What is Required for Denver Drivers?

A database has been maintained since 1997 that lists the proper amounts of insurance for individuals in Colorado. The program is used by government agencies such as traffic courts and law enforcement, aimed at reducing accident expenses and uninsured drivers.

In order to drive in Colorado, it is mandatory that you have the proper liability insurance. Liability insurance is coverage that will pay expenses of injuries to others as well as cover damage made to another’s vehicle due to an accident that you caused or that was caused by someone you permitted to drive your vehicle.

The minimum amount of liability required in the state of Colorado is as follows:

-

$25,000 per person - for bodily injury

-

$50,000 per accident - for bodily injury

-

$15,000 per accident - for property damage

Auto Insurance in Denver

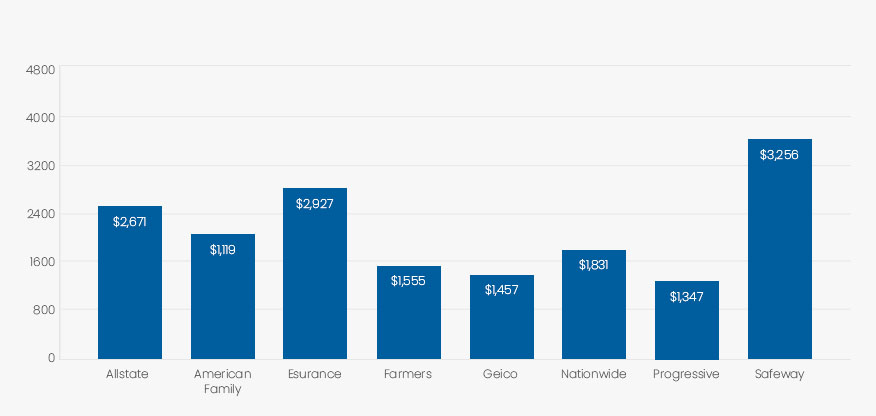

Unmarried Male, 21, No Violations in 3 Years – Lowest/Highest Coverage

This chart contains the results of our Denver insurance quotes analysis. We searched dozens of insurance companies that operate throughout the state of Colorado for insurance rates. After getting quotes from numerous providers in Colorado, we narrowed our results down to the eight trusted companies with the best insurance rates available. As usual, insurance rates in Colorado differ from city to city and depend on a number of factors.

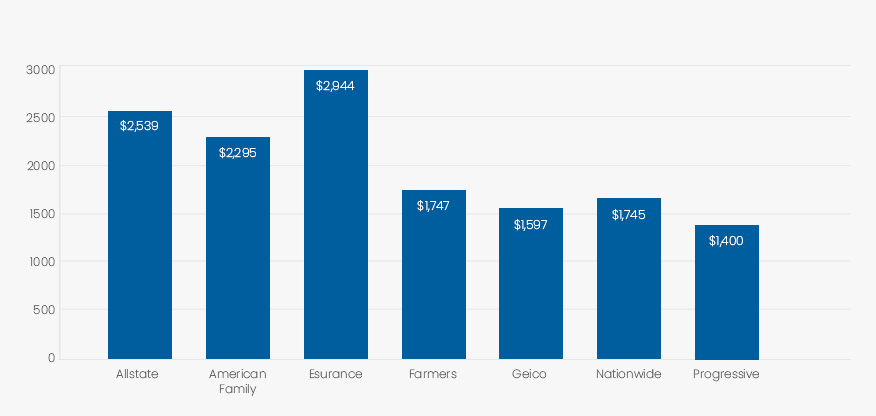

The first scenario is for a single male in his late 20’s who hasn’t had any violations within the past three years, drives at least ten miles each day to work, and is seeking the lowest coverage possible. Living in Denver, he can get the lowest coverage insurance plan with Progressive for just $922, which is the lowest rate. The highest rate of $3,694 is from Safeway. If the same male was looking for the most coverage available, Progressive provides the least expensive at $1,400 and Esurance costs the most at $2,944.

