Compared to National Average

Surrounded by six states and Canada, Idaho is the nation’s 14th most expansive state. Due to the facts that it’s extremely spacious and landlocked, it’s a very popular place for back-road driving. However, regardless of what type of road you happen to be traveling on, you must have auto insurance. Learn what is required of Idaho drivers in terms of auto insurance and how to get the very best rates on your Idaho auto insurance rates.

Auto Insurance in Idaho

When purchasing auto insurance coverage, you’ll find that there are many types of coverages available covering almost any auto-related situation you may encounter. Some types are required by the state and others are optional. Below are the various types of insurance coverage you’ll find at most auto insurance companies.

- Comprehensive pays to fix your car when damaged by anything not collision-related e.g. hail or deer damage

- Collision pays to fix your vehicle from collision-related

- Uninsured/Underinsured motorists pays for damages if you’re involved in an accident and the driver either doesn’t have auto insurance or has an insufficient amount.

- Bodily injury protects your if you’re being sued from an at-fault accident and may pay legal expenses

- Property Damage Liability pays for property damage to another when caused by you

- Medical and funeral payment service

- Rental reimbursement

- Towing

- Custom equipment

What is Required for Drivers in Idaho?

Idaho vehicle owners/operators are not required to carry full coverage on their vehicle but are required to purchase the following types of insurance.

- Bodily injury liability

- Property injury liability

Idaho drivers are required to carry proof of insurance with them any time they’re driving. They are also required to show the proof to law enforcement if requested. Drivers are not required by law to carry collision or comprehensive coverage but may be required by a lender if the vehicle is used as collateral on an auto loan.

Minimum Auto Insurance Requirements in Idaho

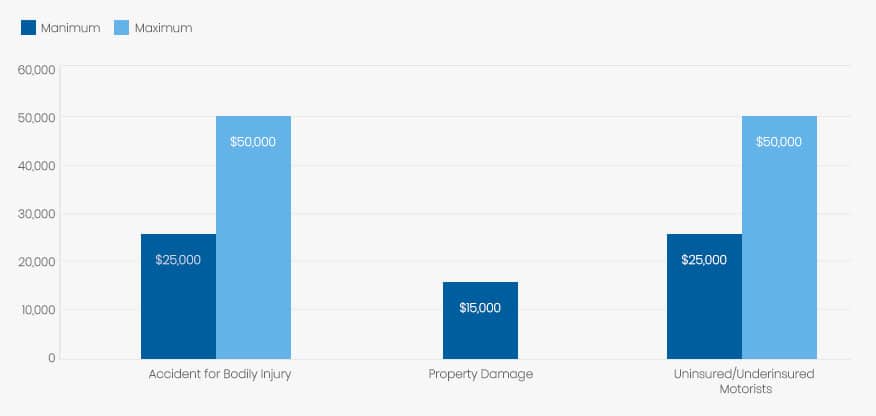

The state of Idaho not only requires you to carry liability insurance but also requires you to carry at least the following amounts. You do have the option of purchasing higher amounts of liability insurance, but these are the bare minimums you must have.

The state of Idaho not only requires you to carry liability insurance but also requires you to carry at least the following amounts. You do have the option of purchasing higher amounts of liability insurance, but these are the bare minimums you must have.

| Coverage | Minimum |

| Accident for Bodily Injury | $25,000 per Person |

| Accident for Bodily Injury | $50,000 for all people |

| Property Damage | $15,000 |

| Uninsured/Underinsured motorists | $25,000/$50,000 |

By signing a waiver form, drivers may be exempt from carrying the uninsured/underinsured motorist coverage. When agents offer you coverage and designate it as 25/50/15, they are referring to the above liability amounts required by the state.

Despite Idaho requiring all drivers to carry auto insurance, agents may deny some drivers auto insurance if the drivers are determined to be risky due to their driving record. Idaho is one of several states that belong to the Western Association of Automobile Insurance Plans (WAAIP), an organization that offers insurance to individuals having difficulty obtaining auto insurance due to their driving record, credit history or similar factors. The WAAIP can assist drivers in purchasing car insurance through the Idaho Automobile Insurance Plan, which works with Idaho insurance companies.

Are Any Auto Insurance Laws Specific to the state of Idaho?

Idaho is an “at fault” insurance state, which means that the driver who causes the accident is responsible for paying for the damages. Even if the other driver has his or her own insurance, the individual who caused the accident will first pay the compensation.

Each state has their own penalties for drivers caught driving without adequate auto insurance. Drivers without proof of insurance in Idaho can get a $75 fine for the first offense. For a second and subsequent offense, the drive can get a fine of up to $1,000 plus up to six months in jail.

The driver will also be required to file an SR-22 form, which is an additional expense. A vehicle must be insured whether it is registered or not. At the time of registration, the owner/driver must sign a form stating that the vehicle is insured.

