Minnesota Car Insurance

- Requirements for Minnesota Drivers

- Minimum Auto Insurance Requirements in Minnesota

- Are Any Auto Insurance Laws Specific to the state of Minnesota?

- Ways to Lower Your Auto Insurance in Minnesota

- Are Requirements Different for Part-Time or Full-Time Minnesota Residents?

- Minnesota Rates Compared to National Average

Ranked the 3rd best state in the nation and the best in the Midwest by U.S.News & World Report, Minnesota is a state also known for its many lakes, which bring many tourists into the state.

Whether drivers are living in Minnesota or just passing through, they need auto insurance. Learn everything you need to know about Minnesota car insurance laws as well as how you can get the very best deal on auto insurance.

Summary of Auto Insurance in Minnesota

With the many auto insurance companies located throughout Minnesota, you’ll have more than your share of companies from which to choose when shopping for auto insurance. Although their coverage amounts and premiums may vary from one company to the next, they’ll all probably offer the basic coverage.

Personal Injury Protection (PIP)

This provides coverage to you if you’re involved in an accident. PIP pays for replacement services, medical expenses and even lost wages whether it’s your fault or not. PIP is also referred to as Basic Economic Loss Benefits.Liability

This provides coverage if another individual comes after your insurance company for an accident that you caused. It also pays for damages to the other individual’s vehicle if you caused the accident.Underinsured motorist coverage

This portion pays for medical bills for anyone covered by on your policy. It is used when the other driver does not have enough liability insurance to pay for damages. This coverage is in addition to the benefits provided under the PIP portion of your policy.Uninsured motorist coverage

This portion pays for any medical bills that are remaining after the PIP benefit pays. It’s used when another driver who has no insurance causes the accident. Unfortunately, some people still drive without car insurance despite the legal requirements and ramifications.Collision

This pays to repair or replace your vehicle when you hit into something whether it’s another car or object.Comprehensive

This pays to repair or replace your vehicle when something hits your vehicle but not from a collision. Examples might be falling objects, storm damage or hitting an animal.Rental car

Full glass replacement

Towing

It’s important to note that with all the above coverages, your insurance will only pay up to the limits of your policy. For instance, you have a policy with $100,000 liability coverage, and you are sued for $200, 000. If you lose the lawsuit, your policy will only pay the $100,000 and you will be liable for the balance.

Requirements for Minnesota Drivers

While Minnesota insurance companies typically offer, the coverages listed above, laws in Minnesota does not require all of them. The only coverages that are required of Minnesota drivers are listed below.

- PIP Insurance

- Liability

- Underinsured Motorist

- Uninsured Motorist

Minnesota is a no-fault insurance state. This is where your PIP insurance kicks in for you. This means that if you are involved in an accident, you and any passengers will receive up to $20,000 in medical benefits and loss income whether it was your fault or the other driver’s fault. Therefore, it is called “no fault” insurance.

Worth noting is that even though the state does not require drivers to carry collision or comprehensive insurance on their vehicles, lenders will require it if the vehicle is used as security or collateral on a loan.

Proof of auto insurance must be in your car at all times and must be shown if you are pulled over by law enforcement. The proof can be your insurance id card, a letter from the insurance company or a copy of your policy. Failure to have auto insurance can result in the following.

- Possible jail time

- At least a $200 fine

- Driver’s license revocation

- Revocation of vehicle registration

Minimum Auto Insurance Requirements in Minnesota

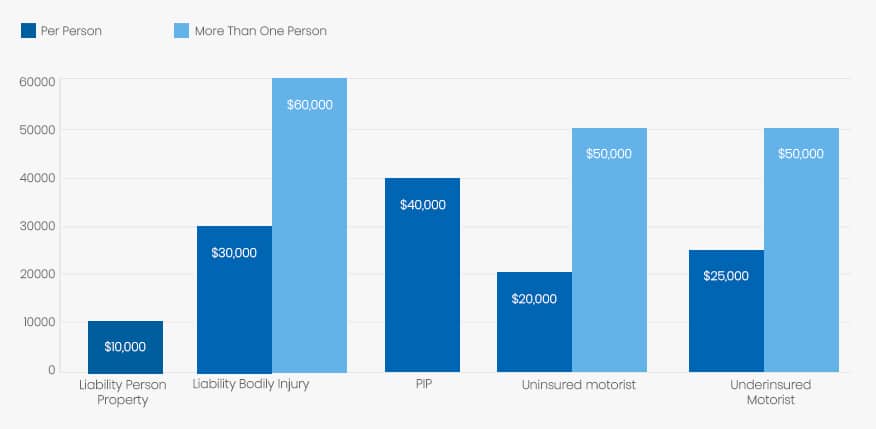

In addition to requiring that all drivers carry certain types of auto insurance coverage, Minnesota also requires that they carry a minimum amount of this insurance. These amounts are listed below.

| Coverage | Minimum |

| Liability person property | $10,000 for damage to someone else’s property |

| Liability bodily injury | $30,000 per person for a covered accident |

| Liability bodily injury | $60,000 maximum for more than one per covered accident |

| PIP | $40,000 minimum per person ($20,000 for medical bills and $20,000 for non-medical expenses |

| Uninsured motorist | $20,000 per person for injuries |

| Uninsured Motorist | $50,000 for more than one person for injuries |

| Underinsured motorist | $25,000 per person for injuries |

| Underinsured motorist | $50,000 for more than one person for injuries |

Are Any Auto Insurance Laws Specific to the state of Minnesota?

