About Liberty Mutual Car Insurance

Liberty Mutual Car Insurance is one of the top automobile insurance companies in the United States. The Boston based global insurer has several insurance specialities including property and workers compensation insurance. However their most significant line of business is automobile insurance. Interestingly, U.S. consumers of Liberty Mutual are also considered shareholders in the company (a nice incentive to give to policyholders). This was met with a bit of resistance however, as some policyholders believed this would result in losses by lessening their worth and dividends. Those fears were proven false as Liberty Mutual continues to expand. Much of their growth has been because of global acquisitions.

Our Rating

Pros

Long-term company history

Partnership with Tesla for forward progress

Lots of policy offerings

Satisfaction Rating

Claims Rating

Shopping Rating

Offerings Rating

Stability Rating

Customer Satisfaction

According to a 2017 J.D. Power Insurance Shopping study, Liberty Mutual scored a 4 out of 5 for Overall Satisfaction, scoring higher than Nationwide, State Farm, and Geico among others. They also scored a 4 out of 5 on Policy Offerings (which take the variety of options offered, the degree to which their needs were met, and the ease of obtaining a new policy into consideration), Pricing (value of cost in regards to coverage), and on how well their interactions with Call Center Representatives were.

Other factors that consumers ranked included how consumers felt after interacting with their Local Agent (they ranked this 3 out of 5) and how they felt when interacting with the Insurer’s Website (also gave it a 3 out of 5). Overall, after everything was calculated, they received the “Better Than Most” ranking.

However, according to a 2017 J.D. Power U.S. Auto Claims Satisfaction Study, Liberty Mutual scored quite low, only receiving a 2 out of 5 score for Overall Satisfaction. There were three items that scored a 3 out of 5 for Liberty Mutual – First Notice of Loss (FNOL), Repair Process, and Rental Experience. For reference, First Notice of Loss is how consumers rate the initial claims process, the Repair Process is how consumers evaluated the restoration time, and the rental experience refers to the policy and execution of Liberty Mutual’s rental car experience.

Claim Servicing (how insurance handled the claim), Estimation Process (how the company appraised the vehicle), and Settlement (regarding how fair consumers found the resolution that the insurer gave them) all ranked 2 out of 5, respectively. These ratings left Liberty Mutual in the lowest pool of automobile insurers, placing 23rd out of the 26 insurance companies ranked.

What Does Liberty Mutual Offer

Overall, it seems that Liberty Mutual receives more complaints regarding automobile insurance than their competitors. Despite this, they still ranked higher on some aspects. To further understand Liberty Mutual, let’s further examine what they offer to policyholders:

- Liability Costs

- Medical Assistance

- Collision Assistance – Coverage on parts no matter how old the vehicle is.

- Windshield Repair – Liberty Mutual will have someone come out to repair your windshield at your convenience, such as at your home or workplace.

- Roadside Assistance – Available 24/7.

- Assistance If the Other Party is Underinsured or Uninsured

- Assistance for Towing and Labor Costs – This is available 24/7 and covered if taken to the nearest approved facility.

- Accident Forgiveness – Your premium won’t increase in the event of an accident.

- New Car Replacement – If you total your new car within a year of acquiring it, you can be compensated for replacing it.

- Better Car Replacement – If your car is totaled at any point, you can be reimbursed for a car that is one year newer and with at least 15,000 fewer miles on it than the one you had.

- Deductible Fund – If you choose to include this into your policy, Liberty Mutual will take $100 off your collision deductible and to take take an additional $100 every year after, as long as your are their consumer. If you’re involved in a collision, you can rest assured that your deductible won’t go up.

- Teacher’s Insurance – This bonus insurance for teachers offers additional protections without additional costs. Included in this insurance is protections against vandalism and/or collisions related to your vehicle and the school.

- Unlimited Rental – If your automobile is being repaired by an approved repair center, you qualify for unlimited rental coverage. This is notable as many other companies don’t offer such extensive assistance

As with anything, some exceptions will apply so it’s best to get information pertinent to you when thinking about which insurance is best.

Claims Process

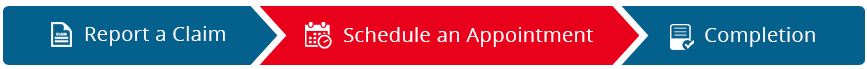

The claims process at Liberty Mutual is as follows:

- Report a claim. You can do this online, over the telephone, or at their nearest location. If you have windshield damage, you can request that someone come over to fix it at a location that is convenient to you such as your home.

