What is Uninsured Motorist Coverage?

Although every state except New Hampshire requires drivers to carry insurance, according to the Insurance Information Institute (III) an average of one out of every eight cars on the road are uninsured. In some states it’s as high as one in every five drivers, so an uninsured motorist policy is designed to help you if you’re involved in an accident with one of those drivers.

Uninsured motorist coverage will pay for the financial costs of an accident such as medical bills. Because ach state sets their own insurance laws there are three basic types of uninsured motorist policies available; the best choice for your own coverage will depend on where you live. Here’s a look at the three policies:

-

Uninsured Motorist Insurance (UM):

This coverage will pay for the medical expenses of you and your passengers if you’re in an accident caused by an uninsured driver. In some states known as Uninsured Motorist Bodily Injury (UMBI), an uninsured motorist policy will also cover lost wages if you or your passengers can’t work due to your injuries as well as medical expenses if you’re the victim of a hit-and-run or if you’re a pedestrian and hit by an uninsured driver.

-

Uninsured Motorist Property Damage Coverage (UMPD):

As the title suggests, uninsured motorist property damage covers the cost to repair damages to your vehicle. Unlike UM which only covers medical fees, UMPD will also cover damages to your property such as that incurred if an uninsured vehicle hits your fence or your house.

-

Underinsured Motorist Protection (UIM):

Underinsured motorist protection is designed to cover the extra costs if you’re hit by a driver who has liability insurance but their policy doesn’t cover the full amount of damages incurred in the accident. In that case, the insurance of the driver at fault would cover up to the limit of their policy and then your own UIM would pay for the difference in vehicle damage.

Keep in mind that the laws vary from state to state; for example California does not allow a hit-and-run accident to be claimed on you UM policy. In addition, because a stolen car is considered uninsured from the moment of theft if you’re in an accident caused by the driver of a stolen car it will probably be covered under your UM policy.

Who needs Uninsured Motorist Coverage?

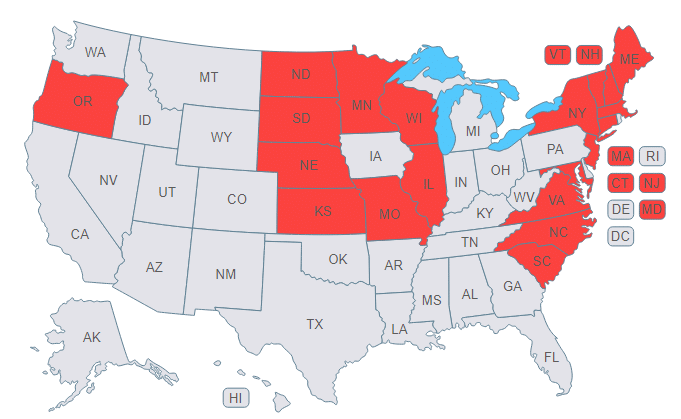

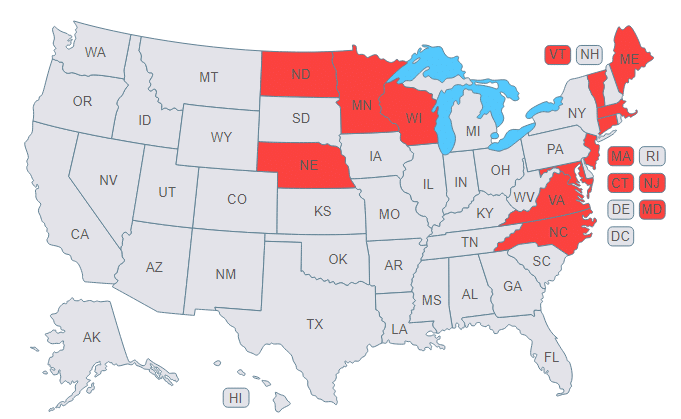

Uninsured motorist coverage is required by law in 20 states as well as the District of Columbia, so if you live in one of the following states it’s a mandatory requirement when you purchase your vehicle insurance policy. If you don’t live in a state that requires UM or UIM here are some facts that may sway your decision to purchase the coverage as an add-on policy:

The Insurance Research Council (IRC) reports that in 2015 a full 13 percent of drivers nationwide were uninsured. This varies widely from state to state; for example in Maine the percentage is only 4.5 but in Florida it’s a whopping 26.7 percent. The following chart shows the top ten highest and lowest uninsured motorist claims by state:

| Higest | Lowest | ||||

| Rank | State | Percent uninsured | Rank | State | Percent uninsured |

| 1 | Florida | 26.7% | 1 | Maine | 4.5 |

| 2 | Mississippi | 23.7% | 2 | New York | 6.1% |

| 3 | New Mexico | 20.8% | 3 | Massachusetts | 6.2% |

| 4 | Michigan | 20.3% | 4 | North Carolina | 6.5% |

| 5 | Tennesse | 20.0% | 5 | Vermont | 6.8% |

| 6 | Alabana | 18.4% | 6 | Vermont | 6.8% |

| 7 | Washington | 17.4% | 7 | North Dakota | 6.8% |

| 8 | Indiana | 16.7% | 8 | Kansas | 7.2% |

| 9 | Arkansas | 16.6% | 9 | Pennsylvania | 7.6% |

| 10 | D.C. | 15.6% | 10 | South Dakota | 7.7% |

-

If you don’t have health insurance you should definitely consider purchasing UM because if you’re in an accident caused by an uninsured driver you’ll most likely be stuck with all of the medical bills.

-

If you live in a no fault insurance state you may think you’re good to go because your personal protection policy will cover you, but check on the amount of coverage. Often it’s quite low compared to the high cost of medical treatment incurred by an accident.

-

You should also determine if there’s a clause in either your vehicle insurance or your health insurance that states one or the other is responsible for accident medical coverage.

-

If your vehicle injury insurance has a deductable you should determine whether you’re health insurance will pay for that amount, as well as the opposite scenario. Often the deductible or copay is a high amount you may be unable to afford out of pocket.

-

If you often carry passengers who are not on your personal health insurance policy their medical expenses would be paid if you have UM coverage. If you regularly carpool the gang to every soccer game you can understand how important this option is!

States that Require Uninsured Coverage

According to the Insurance Information Institute there are 22 states that require uninsured motorist coverage:

-

Connecticut

-

Kansas

-

Massachusetts

-

Nebraska

-

New York

-

Oregon

-

Vermont

-

Wisconsin

-

District of Columbia

-

Maine

-

Minnesota

-

New Hampshire

-

North Carolina

-

South Carolina

-

Virginia

-

Illinois

-

Maryland

-

Missouri

-

New Jersey

-

North Dakota

-

South Dakota

-

West Virginia

In addition, there are 14 states that require underinsured motorist coverage:

-

Connecticut

-

Maryland

-

Minnesota

-

New Jersey

-

North Dakota

-

South Dakota

-

Virginia

-

Maine

-

Massachusetts

-

Nebraska

-

North Carolina

-

Oregon

-

Vermont

-

Wisconsin

If your state isn’t one of the above you still might want to purchase uninsured motorist or underinsured motorist coverage, so keep reading before you decide!

Are There any Limits on Uninsured Motorist coverage?

Uninsured motorist coverage only covers the cost of medical bills and lost wages, not pain and suffering or punitive damages. UM will not cover the expenses if you’re using your vehicle as a taxi or paid delivery vehicle, which means you’re being paid to drive someone or something to their destination. Note this doesn’t include carpools, so you’ll be covered on the way to that soccer game!

In addition, there’s usually a cap on the amount of coverage your UM or UIM policy will pay. This amount is decided at the time your policy is written, so you should clearly understand the amounts and whether they are per person or per incident.

There are usually restrictions on when the policy will be liable, for example if the injuries incurred are covered by a worker compensation policy or disability policy your UM probably won’t be liable because you’d be duplication a claim.

Underinsured Motorist policy limits depend on which state you live in and are usually determined by one of two things:

The underinsured vehicle bodily injury liability is equal to or higher than the limits set by the state.

OR

Is under the limit of the other person’s UIM policy coverage.

State law will determine how this coverage works. For example, if you’re in an accident caused by an underinsured person who only has $50,000 injury coverage and your UIM policy covers up to $100,000 the person at fault’s policy would cover the first $50,000 and then your own policy would pay for the medical fees from $50,001 to $100,000. If you only carry a UIM policy of $50,000 yourself it would pay zero because it is equal to the insurance of the person at fault. In other states the amount of coverage the other person has does not matter.

Check whether the policy offers wage compensation, and whether there’s a separate policy for compensation for pain and suffering and for damages to your vehicle.

How do they Structure the Policies?

