ON THIS PAGE

- What is Required for New Orleans Drivers?

- Cheap Auto Insurance in New Orleans

- The Difference Between Liability and Full Coverage in New Orleans

- Difference Between the two and cost examples

- Ways to Lower Your Auto Insurance Rates in New Orleans

- Factors That Affect Your New Orleans, LA Car Insurance Rate

What is Required for New Orleans Drivers?

In the state of Louisiana, as in all other states, vehicle owners are required to have liability insurance according to state laws. Louisiana is also a “Fault Auto Accident State” meaning someone has to be named as the person who caused the accident and responsible for financial losses. A person In Louisiana, who suffers an injury or damage to their vehicle due to an auto accident, has three options to proceed, they can:

- File a claim with their insurance company, if they are covered for the illness or damage that resulted from the accident, in which case the insurance company will pursue a subrogation claim against the driver who was at-fault’s policyholder.

- File a third-party claim with the at-fault driver’s insurance company, or

- File civil court proceedings or a personal injury lawsuit against the at-fault driver.

The required minimum liability amounts drivers need to have are:

- $15,000 for bodily injury of a single person

- $30,000 for total bodily injury

- $25,000 per accident for property damage

Cheap Auto Insurance in New Orleans

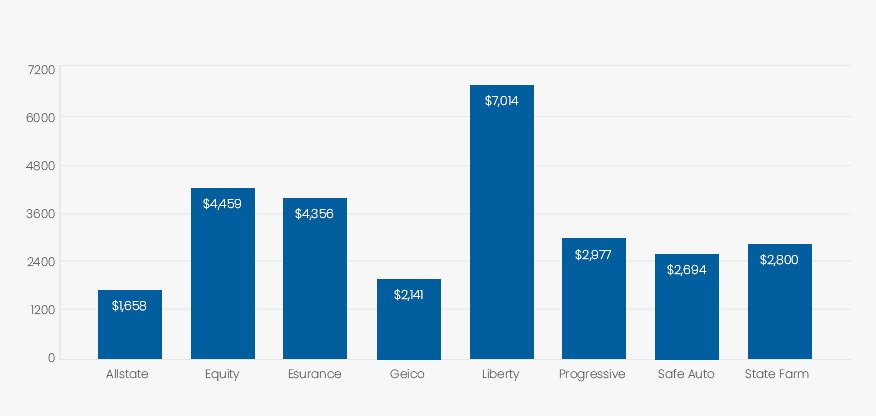

Single Male, 18, 1 At-fault Accident – Liability/Full Coverage

We checked rates and coverage plans for numerous insurance companies operating throughout the state of Louisiana. Out of the many insurance companies that were checked we reduced our list to the 8 well-known companies seen in the chart below, with the best coverage rates.

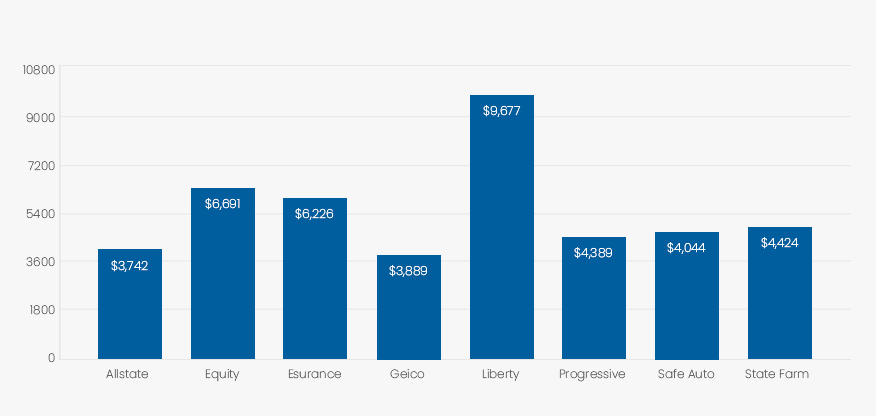

The Louisiana driver profiled in this scenario is an 18-year-old single male who has had 1 accident where he was at fault and is looking for auto insurance coverage. Using the chart, we can determine how much it would cost him for both a liability-only and a full-coverage plan depending on 5 different cities he resides in. As you can see in the chart that Allstate located in New Orleans, has the best rate at $1,700 for liability and for full coverage Safe Auto has the best rate of $3,656. This may seem like a significant increase, but it’s not that surprising. See below for the differences between liability-only and full coverage insurance.

