Utah is a western state known most for its expansive areas of desert and mountains, making it a beautiful state to visit. However, despite the terrain, there is still a lot of traffic flowing through this state at almost any time of the day making it important to be aware of Utah insurance laws. Below is an overview of everything you need to know about car insurance in Utah, including when it’s required, what’s required and how to get the best rates on your Utah auto insurance.

Summary of Auto Insurance in Utah

Utah is one of 12 states that use the no-fault system as part of their auto insurance requirements. No-fault insurance was created to decrease the number of car accident related lawsuits. In a no-fault state, the driver’s own insurance company pays for their damages up to a certain amount. Despite the no-fault laws, some drivers still choose to sue. However, under the no-fault law, they can only sue if their injuries or damages meet certain conditions.

No-fault states use either a verbal or a monetary threshold. Utah uses the monetary threshold, which means that you can only sue if your injuries are more than $3,000 because that is the limit of what your personal injury protection insurance will pay. Utah also uses an injury threshold to determine if you can sue. You can sue if you have the following severe injuries.

- Permanent Impairment

- Permanent Disability

- Permanent Disfigurement

- Dismemberment

Utah auto insurance companies offer various types of coverage; some types are optional and others are mandatory in this state. Below are all the possible coverage types you can purchase.

- Bodily injury liability insurance help pay for damages you cause to others in an automobile accident.

- Property damage liability insurance helps pay for damages you cause to someone else’s property.

- Collision coverage helps pay for damages to your vehicle caused by an accident.

- Comprehensive coverage helps pay for damages caused to your car from something non-collision related.

- Uninsured/underinsured motorist coverage helps you pay expenses resulting from a car accident with a driver who doesn’t have car insurance or doesn’t have enough to cover damages.

- Rental car helps pay the expense of renting a vehicle while your vehicle is being repaired.

- Roadside assistance helps you pay for towing or immediate assistance if your car breaks down and needs assistance or needs to go to a repair shop.

Comprehensive and collision coverage are optional types of coverage as far as the state’s requirements go, but are usually required if your car is used as collateral on a car loan. It’s also a smart choice to carry these coverages if you have newer vehicles. Both of these coverage types require a deductible, which is what you’ll have to pay on a claim before the insurance company pays. Deductibles can range from $100 to $2,000.

Requirements for Utah Drivers

Utah drivers are not required to have full coverage on their vehicles but must carry the following types of auto insurance.

- Bodily injury liability

- Property damage liability

- Personal injury protection (PIP)

In addition to having insurance, Utah drivers must carry proof of insurance when stopped by law enforcement or are in an accident. Proof of insurance may be an insurance card, insurance binder or the declaration page from your policy.

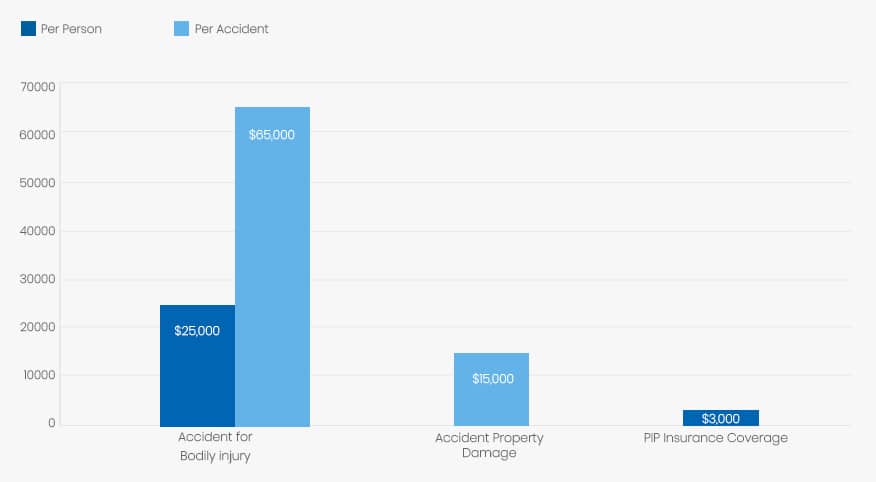

Minimum Auto Insurance Requirements in Utah

To legally drive on Utah’s public roads, Utah drivers are required to have at least the following types and amounts of coverage.

| Coverage | Minimum |

| Bodily injury | $25,000 per accident |

| Bodily injury | $65,000 total per accident |

| Property Damage | $15,000 per accident |

| PIP insurance coverage | $3,000 |

On paper or when getting quotes, these amounts may appear as $25/$65/$15 or $25/000/$65,000/$15,000. Drivers can choose to purchase a package with a total of $80,000, which covers bodily injury and property damage. Although these are the minimum amounts you must purchase, you always have the option of purchasing more coverage. The insurance commission recommends carrying at least $100/$300/$100.

Are Any Auto Insurance Laws Specific to the state of Utah?

The Utah Division of Motor Vehicles uses Insure-Rite to assist them in electronically monitoring driver’s vehicles to determine if they are insured. Utah’s insurance companies are required to report your insurance status to Insure-Rite. If they’ve determined that you are not carrying insurance, you will be notified from Insure-Rite. Once you’ve been notified, you must contact Insure-Rite and provide them with proof of insurance.