| Unmarried Young Male | Lowest Coverage |

| Allstate | $2,488 |

| American Family | $2,119 |

| Esurance | $2,927 |

| Farmers | $1,555 |

| Geico | $1,457 |

| Nationwide | $1,831 |

| Progressive | $1,347 |

| Safeway | $3,694 |

| Unmarried Young Male | Highest Coverage |

| Allstate | $2,539 |

| American Family | $2,295 |

| Esurance | $2,944 |

| Farmers | $1,747 |

| Geico | $1,597 |

| Nationwide | $1,745 |

| Progressive | $1,400 |

| Safeway | N/A |

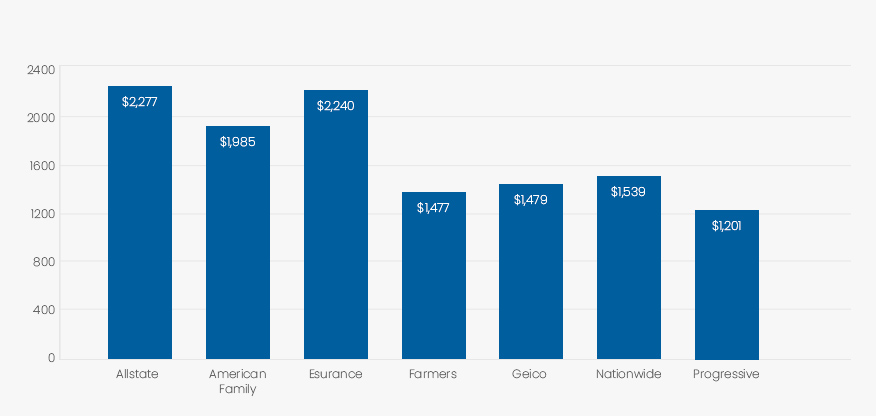

Unmarried Female, 21, No Violations in 3 Years – Lowest/Highest Coverage

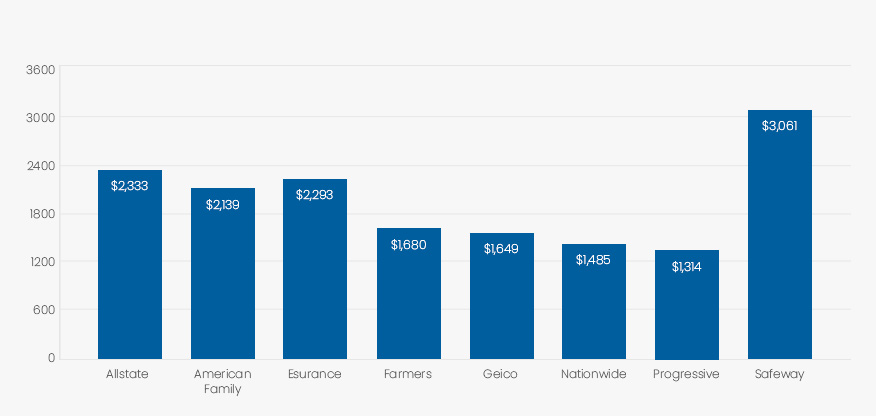

Now let’s take a look at the rates for a single female looking for the least amount of coverage allowed by state law, as well as the highest amount of coverage. The woman in this scenario is approximately 30 years old and hasn’t had any accidents where she was at fault in the previous three years. In addition, she drives 10 miles to work. In Denver, Progressive offers the lowest rate available for both minimum and full coverage, with the minimum costing $1,201 and the full coverage plan costing $1,314. American Family has the highest rate of $2,277 for minimal coverage and $3,061 for the highest coverage plan.

You may have noticed that insurance for males is more expensive than for females with the same scenario. This is because men of a certain age are considered more reckless than women in the same age group, who are more cautious while driving. However, as they age, men’s insurance costs begin to normalize. The rates for older women will be higher than a man’s in the same age group, but not by much.