| Single Male | Liability Coverage |

| Allstate | $1,658 |

| Equity | $4,459 |

| Esurance | $4,356 |

| Geico | $2,141 |

| Liberty | $7,014 |

| Progressive | $2,977 |

| Safe Auto | $2,694 |

| State Farm | $2,800 |

| Single Male | Full Coverage |

| Allstate | $3,742 |

| Equity | $6,691 |

| Esurance | $6,226 |

| Geico | $3,889 |

| Liberty | $9,677 |

| Progressive | $4,389 |

| Safe Auto | $4,044 |

| State Farm | $4,424 |

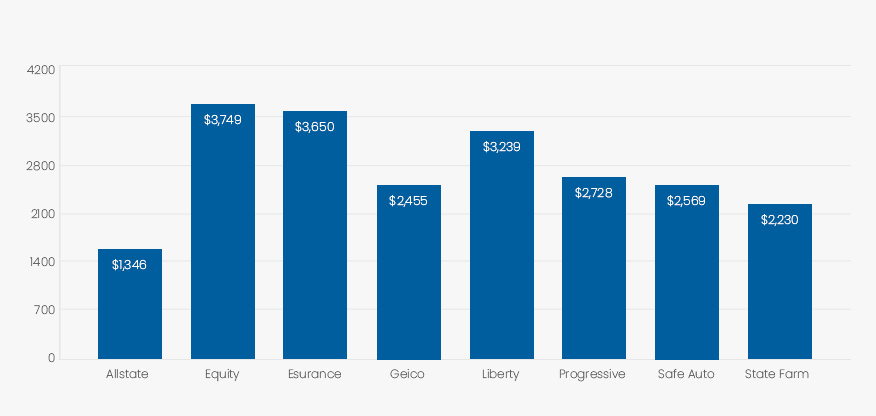

Single Female, 18, 1 At-fault Accident – Liability/Full Coverage

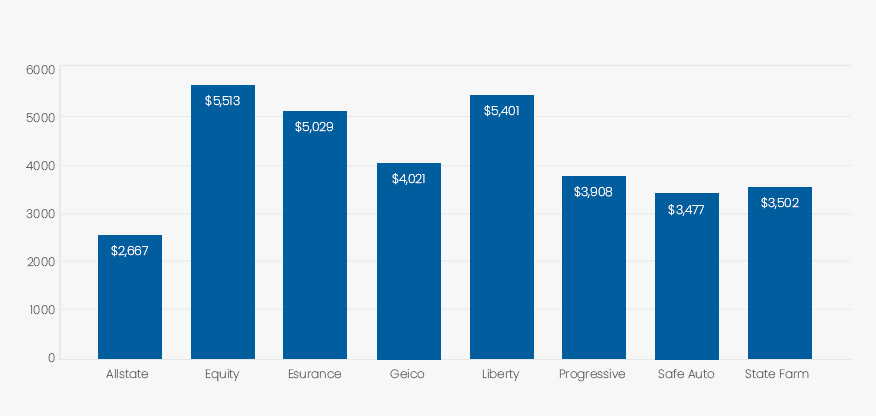

Now let’s take a look at a female driver who fits the same demographics; she is also an 18-year-old driver not married who was the cause of 1 accident and is seeking auto insurance. The best rate for liability is from Allstate again, at $1,382 and for full coverage, Allstate still has the best rate, at $2,623.

