What is Required for Atlanta Drivers?

Atlanta drivers are required to carry liability insurance. This is the type of insurance that covers you if you are at fault in an automobile accident. It covers the losses of those you might have harmed. The minimum insurance requirement in the state of Georgia is:

-

$25,000 that would pay for the death or injury of one other person in an accident that you caused

-

$50,000 to pay for the total loss due to injuries or deaths of more than one person due to an accident you cause

-

$25,000 to pay for any property damage that you caused in an accident where you were at fault

These sums of money would go to cover the expenses of property damage, medical bills, or other costs to people, vehicles, or other property you have injured, killed, or damaged in an accident in which you were at fault. If you are in a more serious accident, and you only have the minimum required insurance, you would be required to pay for the additional losses from your own finances.

Liability coverage only takes care of the loss others have experienced if you are at fault in an automobile accident. It does not compensate your loss if your vehicle is damaged, nor if you are injured in an accident and need medical care. You will need to take out collision and/or comprehensive insurance coverage if you wish to be able to cover your own losses in the event you are at fault in an accident.

Having liability coverage as well as comprehensive and collision coverage so that all expenses are covered in an automobile accident (unless you were driving recklessly) is considered full automobile insurance coverage.

Cheap Auto Insurance in Atlanta

In order to find the best deals for automobile insurance in the Atlanta area, we obtained quotes on different driver demographic scenarios from major automobile insurers who operate in the state of Georgia. We took quotes from the same 10 insurance companies for each driver demographic.

Insurance companies charge different rates depending upon the lifestyle, age, marital status, and driving record of drivers in a given area. In addition, insurers charge different rates for different areas of the country. These rates are based upon an analysis of risks for the different driver demographics and different areas of the country. For example, drivers who are in rural areas tend to be able to buy cheaper insurance than those who live in cities.

We obtained rate information from each of the 10 insurers for both full coverage and for liability-only coverage for each driver demographic. The differences in cost for automobile insurance can be quite astounding.

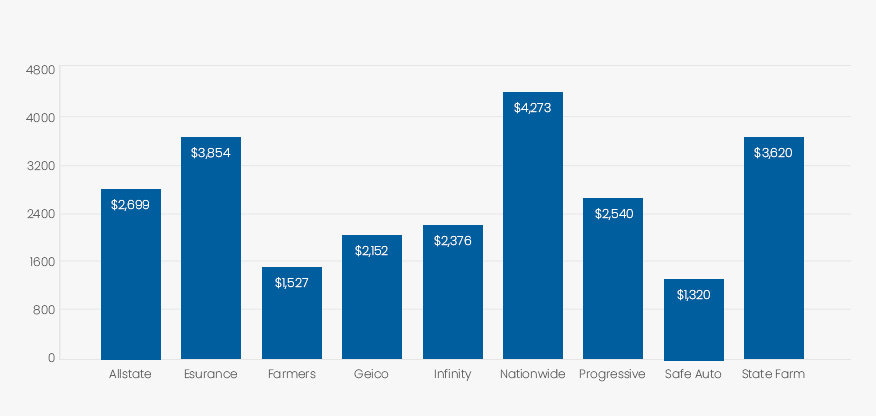

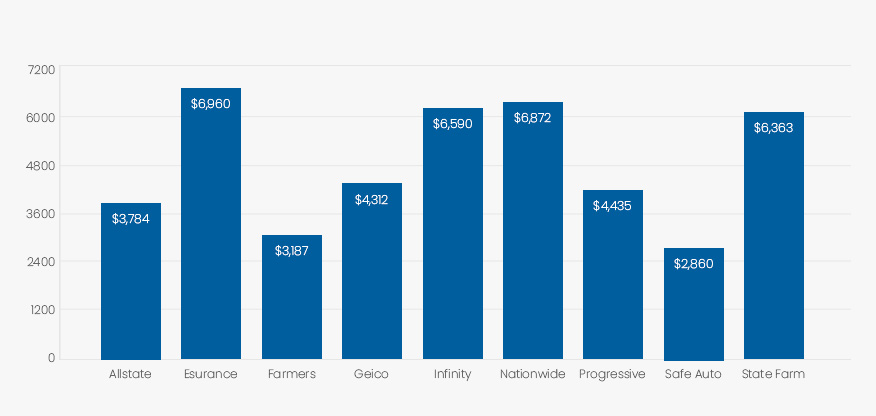

Unmarried Male, 19, 1 Ticket & No Accidents for 12 Months - Liability/Full Coverage

We began with one of the most expensive driver demographics for insurance coverage, a young male driver. This young male driver has one ticket and no accidents, having driven for the past 12 months. He drives approximately 15,000 miles each year. The rates for the Atlanta area and even which insurers are cheaper or more expensive will be different in other areas of the state.