Ways to Lower Your Insurance Rates in Idaho

Despite the lower auto insurance rates found in Idaho, drivers continue to look for ways to save money on their insurance. Often a driver will wonder why his insurance is more expensive than his friend. The reason is because different factors go into determining how much you pay for auto insurance in Idaho, and these factors are not the same for everyone. These factors include the following.

Type of car you drive

Prior car insurance coverage

Miles you drive

Your driving record

Your age

Your gender

Your marital status

Where you live

How long you’ve been driving

If car is used for business or pleasure

Credit history

Some of the factors are within your control to change while others are there to stay. However, to help offset some of the factors affecting you negatively, auto insurance agents often offer discounts. It’s important to realize that not all insurance companies offer the same discounts or they may not mention them on their own. When choosing auto insurance companies, it’s important to ask about any discounts of which you might be eligible.

Additionally, you should also shop around at different insurance companies. Although there are only half dozen or so major insurance companies in the nation, these companies underwrite for various other companies. If one company may not offer you an attractive premium, another one may. Below are some discounts worth mentioning to a potential auto insurance agent.

Good student discount

Paid-in-full discount

Auto/homeowner bundle discount

Multi-car discount

Professional group discount

Alternative fuel discount

Anti-theft device discount

Claim-free discount

You can also lower your Idaho auto insurance rates by lowering your coverage, assuming you’re carrying more than the state-required amount. You can also increase your deductible. The deductible is the amount you pay before your insurance company will pay on a claim. The higher your deductible, the lower your premium will be.

Certain vehicles may warrant higher insurance premiums either because they’re more expensive to repair or because they may be more prone to theft. Below is a list of the ten most stolen vehicles in Idaho in 2016, as reported by the National Insurance Crime Bureau.

2000 Ford Pickup full size

1997 Chevrolet Pickup full size

1997 Honda Accord

1997 Honda Civic

2001 Dodge Pickup full size

1999 GMC Pickup full size

2003 Ford Explorer

1998 Chevrolet Pickup small size

1994 Jeep Cherokee/Grand Cherokee

2001 Dodge Caravan

Are Requirements Different for Full-Time or Part-Time Residents?

The auto insurance requirements in Idaho are the same for part-time and full-time residents. You must establish residency in Idaho within 90 days of moving there. At that time, you’ll need to order new license plates. Proof of insurance must be provided when you apply for the plates. Prior to this period, you are still a resident of your prior state, and since all the states require insurance, you’ll still be required to carry auto insurance.

Where Idaho Ranks in Price Compared to National Average

The Insurance Information Institute reports that Idaho ranked as the least most expensive state for auto insurance for 2010-2014. The National Association of Insurance Commission does surveys periodically to determine the average costs of insurance.

As of their 2015 report, the average annual amount of auto insurance paid was about $841. This amount was for the basic required liability and did not include comprehensive or collision. In 2017, the national average was around $1,669, which is substantially higher than the average for Idaho, which was at $1,031.

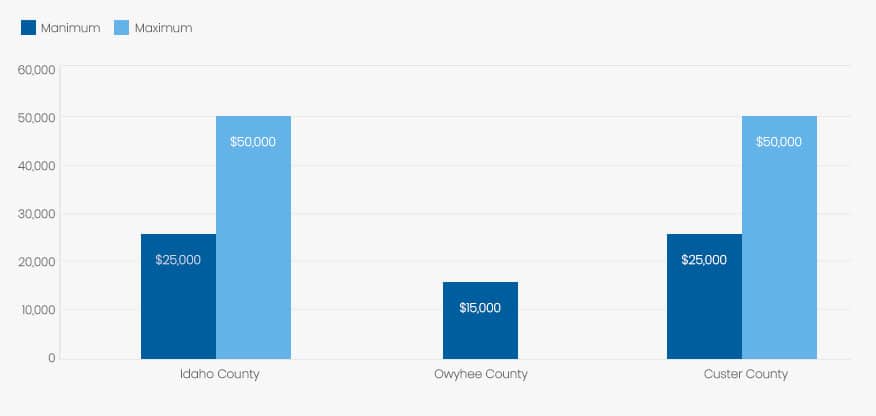

Average Rates in Top Three Counties

As stated above, auto insurance rates in Idaho are less expensive than in most any other state. While they do tend to fluctuate somewhat throughout the state, there is not a huge difference in different counties. Below are the auto insurance rates for three different counties in Idaho. The insure is a 45-year old married female with a good driving record.

| City | Minimum Coverage | Full Coverage |

| Idaho County | $293 for liability | $936 for full coverage |

| Owyhee County | $300 for liability | $843 for full coverage |

| Custer County | $299 for liability | $875 for full coverage |

Summary

About a million licensed drivers travel the roads of Idaho with each of them averaging 10,000 miles a year. With that kind of driving taking place, you can bet there are also many traffic-related accidents. Carrying insurance in Idaho is not only a legal requirement but also a smart choice. Shopping around for the very best deal on Idaho auto insurance can make the difference in the type of insurance you can purchase and also having a little extra cash in your wallet.