You may have noticed that insurance plans, whether it’s just liability or full coverage, are slightly higher for a male, even though he has the same demographics as a female. This is due to males being considered somewhat more reckless drivers than females who are more cautious drivers at a young age. This increases the risk for an insurance company, and therefore also increases their rates. However, this can change with age.

| Single Female | Liability Coverage |

| Allstate | $1,346 |

| Equity | $3,749 |

| Esurance | $3,650 |

| Geico | $2,455 |

| Liberty | $3,239 |

| Progressive | $2,728 |

| Safe Auto | $2,569 |

| State Farm | $2,230 |

| Single Female | Full Coverage |

| Allstate | $2,667 |

| Equity | $5,513 |

| Esurance | $5,029 |

| Geico | $4,021 |

| Liberty | $5,401 |

| Progressive | $3,908 |

| Safe Auto | $3,477 |

| State Farm | $3,502 |

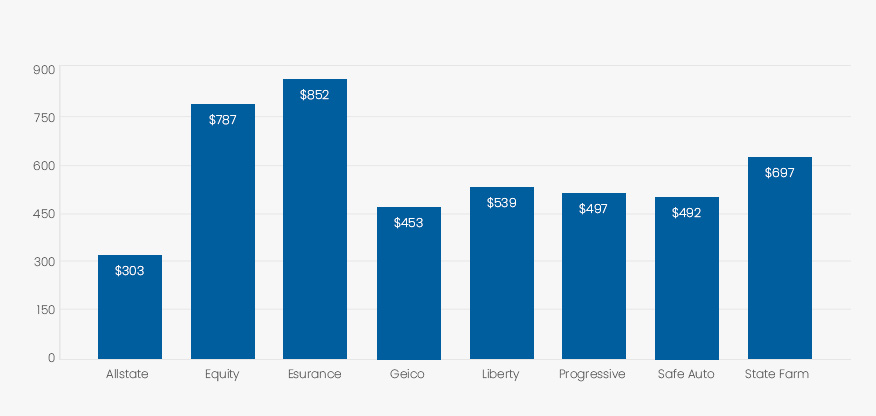

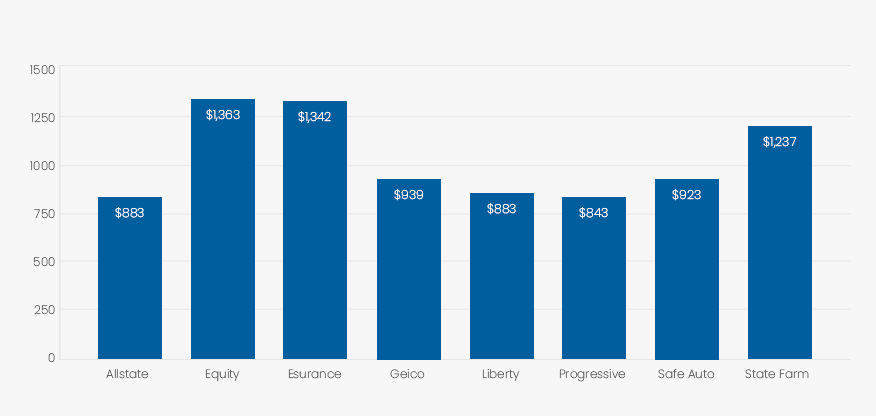

Married Male, 30, No Violations, 15,000 miles driven annually – Liability/Full Coverage

Our next profile is a 30-year-old married male who drives approximately 15,000 miles per year and doesn’t have any violations. Again, Allstate proves to have the lowest rate for liability insurance at only $317. The next closest is Geico at $425. Moreover, it looks like Esurance in New Orleans has the highest rate for liability at $909. For full coverage, this driver can get the best rate from Safe Auto for $853 and the highest rate is $1,493 from Esurance.

