Maine Car Insurance

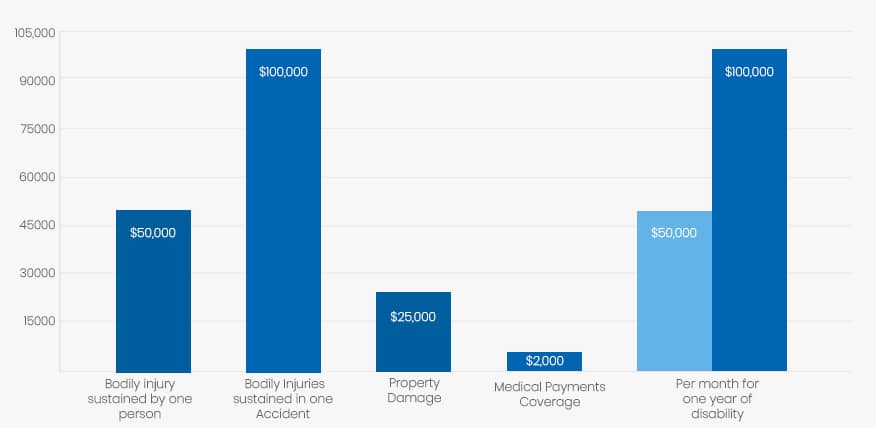

The state of Maine requires all vehicles to be properly insured. Maine law has established that motorists must have insurance in the required liability coverage amounts of:

| Coverage | Minimum |

| Bodily injury sustained by one person | $50,000 |

| All Bodily Injuries sustained in one accident | $100,000 |

| Property Damage resulting from one accident | $25,000 |

| Medical Payments Coverage | $2,000 |

| Uninsured/Underinsured Motorist coverage equal to bodily injury liability insurance limits | $50,000 per person; $100,000 per accident |

As an alternative, vehicle owners may also purchase a single policy with a limit of $125,000.

Ways Driving in Maine is Unique

If you’ve got a young driver in your household, the state of Maine holds them to a high standard.

Maine’s Graduated License Program

Starting with the graduated license program, for a period of 270 days, all new drivers under age 18 may not:

- Drive between midnight and 5 a.m.

- Use a mobile phone while driving

- Carry passengers in their vehicle other than immediate family members or a foreign exchange student living with the family (without a licensed driver present of age 20 or older who has been licensed at least two years and is seated beside the driver)

Any driver in violation of these rules will mean your driving restrictions are extended.

New driver provisional licenses

In Maine, if you are under age 21, you must abide by the state’s provisional license requirements for two years. This means that any violation of traffic laws during the provisional license period results in the suspension of your driver’s license. This will take place for 30 days on the first offense, 180 days on the second offense, and a full year on the third offense.

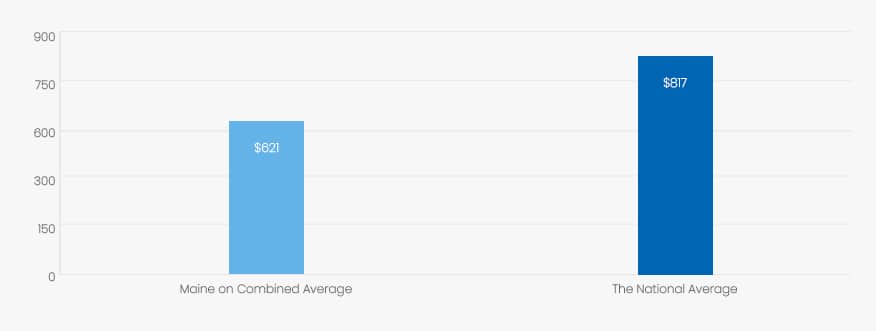

How does Maine measure up on automobile insurance rates nationally?

Maine is 50th in the nation on rates, so you can expect to pay a bit lower than the average amount for car insurance here. For example, the average driver can expect to see a rate of $621 in Maine on a combined average premium where the national average is around $817.

Rates can fluctuate widely depending upon your zip code

For more examples, we compared drivers in the top 3 most populous Maine cities; Portland, Lewiston, and Bangor. By our research, a married 45-year-old homeowner female driver of a 2012 Honda Accord used primarily for commuting to work/school in Portland, Maine could expect to pay around $647 for an average 6-month policy. The same driver in Lewiston, Maine could expect to pay around $660 for coverage on a 6-month policy. A similar policy for the same driver in Bangor, Maine could expect to pay $511 for the full 6 months.

Ways to Lower Your Rates

There are ways to lower your automobile insurance rates in Maine as several possible discounts may apply to you or your household.

Discounts may be given for a variety of reasons in Maine. Some of them include:

- Having prior insurance coverage and maintaining auto insurance without lapse

- Agreeing to a paperless policy

- Claim history

- Credit history and score

- Having or maintaining low mileage

- Selecting a safe, reliable vehicle over high performance cars

- Driver’s education training discounts (for successful completion of an approved program)

- Good driving discounts if all drivers in the household have remained accident-free with no moving violations for a certain number of years

- Good student discounts for maintaining certain grades, usually a B/3.0 average or higher or being on the school’s Dean’s List

- Senior discounts, generally for main policy drivers being 65 years of age or older (without drivers under age 25 on the policy)

- Passive restraint discounts for safety devices being installed in the vehicle such as air bags (factory-installed)

- Multi-car discounts or multiple policy discounts for one household

- Student-away-at-school discount, generally for students attending school at least 100 miles away who leave their cars at home while at school

- Having an anti-theft device installed (other than manufacturer-provided devices)

In general, aside from applying discounts when possible, drivers who maintain a good driving record, remain sober, cautious and law-abiding and avoid texting at all times while driving, make sure their household members also remain responsible drivers, and keep their credit scores as high as possible can keep their premium rates low.

For more details, you may visit:

Maine Bureau of Insurance Auto Insurance Information

State of Maine FAQ on Auto Insurance Claims

State of Maine Professional and Financial Regulation website – Bureau of Insurance