New Jersey Car Insurance

- Requirements for New Jersey Drivers

- Minimum Auto Insurance Requirements in New Jersey

- Are Any Auto Insurance Laws Specific to the state of New Jersey?

- Ways to Lower Your Auto Insurance in New Jersey

- Are Requirements for Part-Time or Full-Time New Jersey Residents?

- New Jersey Rates Compared to National Average

Home of the Taylor Ham Pork Roll and known as the Diner Capital of the World, New Jersey is a small state located on the northeastern part of the U.S. Whether it’s the great food or the many tourist attractions, this state sees much traffic on a daily basis. Car insurance is an important thing in this busy state. Whether you’re visiting, living in or planning to move to New Jersey, it’s important to know the laws regarding New Jersey car insurance. You’ll also get some tips on how to save money on your premiums.

Summary of Auto Insurance in New Jersey

New Jersey is one of 12 states that are no-fault insurance states. In a no-fault state, a victim of a car accident will be paid from his or her own insurance company regardless of who was at fault. No-fault insurance was designed to discourage drivers from suing other drivers. However, even in no-fault states, car accident victims can sue other drivers if the case meets certain conditions or thresholds. The thresholds may be either verbal or monetary.

In a verbal threshold, the accident victim must have certain injuries or disabilities before they can sue. In a monetary threshold, victims’ injuries must meet certain monetary limits before they can sue. Although New Jersey utilizes the verbal threshold method, New Jersey uses the verbal threshold method, they also have a “choice” no-fault law, which means that victims can reject the threshold and still sue another driver.

Auto insurance companies in New Jersey offer various types of coverage to motorists.

Liability coverage

This coverage generally is offered as both bodily injury and property damage liability. The bodily injury portion pays for damages to the other party when you are legally responsible for the accident. The property damage portion pays for damages you do to another person’s property like buildings or parked vehicles. It does not cover your own car.Personal injury protection (PIP)

This coverage is part of no-fault insurance and pays for injuries to you stemming from a car accident.Collision Coverage

This helps you pay to have your car repaired when it was involved in an accident when the accident involved a collision.Comprehensive Coverage

This helps you pay to have your car repaired when it was in a non-collision accident. Examples are windshield replacement, theft, animal damage, falling objects, or vandalism.Uninsured motorist coverage

This will offer you protection if you’re in an accident with a driver who doesn’t have any auto insurance.Towing Coverage

This pays to have your vehicle towed when it was involved in an accident.Rental Coverage

This pays the cost of a rental vehicle while your vehicle is being repaired from an accident.

Both collision and comprehensive coverage require a deductible, which is a certain dollar amount that you must pay before your insurance company pays anything. Unlike health insurance, which requires you to pay a deductible per year, auto insurance requires you pay the deductible each occurrence.

If you have four collision or comprehensive claims in a year, you would need to pay the deductible four times. You can choose deductibles as low as $250 to $1,000 or more. The lower your deductible is, the higher your premiums will be.

Requirements for New Jersey Drivers

Drivers in New Jersey must carry certain types of car insurance, and they must be purchased through a state-approved auto insurance company in New Jersey. Drivers have the option of choosing from a basic policy or a standard policy. While the basic policy has smaller limits of coverage, it’s less expensive than the standard policy and does meet the state’s requirements. The Basic Policy includes the following coverage.

- Property damage liability

- Personal injury protection

- PIP for a significant or permanent injury

In addition to the fine and suspension, the driver’s registration will also be suspended and the owner will have to pay the following:

First violation

$200 reinstateSecond and subsequent violations

$400 reinstatement fees and four-month suspension of registration

The standard policy includes the following coverage.

Bodily injury liability

- Property damage liability

- Uninsured/underinsured bodily injury

- Uninsured motorist property damage

- Personal injury protection

- PIP for a significant or permanent injury

Drivers who choose the standard policy also get the option of an unlimited right to sue or a limited right to sue. The unlimited right to sue option is more expensive, but it allows you to sue anytime you’re involved in an accident. The limited right to sue option only allows you to sue if you suffer from certain injuries.

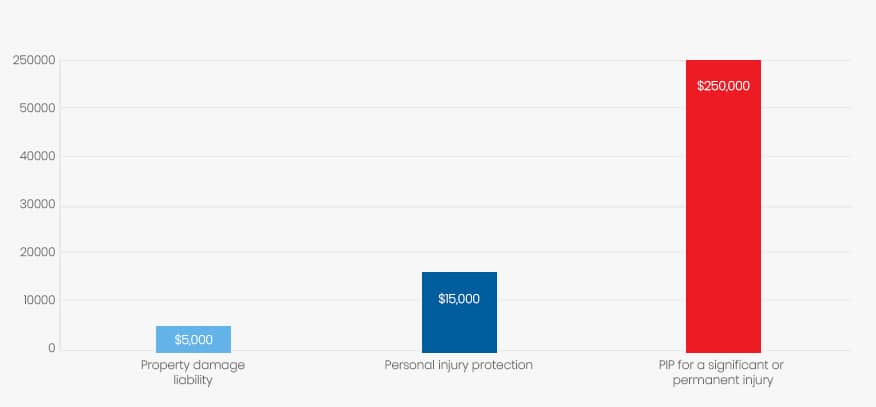

Minimum Auto Insurance Requirements in New Jersey

| Coverage | Minimum |

| Property damage liability | $5,000 |

| Personal injury protection | $15,000 |

| PIP for a significant or permanent injury | up to $250,000 |

Drivers choosing the standard plan will have at least the following amounts of coverage.