| Married Male | Liability Coverage |

| Allstate | $303 |

| Equity | $787 |

| Esurance | $852 |

| Geico | $453 |

| Liberty | $539 |

| Progressive | $497 |

| Safe Auto | $492 |

| State Farm | $697 |

| Married Male | Full Coverage |

| Allstate | $883 |

| Equity | $1,363 |

| Esurance | $1,342 |

| Geico | $939 |

| Liberty | $883 |

| Progressive | $843 |

| Safe Auto | $923 |

| State Farm | $1,237 |

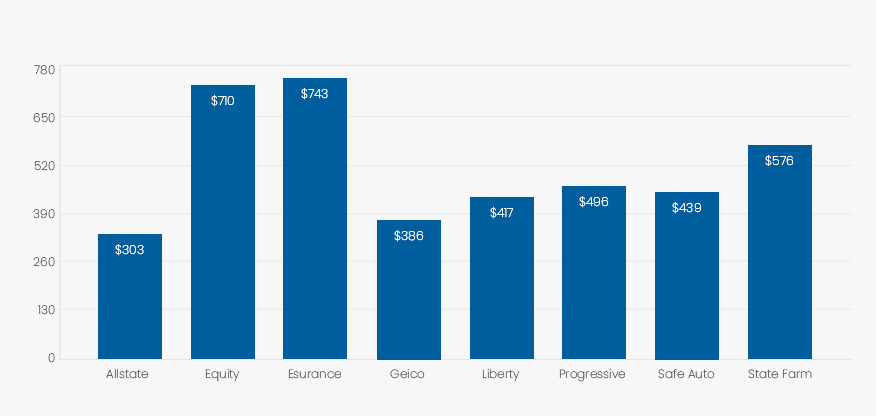

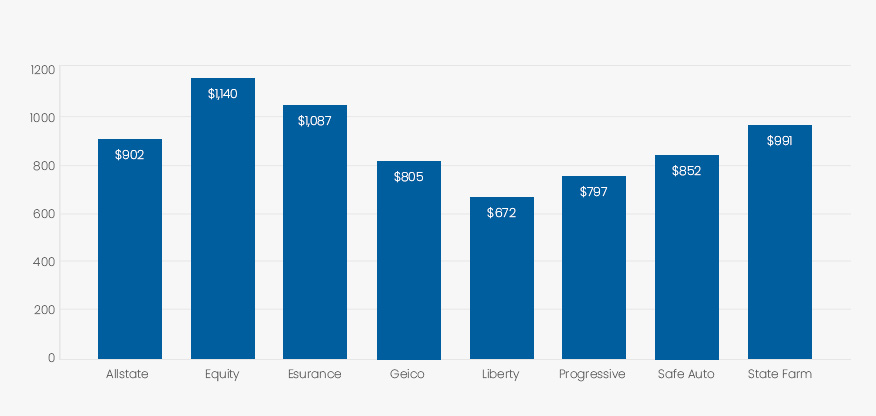

Married Female, 60, No Accidents or Violations, 5,000 miles driven annually – Liability/Full Coverage

A 60-year-old married female without any violations or accidents who drives 5,000 miles per year can also get a liability insurance coverage plan for $317 from Allstate. Esurance has the highest rate at $790 for liability-only insurance in New Orleans. If the same female was looking to get a full coverage insurance plan in New Orleans, she would need to pay $709 at Liberty Insurance and again Esurance in New Orleans has the highest rate for full coverage at $1,185.

| Married Female | Liability Coverage |

| Allstate | $303 |

| Equity | $710 |

| Esurance | $743 |

| Geico | $386 |

| Liberty | $417 |

| Progressive | $496 |

| Safe Auto | $439 |

| State Farm | $576 |

| Married Female | Full Coverage |

| Allstate | $902 |

| Equity | $1,140 |

| Esurance | $1,087 |

| Geico | $805 |

| Liberty | $672 |

| Progressive | $797 |

| Safe Auto | $852 |

| State Farm | $991 |

The Difference Between Liability and Full Coverage in New Orleans

What is Liability-Only

Liability insurance covers the possible cost of damage you cause to others while driving. This could mean the cost of medical care for those injured in an accident or repair costs of the damage you have caused to other vehicles.