Minnesota is one of 12 states using the no-fault insurance status. While some use verbal thresholds, others use a monetary threshold. The verbal threshold means that in the case of an accident, certain conditions must be met, like death or severe disability, before a lawsuit can be initiated. With a monetary threshold, the medical bills must reach a certain amount before a lawsuit can be pursued.

Currently the monetary threshold in Minnesota is at $4,000. Although lawmakers have tried to pass bills that change that into a verbal threshold, it remains the same. No-fault laws do not apply to drivers on motorcycles or snowmobiles unless it’s a separate policy specifically for these motorized vehicles.

Minnesota law also requires that the property damage liability section of every car insurance policy of rental agencies provide at least $35,000 in coverage for loss of or damage to a rental vehicle. The law also states that a notice be provided in the vehicle so the driver is aware of the coverage. Deductibles do not apply with this particular law.

It is within the insurance company’s right to deny coverage to any individual they consider may be high risk. Drivers denied insurance are guaranteed to receive insurance through the Minnesota Automobile Insurance Plan, although this insurance is quite expensive.

Ways to Lower Your Auto Insurance in Minnesota

Your insurance premiums in Minnesota are determined by several factors.

- Age and gender

- Marital status

- Type of vehicle

- Miles you drive

- Driving record

- Where you live

- Amount of coverage

- Deductibles

Some of the above factors are beyond your control. However, that doesn’t mean you’re stuck with the premiums you’re offered when you begin insurance shopping. There are several ways you can lower your insurance premiums.

- Lower your deductibles

- Lower your coverage as long as you keep the legal requirements

- Ask about discounts – Many insurance companies offer discounts for being accident- or claim free; being a good student; having safety features in the vehicle and insuring more than one vehicle with the company.

Minnesota law requires the following discounts be given

- 10 percent discount to drivers 55 and older who have completed a defensive driving course

- A 5 percent discount on the comprehensive coverage to drivers who drive a vehicle with a anti-theft protection device installed in the vehicle.

Are Requirements Different for Part-Time or Full-Time Minnesota Residents?

Insurance requirements are the same for part-time and full-time residents. You must become a resident of Minnesota within 60 days of moving there. Prior to the time they become full-time residents and obtain a Minnesota driver’s license, they are driving with a license and insurance from the state where they still are legal residents. Once they become residents, they must pass a knowledge test about driving laws in Minnesota. They must provide proof of insurance when they register their vehicle.

Minnesota Rates Compared to National Average

Car insurance rates can vary from city to city. Insurance rates in Minneapolis are about $600 higher than Elmore, which happens to be the area with some of the highest insurance rates. One zip code in Minneapolis has rates that are about $1,000 more than the city with the cheapest rates.

However, as a state overall, their rates aren’t higher than many of the other states. The average auto insurance rate in Minnesota is about $1,187, an amount that’s about $190 less than the national average as of 2017.

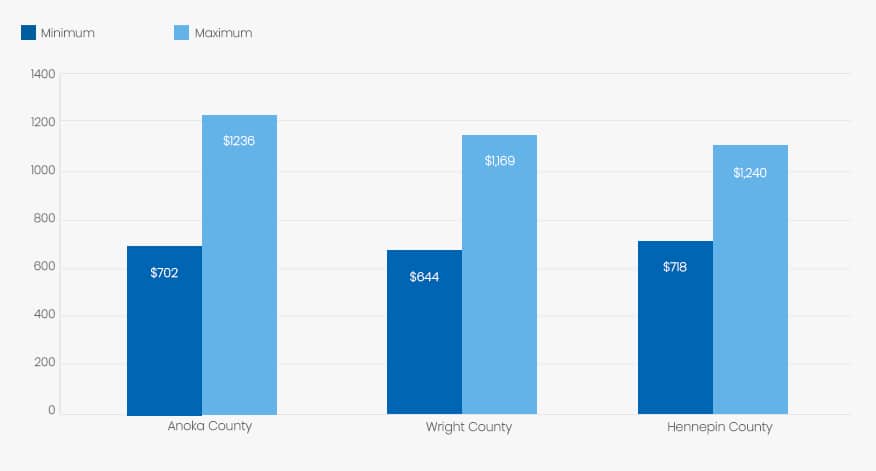

Average Rates in Top Three Minnesota Counties

As indicated above, where you live does play a role in determining your auto insurance rates just as your age, gender and marital status play a role.

You can see the difference in premiums just by looking at the three Minnesota counties below. All the premiums are for a married female who is 45 years old and a good driver.

| County | Minimum Coverage | Full Coverage |

| Anoka County | $702 for state minimum liability | $1,236 for full coverage |

| Wright County | $644 for state minimum liability | $1,169 for full coverage |

| Hennepin County | $718 for state minimum liability | $1,240 for full coverage |

In Summary

I hope this article provides you with the information you need regarding Minnesota car insurance whether you’re a new driver, a new resident to the state or just an individual brushing up on the law. All drivers in Minnesota require auto insurance, but you can determine the amount of coverage if you have at least the required minimum. Many drivers choose to buy more protection and increase coverage. By shopping around, looking for the best deals and utilizing discounts, you may be able to increase coverage without increasing your cost!