- Schedule an appointment so that damages can be reviewed and repaired. Note that your vehicle can be repaired anywhere, however, coverage is only guaranteed if you go to repair centers that are pre-approved by Liberty Mutual. If you prefer somewhere else, they will try and work with them to give you an estimate of the costs. If there isn’t a lot of damage, you can also upload pictures of the damage via the Liberty Mutual app and someone will get back to you with an estimate, usually within the business day. You are welcome to bring the vehicle into a Liberty Mutual office for inspection on the spot. Depending on your coverage, you can also get a rental vehicle at a pre-approved rate.

- Completion. It is recommended that you take your vehicle to an approved shop for repair. They’ll pay the costs and you’ll only be responsible for the deductible.

You can track your claim online or by phone to get updates on the progress of your claim.

Company Stability

Liberty Mutual was founded over a hundred years ago in 1912. It has since acquired and grown to offer different types of insurance all over the world. They’ve established themselves as one of the leaders in their industry and continue to rank highly on their policies. A few things to note about Liberty Mutual:

- Ranked as a Fortune 500 company (75th in the USA, 249th globally) and has been on the Fortune 500 list for 23 years

- Revenue in 2016 ended with $38.3 billion; profits $1 billion — a 96% gain since 2015!

- However, profits fell 65% towards the back half of the year (the time of year when weather is most extreme)

- Over 900 locations worldwide

- CEO David H. Long

- Exclusively partnered with Tesla to offer an insurance package, InsureMyTesla, that will be available in the U.S. for Tesla’s self-driving cars. One major benefit includes the option to replace a Tesla that was severely damaged within the year. It promises to be a lower cost for consumers because there’s less likelihood of damage with Tesla’s safety features and there’s less expenses for maintenance on an electric vehicle. This plan is already available in other countries, allowing Liberty Mutual and Tesla time to research the American markets and understand the unique challenges that are specific to the USA.

Value for Price

So what do get for the price you’re paying? The New Car Replacement policy and the Better Car Replacement policy are unique and valuable incentives for your money. You can get discounts for having certain vehicle safety features on your car such as anti-theft and anti-lock brakes, for having a hybrid car, and for having multiple cars on the same policy. If you bundle your home and vehicle policies, you may qualify for additional savings. Also, if you pay your bill in full or use an automatic payment system, you can save extra time and money. Lastly, joining Liberty Mutual earns you special savings on your premium.

Who is this best for?

So what does all of this mean? Well aside from offering basic auto insurance that you’d expect, Liberty Mutual does have a few interesting incentives. For one, the new car or better car replacement is good if you live in an area that is prone to collisions. This could include heavily populated and therefore, heavily traffic congested cities. It’s also good for cities that have extreme weather conditions that may leave you out in the dust should something happen.

Additionally, the benefits for teachers that requires no extra costs or unexpected fees is a good incentive for giving Liberty Mutual a try. This teacher’s auto insurance includes:

- Loss Protection: If your vehicle is vandalized on school property or during a school-related event, you will not have to pay a deductible

- Personal Property Coverage: If your personal teaching materials or any property owned by the school is stolen or damaged while in your vehicle, you can be reimbursed up to $2500. If it happens several times, you can still be reimbursed $2500 each time, depending on the case.

- Collision Coverage: If you’re driving for a school related trip and your car is damaged due to a collision, there is no deductible for the damage.

There are also discounts for teens, good drivers, good students and graduates, those who are newly married, newly relocated, and newly retired people.

What should you be aware of?

According to 2016 reports, some consumers complained that communication between departments and to the consumers needed improvement. A few complaints were also about rates increasing without explanation. Policyholders claimed that the delays for their claims in regards to investigation and processing was excessive. There were also complaints from consumers that Liberty Mutual offered or settled for less than or below what they were expected to pay or their claims were flat out denied altogether. Pay attention to your policy and question anything that seems off. Additionally, rates and policies can vary from state to state. As long as you’re aware of what applies to you and your living situation, you can plan accordingly.

Conclusion

Liberty Mutual is the 7th most used automobile insurance in the United States. It has been around since 1912 and doesn’t seem to be stopping anytime soon. Liberty Mutual policyholders have the benefit of accident forgiveness (if the accident occurs after five years of clean history), new car replacement, and lifetime repairs — all bonuses to having automobile insurance. Additionally, because Liberty Mutual is a growing company, ways to access and communicate to agents are numerous and will likely continue to grow.