| Coverage | Minimum |

| Bodily injury liability | $25,000 $15,000 per person per accident |

| Bodily injury liability | $30,000 for more than one person per accident |

| Property damage liability | $5,000 per accident |

| Personal injury protection | $15,000 per person per accident |

| PIP for a significant or permanent injury | up to $250,000 |

| Uninsured/underinsured bodily injury | $15,000 per person per accident |

| Uninsured/underinsured bodily injury | $30,000 for multiple people per accident |

| Uninsured Motorist Property Damage | $5,000 |

Are Any Auto Insurance Laws Specific to the state of New Jersey?

The New Jersey Special Automobile Insurance Policy (SAIP), is available for individuals who are enrolled in Federal Medicaid with hospitalization but under able to afford a standard car insurance policy. It offers these individuals a less expensive insurance policy; however, it only provides them with protection for accident-related medical costs.

This policy, which costs $365 annually, can be purchased through most insurance companies in New Jersey or through the state’s Personal Automobile Insurance Plan (PAIP). The PAIP also offers auto insurance plans for drivers who can’t get insurance through the open market due to bad driving records or having too many demerit points on their driving record.

When you purchase auto insurance in New Jersey, your insurance company is required to issue you either a paper or an electronic insurance identification card. The insurance card may either be on state-required card stock or displayed on an electronic device.

Regardless of which method you choose to use, it must be with you in the vehicle at all times, or you could be subject to fines, jail time, community service and/or license suspension. The insurance identification card must be displayed at the following times.

- If you’re involved in an accident

- If you’re pulled over for a traffic violation

- If you’re stopped for a spot check by law enforcement

- Prior to an inspection

Ways to Lower Your Auto Insurance in New Jersey

Several things go into determining what you’ll pay for New Jersey car insurance.

- Driving record

- Vehicle type

- Geographic location

- Age and gender

- Marital status

- Vehicle use

- Policy coverage amounts

- Your deductible

- Insurance score based on credit history

You can lower your insurance premiums by doing several things. If you have more than the basic policy, you may consider lowering your coverage amounts. Increasing your deductible can also result in lower premiums.

You may be eligible for discounts through your insurance company. Discounts may vary from one agency to the next so don’t hesitate to ask the insurance company what discounts may apply to you. Some possible discounts include:

- Multiple car/other policies discounts

- Vehicle safety features discount

- Good student discount

- Claim and accident free discount

- Defensive driving discount

Are Requirements Different for Part-Time or Full-Time New Jersey Residents?

The requirements are the same for part-time and full-time residents because they’re all required to carry at least the minimum amounts of auto insurance. If they have a New Jersey driver’s license, they must follow New Jersey’s insurance laws.

New Jersey Rates Compared to National Average

New Jersey auto insurance rates are quite high considering so much of the state is rural areas. According to the National Associate of Insurance Commissioners, the national average for auto insurance is about $900 annually. The average rate in New Jersey is about $1,355, putting them much higher than the national average.

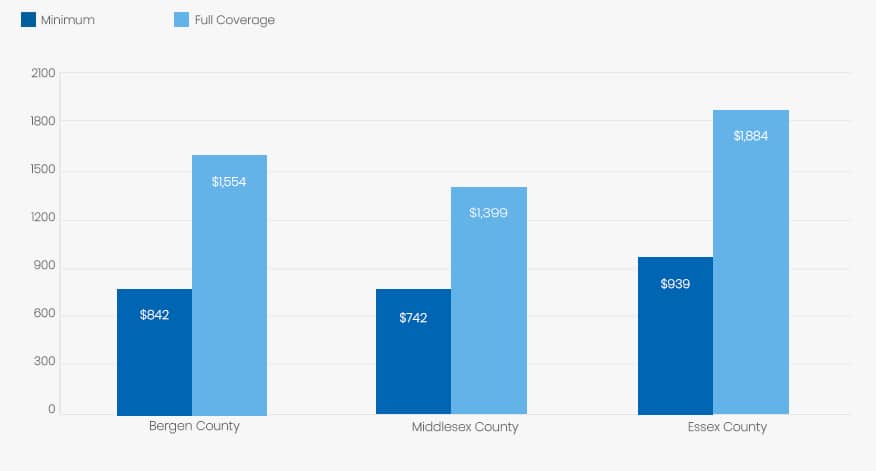

Average Rates in Top Three New Jersey Counties

Below is an example of how insurance rates can fluctuate in different areas and counties. Using a 45-year old married woman with a good driving record as the client, I’ve obtained potential insurance rates in three top New Jersey counties.

| City | Minimum Coverage | Full Coverage |

| Bergen County | $842 | $1,554 for full coverage |

| Middlesex County | $742 | $1,399 for full coverage |

| Essex County | $939 | $1,884 for full coverage |

Conclusion

Drivers in New Jersey often feel they have an advantage because they can choose from an expensive policy and work their way up until they have a policy that meets their needs. Being aware of the laws and what type of insurance is available can help you make smart choices when purchasing auto insurance. Driving safely, utilizing discounts and shopping around can all help you get the best possible rates on your policy.