Washington Car Insurance

The state of Washington currently requires all motor vehicle drivers to carry automobile liability insurance, and to keep valid proof of this insurance in the vehicle at all times. The Washington State Department of Licensing authorizes the State of Washington to mandate automobile insurance law.

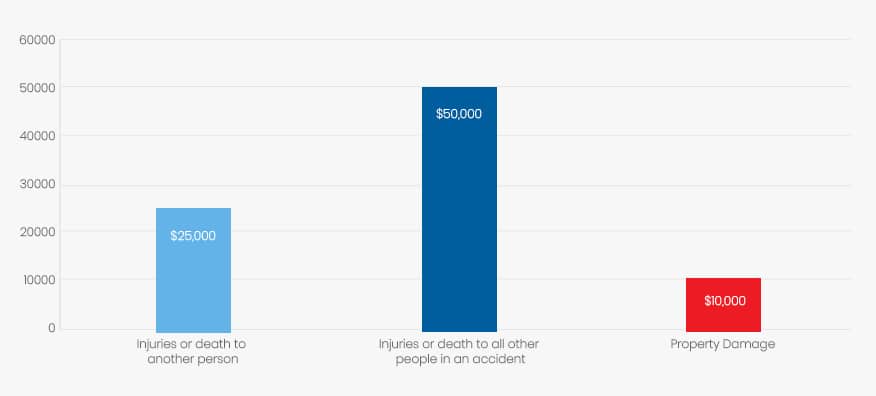

According to Washington State law, the current mandatory minimum liability insurance requirements are 25/50/10

| Coverage | Minimum |

| Injuries or death to another person | $25,000 |

| Injuries or death to all other people in an accident | $50,000 |

| Property Damage (for property belonging to another person) | $10,000 |

Alternatives to carrying this insurance exist

Instead of purchasing this insurance, you may also apply for a certificate of deposit through the Department of Licensing or have a liability bond of at least $60,000 filed by a surety bond company authorized to do business in the state of Washington. For details on this type of arrangement, contact the Department of Licensing to submit the appropriate forms.

Also, if you happen to have 26 or more vehicles, you may qualify for self-insurance. Details on this type of insurance can be obtained by contacting:

- Driver Records

- Department of Licensing

- PO Box 9030

- Olympia, WA 98507-9030

Keep your valid, current proof of automobile insurance handy at all times

Your insurance company will send you a proof-of-insurance card indicating your policy coverage amounts, dates of effectiveness and expiration, names of the insured, vehicles insured, etc. This card must be produced upon request if you are pulled over by the police or have an accident. Without it, you will be ticketed for a motor vehicle violation. Motorcycles, scooters, mopeds, horseless carriages over 40 years old (specially licensed), common or contract carriers with the Washington Utilities and Transportation Commission, and police/government-owned vehicles may not be included under this law — however, you’re still responsible for any damages/injuries caused by all of these vehicles in the event of a collision or other accident. Please keep in mind that knowingly providing false proof of insurance coverage is considered a misdemeanor in Washington and carries the appropriate penalties.

Insurance coverage across states

If you drive a vehicle in the state of Washington which is also required to be registered in another state, you must carry the insurance required by that state. This proof of insurance must be carried at all times in the registered vehicle and provided to a police officer upon request.

More specific information about property and casualty insurance laws and rules in the state of Washington can be found here

Insurance Information Unique to Washington

In the state of Washington, insurance providers must offer you a type of insurance called Personal injury protection, or PIP insurance — however, you do not need to accept it. PIP covers medical and funeral expenses, wages lost or other loss of services for any family members named on the insured policy or not named on it, as well as extended family or step/foster family in the household, pedestrians, passengers, or other non-related persons injured in an accident regardless of who is at fault.

Ways to Lower Your Rates

Auto insurance rates can vary due to many factors, including the vehicle’s garaging location, the type of vehicle and household members, driver’s age or sex, marital status, annual number of miles driven, driving records of all licensed drivers in the household, etc.

