Indiana Car Insurance

- What is Required for Drivers in Indiana?

- Minimum Auto Insurance Requirements in Indiana

- What Car Insurance Things are Specific to the state of Indiana?

- Ways to Lower Your Insurance Rates in Indiana

- Are There Different Requirements for Full-Time and Part-Time Residents?

- Where Indiana Ranks in Price Compared to National Average

Indiana is a Midwestern state with many interesting characteristics. It’s not only been home to the famous Indianapolis Motor Speedway, the Indianapolis Colts and Hall of Famer Peyton Manning, but it also has 13 different major highways running through the state. With all that traffic, you can bet insurance and accidents are an issue. If you’re living or planning to move into Indiana, get familiar with the insurance laws. Get all the important facts below.

Summary of Auto Insurance in Indiana

Indiana auto insurance companies offer various types of coverage. The state of Indiana requires certain types of coverages while others are optional. Most insurance companies in Indiana offer these coverage types.

Comprehensive

This pays for damages to your vehicle from incidents like fire, storm, theft, animals.Collision

This helps pay to have your car repaired after an accident where you hit something.Bodily damage liability

This protects you from liability when others are injured in an accident where you were at fault.Property damage liability

This protects you from liability when you damage the property of others in an accident.Uninsured motorists bodily injury

This helps pay damages caused by another driver when he or she has no insurance.Uninsured motorists property damage

This helps pay for property damages caused by another driver when he or she has no insurance.Underinsured motorist bodily injury

This helps pay for medical damages when the other drive doesn’t have enough insurance.Rental reimbursement

This pays you to rent a car while your car is being repaired from a claim.Loan/lease gap coverage

This helps pay the difference between your car’s actual cash value and what you still owe on it.Medical payments coverage

This helps pay for medical bills or funeral costs resulting from an accident.Emergency roadside assistance

This pays to have your car towed to a local repair shop or for minor repairs.Customized parts and equipment

This helps pay for specific parts used to repair your vehicle.

What is Required for Drivers in Indiana?

The following insurance coverage is mandatory for all drivers in Indiana

- Bodily injury liability

- Property damage liability

- Uninsured motorist bodily injury

- Uninsured motorist property damage

- Underinsurance motorist bodily injury

Drivers are required to provide proof of insurance or financial responsibility at the following times.

- Anytime when you’re driving

- After an accident

- When requested by law enforcement

- When registering or renewing your car’s registration

Once you’ve been convicted of driving without insurance, your name is placed in the Previously Uninsured Motorist Registry (PUMR) and left there for five years. When your name is in the registry, it can be randomly selected. If this happens, you will have to immediately provide proof of financial responsibility.

Drivers who are denied insurance because of their driving records can apply to purchase auto insurance through the Indiana Automobile Insurance Plan. Indiana drivers must demonstrate proof of financial responsibility. Most choose to do this by purchasing an auto insurance policy, but there are other ways of proving financial responsibility in Indiana.

- Buying a basic liability auto insurance policy

- Depositing $40,000 with the Indiana State Treasurer

- Getting a trust fund valued at $40,000 in the current market

- Purchasing a state-approved bond with an Indiana surety company

There are penalties if you’re caught driving without the required auto insurance coverage. Your first offense of driving without insurance will result in the following.

- License suspension for 90 days to a year

- License reinstatement fees of up to $300

- Must maintain an SR-22 on record with the state for three years

Minimum Auto Insurance Requirements in Indiana

When Indiana drivers purchase an auto insurance policy, the policy must have at least the following amounts.

| Coverage | Per Person | Per Accident |

| Bodily injury liability | $25,000 per person | $50,000 per accident |

| Property damage liability | $25,000 | $25,000 |

| Uninsured motorist bodily injury | $25,000 per person | $50,000 per accident |

| Uninsured motorist property damage | $25,000 per accident | $25,000 per accident |

| Underinsured motorist bodily damage | $50,000 per person | $50,000 per accident |

When purchasing the state’s required amount, it will appear as 25/50/25. Other available liability amounts are 50/100/50 or 100/200/100. Auto insurance agents are always willing to offer more coverage. Although the state sets a minimum amount of liability insurance a driver must buy, drivers may choose to purchase higher amounts so they’re adequately covered in the case of an accident-related lawsuit.

What Car Insurance Things are Specific to the state of Indiana?

Indiana requires that all drivers have financial responsibility when operating a vehicle on Indiana roads. As an “at-fault” state, Indiana state uses a tort system that means when there is an auto accident someone must be at fault. Based on this theory, the individual causing the accident and his or her insurance company are expected to pay for any accident-related financial damages.