Your policy will depend on your personal information, and for UM there may be state minimum requirements. The following chart shows a typical list of the Massachusetts minimum coverage for each type of insurance:

| Coverage | Minimum |

| Bodily Injury to Other | $20,000 per person $40,000 per accident |

| Personal Injury Protection(PIP) | $8,000 per person, per accident |

| Bodily Injury Caused by an Uninsured Auto | $20,000 Per person $40,00 Per accident |

| Danage to Someone Else’s Property | $5,000 per accident |

So by the Massachusetts example above, if you’re in an accident caused by an uninsured driver your policy would cover $20,000 in medical expenses for you and each passenger in your vehicle, up to $40,000 per accident. Note that this is the minimum coverage; if you’ve ever seen a bill for an emergency room visit or operation then you know it might be a wise choice to purchase a higher amount of coverage!

As another example, South Carolina law requires you to have UM coverage that is equal to the minimum liability requirements, which are 25/50/25. (UIM is optional in South Carolina).

Generally you will have choices as to how much coverage you’d like to purchase if you wish to have more than the required minimum (if any) in your state. Although choosing a higher amount of UM coverage will raise your premium it may be a wise choice if you live in one of the states that are on the above chart of highest uninsured drivers!

In some states it’s required that you are offered the purchase of uninsured or underinsured motorist coverage, and if you decide not to buy the policy you’ll be asked to sign a waiver to prove the insurer offered you the choice.

As a rule of thumb your choices of UM or IUM coverage will basically match your liability coverage choices. If you don’t understand the way the policy is structured in your state don’t be afraid to ask!

What do you decide before you Buy?

Before you purchase your insurance you should determine whether uninsured motorist or underinsured motorist coverage is required in your state, and if so the minimum amount you’ll be required to buy. If it’s not required you should decide whether you want it as an optional policy and if so how much coverage you’ll need. As a rule of thumb, UM and IUM is offered at the same amounts as your liability coverage.

Here’s an example from the California Department of Insurance:

| Liability Coverage | Limit for each Person | Limit for each Accident |

| Bodily Injury Limits | $15,000 | $30,000 |

| $25,000 | $50,000 | |

| $50,000 | $100,000 | |

| $100,000 | $300,000 | |

| $250,000 | $500,000 | |

| Liability Coverage | Minimum |

| Property Damage Limits | $15,000 |

| $5,000 | |

| $10,000 | |

| $25,000 | |

| $50,000 | |

| $100,000 |

Uninsured Motorist–Bodily Injury

These limits are usually the same as your Liability Coverage–Bodily Injury Limits

Uninsured Motorist–Property Damage

The limit is $3,500.

The following example is from the Texas Department of Insurance, so you can see the difference in requirements:

Uninsured/Underinsured Motorist (UM/UIM) Coverage

What it pays:

Your expenses from an accident caused by an uninsured motorist, a motorist who did not have enough insurance, or a hit-and-run driver. Also pays for personal property that was damaged in your car.

There is a mandatory $250 deductible for property damage. This means you must pay the first $250 of the expenses yourself before the insurance company will pay.

There are two types of UM/UIM coverage:

What it pays: Your expenses from an accident caused by an uninsured motorist, a motorist who did not have enough insurance, or a hit-and-run driver. Also pays for personal property that was damaged in your car.

There is a mandatory $250 deductible for property damage. This means you must pay the first $250 of the expenses yourself before the insurance company will pay.

There are two types of UM/UIM coverage:

-

Bodily injury UM/UIM pays for medical bills, lost wages, pain and suffering, disfigurement, and permanent or partial disability. There is not a deductible with this type.

-

Property damage UM/UIM pays for auto repairs, a rental car, and damage to items in your car.

Who it covers: You, your family members, passengers in your car, and others driving your car with your permission.

Insurance companies must offer UM/UIM coverage. If you don’t want it, you must reject it in writing.

Other Factors

Here are some other factors you should decide on when you make the choice to purchase uninsured motorist insurance:

-

Do you have health insurance, and will it cover injuries from an accident caused by an uninsured driver?

-

Does your health insurance cover loss of wages if you’re unable to work due to injuries sustained in an accident caused by an uninsured or underinsured driver?

-

Do you live in one of the states with the highest number of uninsured drivers?

-

Is there a high rate of stolen vehicles in the area in which you live?

-

Do you often carpool or drive other passengers (but not for a fee)?

-

Do you live in an area that has a high occurrence of accidents?

Before you choose or refuse UM or UIM insurance you should check with your health insurer and determine exactly what would be covered and what would not. If you’re still not clear then make a list of questions before you get your insurance quote from us!