If You’ve “Frozen” Your Credit…

If you’ve frozen your credit in response to recent data breaches, you may find this can impact your insurance rates. Although insurers are not allowed to raise your rates solely due to a frozen credit report, they must inform you if it has impacted your rates at all within 30 days of the premium change. You may be able to temporarily “unfreeze” your credit in order to bypass this matter and allow the insurance company access briefly, however. For options on this and other possible solutions to this, check the FAQ on Credit Freezes and Insurance.

Usage-Based Insurance

Usage-based insurance may save you money if you don’t drive a lot and you don’t mind the monitoring of your vehicle with a UBI device. Such devices confirm your vehicles’ miles driven, but can also track your location, how you drive (rapid acceleration, etc), and whether your airbag deploys. Be sure to ask your insurer detailed questions on how this might benefit you, what the requirements are, and how much you could save if you agreed to this type of insurance.

Gap Insurance

Gap insurance might benefit someone whose car is totaled in an accident if they still owe a vehicle loan amount higher than the current market value of their car. For example, if someone still owes $5,000 on a $20,000 vehicle loan but the actual cash value of the vehicle at time of totaling is only $15,000, gap insurance pays the extra $5,000 on the payout amount. For more insurance, find details here.

How does Washington rank nationally on car insurance rates?

Washington ranks 17th in the nation on auto rates, with an annual combined average premium of $836. 25 compared to the national average of $817.43.

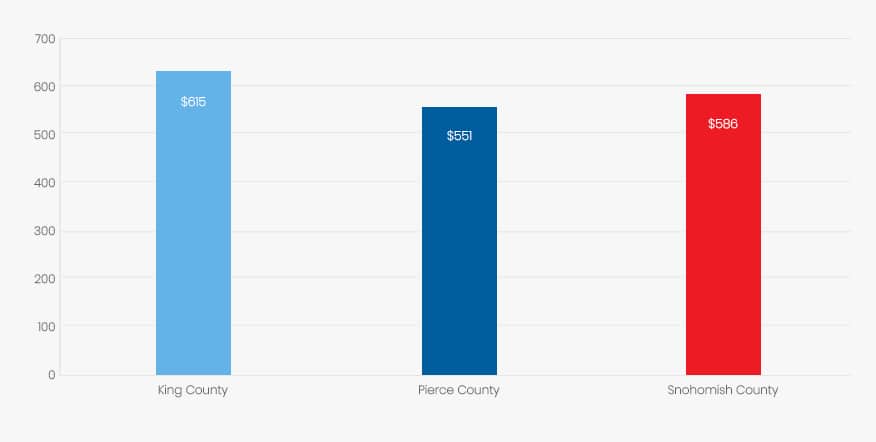

To get more specific, the minimum required liability rates annually for a 40-year-old married woman in the 3 largest Washington counties of King, Pierce, and Snohomish were:

| City | Coverage |

| Angola (King County) | $615 |

| Carbonado (Pierce County) | $551 |

| Bothell (Snohomish County) | $586 |

Use extra caution when driving in Washington

Additionally, Seattle, Washington was ranked 181st out of 200 cities for safe driving in the Allstate Best Drivers Report. Factors that contribute to this score are slippery roads due to the perpetually wet weather of the region. While most drivers go at least ten years without a car accident, those in Seattle bring it down to an average of 6.7 years. Fatality rates are low by comparison, however, at a safer 2.29 fatality rate per 100,000 residents.

Generally, maintaining a good driving record and responsible, cautious driving habits (and ensuring the rest of your household does the same), keeping your credit score as high as possible, and shopping around for discounts that pertain to your habits/household (i.e. non-smokers’ rates, good student rates, multi-car coverage rates, etc.) should land you the best insurance rates available. If you drive an older vehicle, consider dropping your collision coverage. (If you can afford to replace the car’s value at the current time, it becomes essentially unnecessary.) Raising your deductibles, if you can afford it, can help to lower your rates too.

For additional information, you may contact

Washington State Office of the Insurance Commissioner

Washington State Department of Licensing

Washington State Agencies, Boards, and Commissions