Unlike many other states, Indiana does require that all Indiana liability insurance policies include the uninsured/underinsured motorist liability coverage, and the amounts of coverage must equal the amounts of basic liability coverage.

Ways to Lower Your Insurance Rates in Indiana

Auto insurance rates in Indiana are determined by a variety of factors. Some of the factors can be changed to try to lower rates, but other factors cannot be changed. Here are some of the many factors that determine what rate drivers pay for auto insurance.

- Age and gender

- Marital status

- Vehicle usage

- Driving record

- Geographic location

- Amount of insurance coverage

- Make and model of car

- History of claims

- Driver training

- Credit scores

- Deductible

Discounts offered through the insurance can really lower insurance premiums. Most companies offer discounts, but the type of discounts offered vary from company to company. The insurance industry is a competitive business, and agents typically try to offer the best discounts to get your business. There are many auto insurance companies in the U.S. so customers can negotiate to see who offers the best price and which company offers the most discounts. Below is an example of some of the benefits insurance companies may offer.

- Bundling discount (home and auto insurance)

- Good driver discount

- Hybrid vehicle discount

- Multi-car discount

- Good credit discount

- Senior discount

- Loyalty discount

- Military discount

- Safety device discount (anti-lock brakes, rear camera, warning systems, automatic seat belts)

Are There Different Requirements for Full-Time and Part-Time Residents?

Very seldom are people residents in two states (even part-time residents) because establishing residency involves getting a driver’s license. A driver really can’t or shouldn’t have a driver’s license from two states because it can be a nightmare for the Department of Transportation to monitor two driving records from the same person. Although there are a couple exceptions to this, these exceptions do not apply to Indiana. Once individuals become residents of Indiana, they must register their vehicles within 60 days.

Prior to the time they get their Indiana driver’s license, they carry a license from that state. When individuals apply for their Indiana license, they must show proof of insurance at that time. Therefore, there are not different requirements for part- and full-time residents. The only exception might be for military personnel who might be Indiana residents but stationed elsewhere.

Where Indiana Ranks in Price Compared to National Average

According to 2017 survey of auto insurance premiums in different states, the lowest average annual premiums ($874) were in North Carolina, and the highest ($4,054) were in Michigan. Based on that, Indiana auto insurance rates are on the low end. The average premiums for Indiana were $1,327, and amount slightly lower than the national average of $1,669.

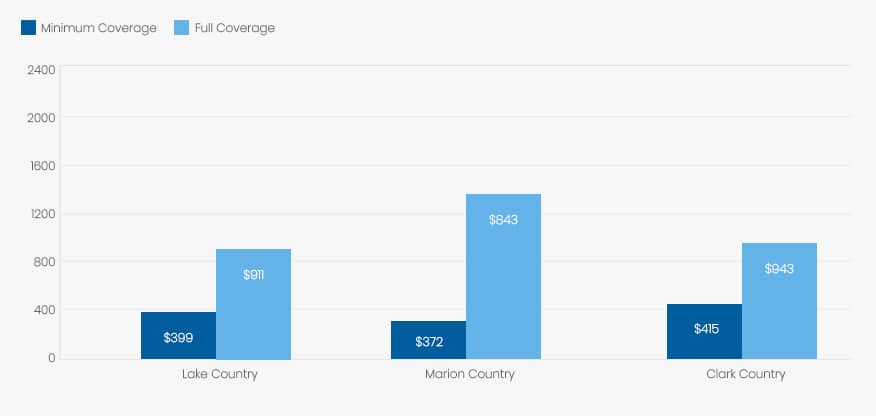

Average Rates in Top Three Counties

Average rates of Indiana are on the low side. Even in the capital city of Indianapolis, rates are under $900 per year, which is much lower than in other large cities in other states. The rates do change from city to city. Below is an example of rates from three large Indiana counties for both full coverage and the state’s minimum amount of liability insurance. The rates are for a married, female who is 24 years old and has a good driving record.

| County | Minimum Coverage | Full Coverage |

| Lake County | $399 for liability | $911 for full coverage |

| Marion County | $372 for liability | $843 for full coverage |

| Clark County | $415 for liability | $943 for full coverage |

Summary

Purchasing auto insurance in Indianapolis, Indiana doesn’t have to be the daunting and stressful task we tend to make it out to be. While it may be a legal requirement, it’s also a form of protection against loss of our vehicle and our livelihood in the case of a lawsuit. We all think we’re good drivers and will never get into an accident. Unfortunately, accidents happen to the best of us, and it’s best to be prepared financially. I hope that this insurance overview can help you get the best deal.