Utah considers driving without insurance a Class B misdemeanor, and drivers caught driving without insurance may receive the following penalties.

- Driver’s licenses suspension

- Vehicle registration suspension

- At least $400 fine for first offense

- Reinstatement fees

Drivers who are unable to purchase car insurance through the voluntary market due to poor driving records can purchase insurance through the Western Association of Automobile Insurance Plan. The WAAIP is made up of many insurance companies, and they can offer insurance because all the insurance companies are sharing the risk of insuring these drivers rather than just one insurance company. Policies purchased through the WAAIP do come with higher premiums.

Ways to Lower Your Auto Insurance in Utah

Although one of the best ways to lower your auto insurance in Utah is to be a safe driver and obey all traffic laws, Utah auto insurance companies use various factors to determine your insurance rates.

- Your driving record

- Your car’s year, make and model

- Age and gender

- Marital status

- Mileage you put on

- Purpose of vehicle (personal or business)

- Your credit scores

- Your coverage amounts

- Your deductible or out-of-pocket (the higher your deductible, the lower your premium)

- Any discounts that may be applicable to you

While some of the above factors may help you, others may actually hurt you in terms of premiums. Almost every insurance company offers some kind of discounts. Don’t hesitate to ask your potential agent what type of discounts they offer and which ones you may be eligible to receive. Some possible discounts may include:

- Good driver discount

- Good student discount

- Multiple car discount

- Home/car insurance discount

- Safety feature discount

- Senior discount

- Defensive driver course discount

- Claim-free discount

- Auto-pay discount

- Auto-renewal discount

For whatever reason, some vehicles are more prone to theft than others are. This can increase the insurance rates on these vehicles because the insurance believes there is a likelihood that they may be paying out on a claim. The National Crime Bureau has listed the ten most stolen vehicles in Utah in 2016. While the list may not deter drivers from buying these vehicles, it can encourage them to install safety and anti-theft devices, both of which can mean discounts on your auto insurance.

- 1997 Honda Accord

- 1998 Honda Civic

- 2001 Ford full size pickup

- 2001 Chevrolet full size pickup

- 2000 Toyota Camry

- 1999 Jeep Cherokee/Grand Cherokee

- 2005 Dodge full size pickup

- 1998 Subaru Legacy

- 2005 Toyota Corolla

- 1997 Nissan Altima

Are Requirements Different for Part-Time or Full-Time Utah Residents?

The insurance requirements are typically the same for part-time and full-time residents of Utah. If you’re a permanent or full-time resident, you must follow Utah’s car insurance requirements. If you’re a temporary resident, you follow the laws from the state in which you live and where your vehicle is registered. However, non-residents of Utah must follow Utah’s insurance laws when they’ve been in Utah for at least 90 days.

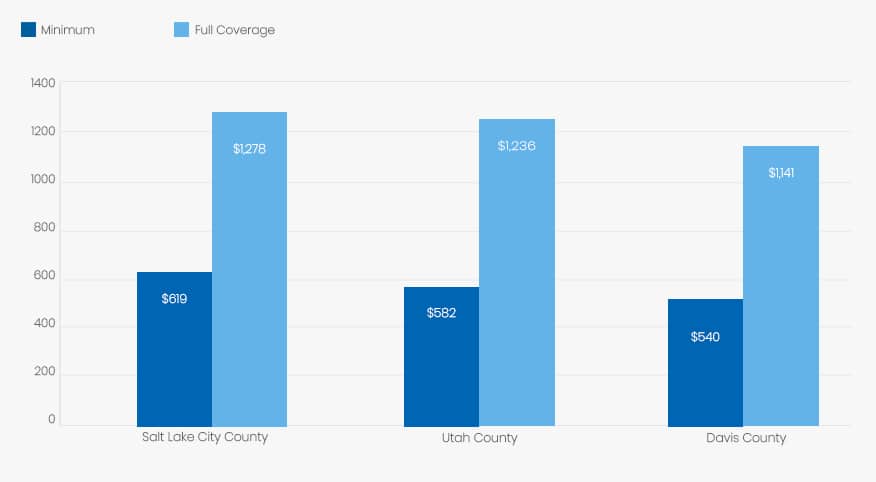

Utah Rates Compared to National Average

Despite being a no-fault state, Utah’s car insurance rates are lower than the national average. The average annual rates for full coverage in Utah are $1,121 while the national average is about $1,669.

Average Rates in Top Three Utah Counties

| County | Minimum Coverage | Full Coverage |

| Salt Lake City County | $619 for state minimum requirement | $1,278 for full coverage |

| Utah County | $582 for state minimum requirement | $1,236 for full coverage |

| Davis County | $540 for state minimum requirement | $1,141 for full coverage |

Conclusion

Auto insurance is so much more than just another monthly expense. It’s a very valuable form of protection. It protects us not only from being victims of costly lawsuits but also ensures us that if our cars are damaged or destroyed we’ll have the funds needed to replace them. Car insurance is also something that we seldom appreciate until it’s needed. Hopefully, this overview of Utah car insurance gives you all the information you need to make smart choices and save money when shopping for car insurance.

Sources:

- http://dmv.utah.gov/register/insurance

- https://www.nicb.org/sites/files/2017-11/2016-Hot-Wheels-Report.pdf