Maryland Car Insurance

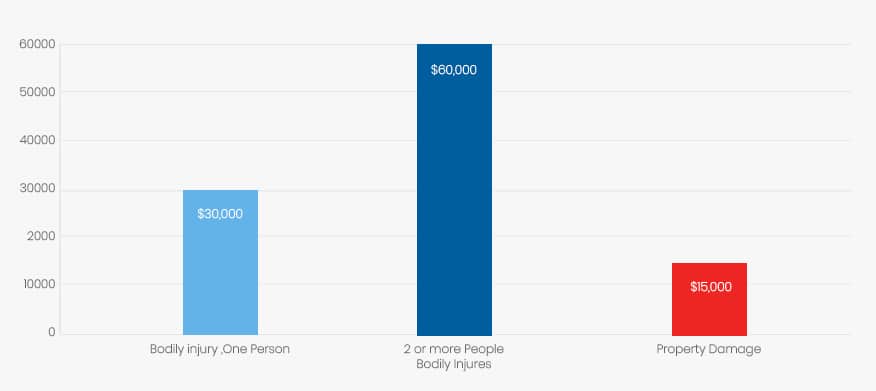

Maryland is a mandatory vehicle insurance state, meaning that any vehicle operated in the state has the following minimum required liability coverage amounts:

| Coverage | Minimum |

| Bodily injury, one person | $30,000 |

| 2 or more people bodily injuries | $60,000 |

| Property Damage | $15,000 |

Additionally, the insurance you purchase must be licensed to do business in the state of Maryland

Ways Driving in Maryland is Unique

Providing proof of auto insurance in Maryland:

- You must obtain the Maryland Vehicle Insurance Certification form #FR-19 in order to provide verification of vehicle insurance

- This form can only be issued by a company licensed to do business in Maryland or their authorized agent

- It can only be used for 30 days

- It can be faxed or submitted electronically to the MVA by your insurance company

- Photocopies of the original will not be accepted

Maryland vehicle insurance mandate

There are various fines and penalties for driving without insurance in the state of Maryland. These include:

- $150 for the first 30 days of driving without insurance, and an additional $7 per day after that, totaling an annual maximum amount of $2,500

- Registration suspension will be automatic. Continuing to drive once your registration is suspended may result in your vehicle being impounded, as well as further tickets and/or fines

- If you ignore notices from the MVA regarding your insurance or suspension, your case may be referred to collections at the Central Collections Unit, or CCU.

- Once your case has been sent to CCU, your original fines become subject to an additional 17 percent collection fee and your income tax refund will be intercepted.

Note: If you have had any of the above situations occur or you have an uninsured vehicle, you may contact the Insurance Debt Reduction Program for assistance.

Turn your license plates in before cancelling insurance.

You may turn your vehicle’s license plates in at any Maryland Motor Vehicle Administration office prior to cancelling your auto insurance. If you do not turn your plates in first, you may be charged a fee by both tag and title companies. This must be done when you sell or transfer ownership of the vehicle as well. The state also advises getting a receipt from the MVA when you turn the plates in.

If you move outside the state of Maryland, and forget to return your license plates:

you must contact the Maryland Motor Vehicle Administration with the following info:

- your Maryland tag and title number

- copy of current registration in the new state

- date of vehicle being titled in the new state

- if you have not yet titled your vehicle out of state, you must provide the MVA with your effective and termination dates on your current auto insurance policy.

If you move into the state of Maryland and wish to continue insurance coverage from your previous state:

you must contact your insurance company to get your policy converted to a Maryland policy. You must also make sure your insurance company is licensed to do business in the state of Maryland.

If you have trouble getting insurance:

You may contact the Maryland Automobile Insurance Fund, or MAIF, for assistance. They provide help to drivers who have been denied basic coverage by two or more insurance companies, or have been cancelled by one.

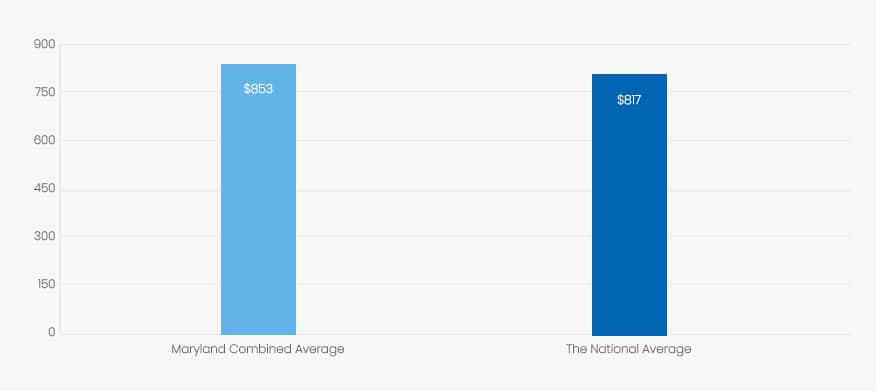

How does Maryland measure up on automobile insurance rates nationally?

Maryland rates are around 15th in the nation on premium rates, so you can expect to pay higher than the average amount for car insurance here. For example, the average driver can expect to see a 6-month policy rate of at least $853 on a combined average premium where the national average is around $817.

To get more specific, we compared drivers in the top 3 most populous Maryland cities. For our research, the cities of Baltimore, Columbia, and Germantown were used:

A 45-year-old married home-owning female driving a 2012 Honda Accord used mainly for commuting to work/school around 30 miles round trip 5 days weekly could expect to pay as much as $1432 or a 6-month liability insurance policy in the city of Baltimore, Maryland. The same driver in Columbia, Maryland could expect to pay $656 on a similar 6-month policy. In Germantown, Maryland the same driver could spend $988 for the full 6 months on the same type of policy.

As you can see, rates fluctuate drastically based upon your garaging location in the state of Maryland!

Ways to Lower Your Rates in Maryland

There are ways to lower your rates in Maryland as several possible discounts may apply to you or your household.

Discounts may be given for a variety of reasons in Maryland. Some of them include:

- Automatic payment/paperless billing

- active military discounts

- Bundle discounts for multiple cars or multiple policies in one household

- Student-away-at-college discount for students attending college at least 100 miles away from home who leave their car at home while attending

- Homeowner discounts for responsible home ownership

- Paying in full discounts (pay in full up front rather than in installments)

- Claims-free or accident-free discounts, generally if you have not been in an at-fault accident or received a moving violation within a certain number of years

- Good grades driver discounts, usually for at least a B or 3.0 GPA, Dean’s List or Honor Roll students, or scores in the top 20 percent of national standardized tests

- Mature driver discounts, if driver is 65 years old or older

- Successful completion of an approved driver’s education program

- Anti-theft device discounts

- Anti-lock brake discounts

- Electronic stability control

- Passive restraint discounts (for air bags, etc., usually factory-installed)

- Pay early discounts, generally used if paying a week or more before due date of policy renewals

In general, aside from applying discounts when possible, drivers who maintain a good driving record, remain sober, cautious and law-abiding and avoid texting at all times while driving, make sure their household members also remain responsible drivers, and keep their credit scores as high as possible can keep their premium rates low.

For more details, you may visit:

Maryland Department of Transportation Motor Vehicle Administration

Maryland Insurance Administration – Automobile Insurance

Insurance Debt Reduction Program