| Unmarried Young Female | Lowest Coverage |

| Allstate | $2,277 |

| American Family | $1,985 |

| Esurance | $2,240 |

| Farmers | $1,477 |

| Geico | $1,479 |

| Nationwide | $1,539 |

| Progressive | $1,201 |

| Safeway | N/A |

| Unmarried Young Female | Highest Coverage |

| Allstate | $2,333 |

| American Family | $2,139 |

| Esurance | $2,293 |

| Farmers | $1,680 |

| Geico | $1,649 |

| Nationwide | $1,485 |

| Progressive | $1,314 |

| Safeway | $3,061 |

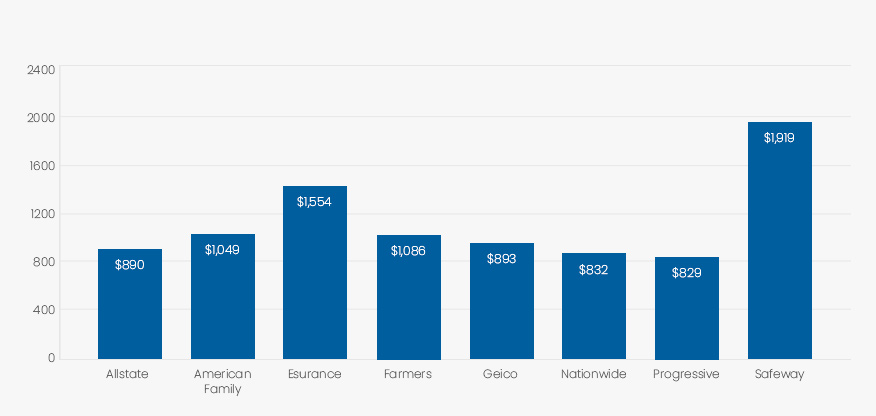

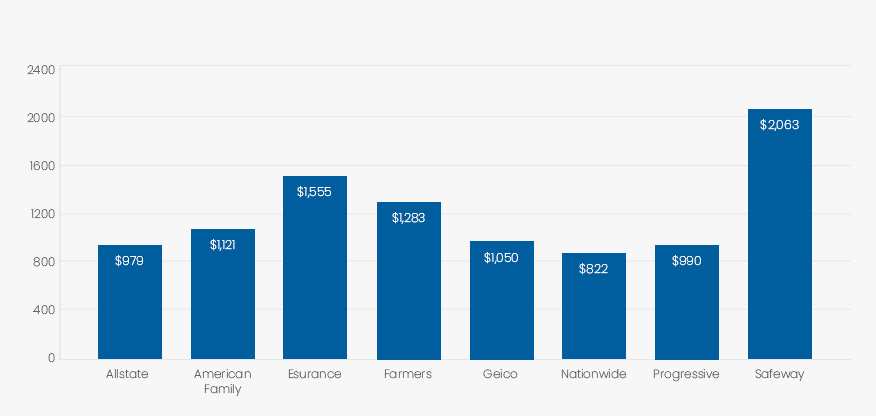

Married Male, 35, No Violations in 3 Years – Lowest/Highest Coverage

The chart we put together clearly shows that, for a 35-year-old married male with no violations in three years, the lowest rate for the least amount of coverage is $829 from Progressive and the highest is $1,919 from Safeway. Nationwide has the lowest rate of $822 for the highest coverage amount and Safeway in Denver has the highest rate for the highest coverage; $2,063.

You may be wondering why someone who is single has to pay more insurance than someone who fits the same profile but is married. The truth is, average singles pay 10% more in premiums than those who are married because single drivers are considered a higher risk, as they are more likely to file claims.

| Married Male | Lowest Coverage |

| Allstate | $890 |

| American Family | $1,049 |

| Esurance | $1,554 |

| Farmers | $1,086 |

| Geico | $893 |

| Nationwide | $832 |

| Progressive | $829 |

| Safeway | $1,919 |

| Married Male | Highest Coverage |

| Allstate | $979 |

| American Family | $1,121 |

| Esurance | $1,555 |

| Farmers | $1,283 |

| Geico | $1,050 |

| Nationwide | $822 |

| Progressive | $990 |

| Safeway | $2,063 |

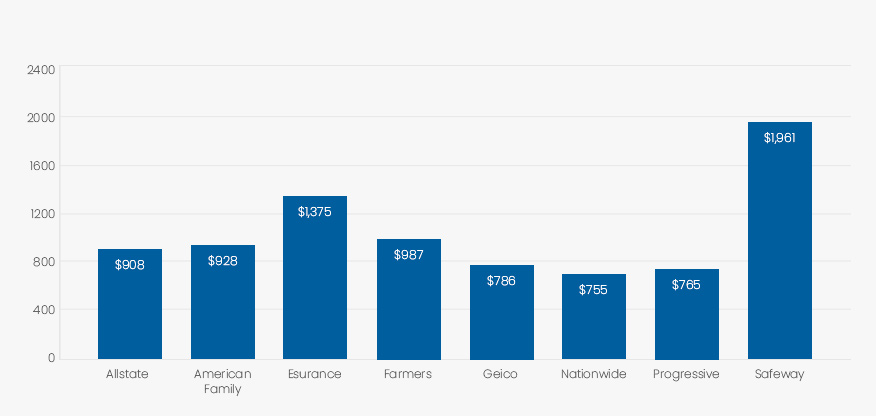

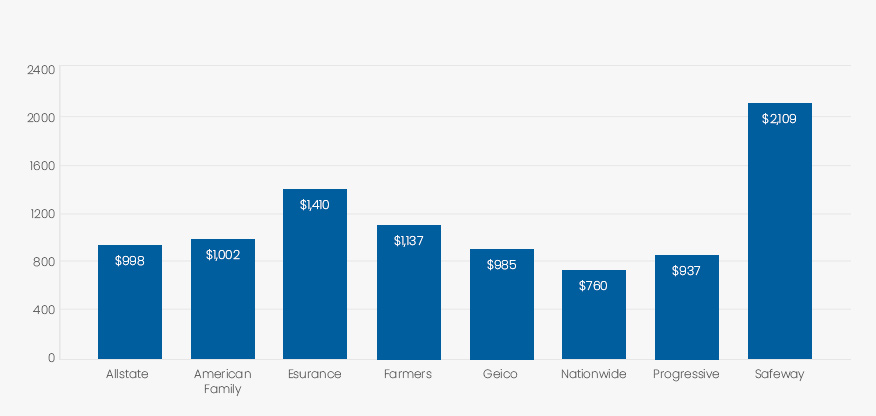

Married Female, 21, No Violations in 3 Years – Lowest/Highest Coverage

A married female living in Denver, without any violations, and who doesn’t drive for work can get minimum insurance coverage from Nationwide for as little as $755 and full coverage from Nationwide for just $760. The most expensive of these plans comes from Safeway, with minimum coverage for $1,961 and full coverage for $2,109.