With liability insurance, there are 3 key numbers: injury coverage per person, coverage for total injury per accident, and property damage coverage per accident. The state of Louisiana liability coverage requirements looks like this 15/30/25. $15,000 per injured person, with a maximum of $30,000 for all the people who are injured in an accident, and $25,000 in coverage for property damage.

What is Full Coverage

While liability insurance covers other people and vehicles in an accident where you were the one considered at fault, full coverage insurance can also cover you and your vehicle as well. Full coverage includes two different types of coverage combined into one insurance plan; comprehensive insurance and collision.

Comprehensive coverage is for the damage of other vehicles that are outside of driving situations such as weather damage, fire, or theft.

Collision coverage is basically to pay for damage that you caused while driving such as an accident with another vehicle, hitting an object, or driving off the road.

The difference between collision and comprehensive is, if a tree were to fall on your car and damage it, comprehensive insurance would cover it, however, if you were driving and hit a tree causing damage to your car, then it would be covered by collision.

Difference Between the two and cost examples

The main difference between liability and full coverage insurance is that full coverage will cost more than liability insurance and this is because it protects you against many more possible risks that liability doesn’t cover.

In addition, liability insurance only covers other people’s injury claims and damages to other vehicles where full coverage will cover other’s injuries and vehicle damages as well as your injuries and damage to your own vehicle.

According to the National Association of Insurance Commissioners, who compiled statistics in 2014, Louisiana is third in states that have the highest insurance rates, with an average rate of $1,275. Washington, DC is the second with an average rate of $1,289, and New Jersey holds the first place at $1,334.

Ways to Lower Your Auto Insurance Rates in New Orleans

-

Raise your deductible

If you are willing to pay more money for a deductible, in the event of an accident, then you can lower your insurance rates substantially. You can lower your premium to around 10% just by raising your deductible to around $1,000. -

Drop Collision Coverage on Old Cars

Dropping collision coverage on older cars can really help save you a lot, especially for cars that are more than ten years old and only worth four or five thousand dollars. Think about it, if you have an accident while driving an older car, are you really going to pay to repair it or just buy a new car? -

Check Insurance Rates for Your Car’s Make and Model

The make and model of your car can make a big difference in how much you pay for auto insurance. Therefore, before purchasing a new car, be sure and check the insurance rates for it as some can be much higher than others. -

Shop Around to Check Rates from Numerous Insurance Companies

The chart in this article should be enough proof to know that there can be a big difference in what various insurance companies charge for auto insurance. That is why it is a good idea to check rates from a number of insurance companies before deciding which plan to choose. -

Drive Fewer Miles

One of the questions asked when applying for auto insurance rates, is how many miles you drive regularly. This is because the more miles you drive, the more risk you are to the insurance company and the higher your insurance cost will be. Try to drive fewer miles, if possible, to save more money on your premiums. -

Maintain a Good driving record

Being a safe driver can not only save your life, but it can also save you a lot of money, too. There is a big difference in how much people with accidents on their record have to pay, and what those without any accidents pay. Therefore, always drive safely. -

Live in a less populated area

Your location matters when it comes to auto insurance rates. If you live in a highly populated area, your rates will be higher than if you live in a lower-population area. The Jefferson and New Orleans areas have some of the highest rates in Louisiana, but if you live just 30 minutes outside of the city, you can expect your rates to go down.

Factors That Affect Your New Orleans, LA Car Insurance Rate

- Gender

- Marital Status

- Age

- Number of Violations

- Credit Report/Score

- Location

- Driving Record

- Insurance Company

- Make and Model of your car

- Your Insurance Plan

- How many cars you have insured

- Your Occupation

- Miles you drive per year