| Married Female | Lowest Coverage |

| Allstate | $908 |

| American Family | $928 |

| Esurance | $1,375 |

| Farmers | $987 |

| Geico | $786 |

| Nationwide | $755 |

| Progressive | $765 |

| Safeway | $1,961 |

| Married Female | Highest Coverage |

| Allstate | $998 |

| American Family | $1,002 |

| Esurance | $1,410 |

| Farmers | $1,137 |

| Geico | $985 |

| Nationwide | $760 |

| Progressive | $937 |

| Safeway | $2,109 |

The Difference Between Liability and Full Coverage in Denver

What is Liability-Only

Liability is insurance coverage that helps protect others in the event of a collision where you are at fault. Coverage is basically a liability policy divided into two sections, breaking down the limits of each: bodily injury and property damage. Bodily injury liability is also split into two different segments: bodily injury per person and per accident. Colorado state limits are $25,000 bodily injury protection per person, up to $50,000 personal injury protection per accident, and $15,000 protection for property damage, shown as 25/50/15.

This means that if you carry the minimum state liability insurance and cause an accident, your policy would cover up to $25,000 per person, up to $50,000 per accident for bodily injury — if you cause injury to multiple people — and $15,000 for property damage to another vehicle.

This does not include you or your vehicle. If you want to include protection for you and your vehicle you will need to get a full coverage policy.

What is Full Coverage

Full coverage combines collision and comprehensive insurance into one policy that will protect you and others. Collision coverage will protect your vehicle against damages in an accident, whether or not you were at fault. Comprehensive coverage will protect the vehicle from damage that resulted from an incident other than a driving accident such as vandalism, theft, fire, etc.

However, both collision and comprehensive insurance policies include a deductible in the plan, meaning you will have to pay a certain amount before your policy will take effect.

Difference Between the Two and Cost Examples

The difference between liability and full coverage insurance policies is that liability only covers other people and their vehicle if an accident should occur where you are at fault, but, with a full coverage insurance plan, you and your vehicle would also be covered along with other’s and their vehicle as well.

Another difference between the two is that a deductible is associated with full-coverage insurance, but not with liability.

There is also a difference in price, where full coverage will cost more than liability insurance. For example, the average annual insurance rates in Colorado are $592 for liability and $1,636 for full coverage. You pay $1,044 more for full-coverage or $87 per month, but you will have peace of mind knowing everything will be covered in the event of an accident or any damage done to you, your vehicle, and others and their vehicles as well.

Additional cities in Colorado you can check out:

- Colorado Springs

- Aurora

- Boulder

Ways to Lower Your Auto Insurance Rates in Denver

There are many ways that you can save on auto insurance in Denver:

-

A good driving record

Being a safe driver is the best way to keep your auto insurance cost down; the fewer accidents you have the less you will pay. -

Shop around for quotes

Insurance rates can vary substantially from company to company, which is why you will need to shop around and get quotes from each company. Most companies will give you a fast, free quote online. -

Raise your deductible

If you are considering getting a full-coverage plan, you can ask for a higher deductible to lower your monthly cost. The higher the deductible the lower your price will be. -

Save on bundling

You can save some money on auto insurance by bundling. Getting both auto insurance protections along with something like homeowners’ insurance in one plan will cost less than if you were to get separate plans. -

Establish a good credit report

Insurance companies base your cost on many factors, including what’s in your credit report, so, the better your credit report is, the lower your auto insurance costs will be. -

Reduce the miles you drive daily

Reducing how many miles you drive daily can also help cut auto insurance costs. You might consider car-pooling, taking a bus, or getting places the old-fashioned way - walk.

Factors That Affect Your Denver, CO Car Insurance Rate

There are quite a few factors included in determining your cost for auto insurance such as:

-

Your location

-

Age

-

Number of violations you had in the past

-

Gender

-

Whether you are married or single

-

Your credit score

-

The plan you are seeking

-

The deductible

-

Daily miles you drive

-

The make, model, and year of the vehicle to be insured

-

Whether you live alone or with others

-

Your occupation