Liability-Only - This unmarried, young male will find his cheapest liability-only rates at Safe Auto at $1,320 yearly and Farmers at $1,527 yearly. Geico and Infinity came in next cheapest in the low $2,000 range. Progressive and Allstate are in at the mid-$2,000 range. State Farm, Esurance, and Nationwide were the most expensive at over $3,000 a year, with Nationwide at $4,273. This is for liability-only insurance! Our savvy young driver who shops around will be able to save almost $3,000 a year on liability-only auto insurance from the carrier charging the most to the carrier charging the least.

Full Coverage – When shopping for full coverage insurance, our young male driver from Atlanta will again find Safe Auto the least expensive at $2,860 and Farmer's close by at $3,187, followed by Allstate in the high $3,000 range, and Geico and Progressive over $4,000. The most expensive options for a young male in Atlanta for full coverage insurance were State Farm, Infinity, Nationwide, and Esurance. Each of these most expensive options was over $6,000 a year. Esurance's rate, the highest for full coverage, was $6,960. That's just under $7,000 a year. By choosing the carrier who charges the least, our young male driver will save $4,100 per year in automobile insurance.

| Unmarried Male | Liability Coverage |

| Allstate | $2,699 |

| Esurance | $3,854 |

| Farmers | $1,527 |

| Geico | $2,152 |

| Infinity | $2,376 |

| Nationwide | $4,273 |

| Progressive | $2,540 |

| Safe Auto | $1,320 |

| State Farm | $3,620 |

| Unmarried Male | Full Coverage |

| Allstate | $3,784 |

| Esurance | $6,960 |

| Farmers | $3,187 |

| Geico | $4,312 |

| Infinity | $6,590 |

| Nationwide | $6,872 |

| Progressive | $4,435 |

| Safe Auto | $2,860 |

| State Farm | $6,363 |

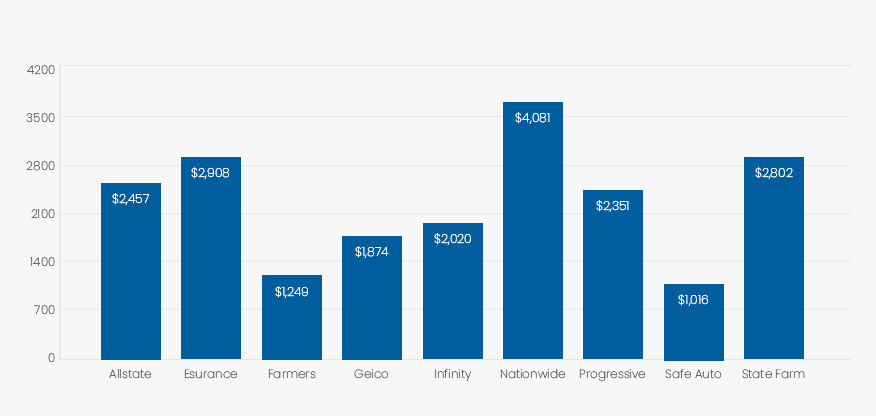

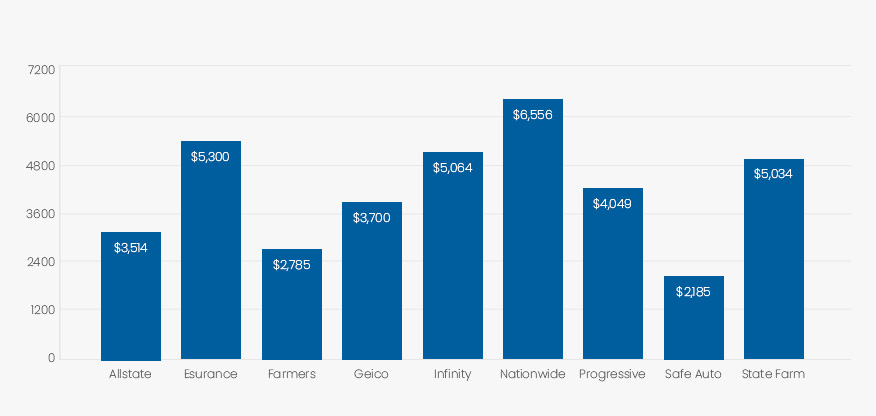

Unmarried Female, 19, 1 Ticket & No Accidents for 12 Months - Liability/Full Coverage

Next, we looked at a female inexperienced driver, 19-years-old, who has one ticket and no accidents. Insurance agencies tend to charge a bit less to female younger drivers than their male cohorts. It is important to emphasize that these are rates for the Atlanta area. The rates and which carriers are cheaper will vary by area.

Liability-Only - Our young female driver will save the most on her liability-only automobile insurance coverage with Safe Auto at $1,016. Again, Farmer's comes in second cheapest at $1,249. Geico keeps the cost under $2,000. In the $2,000 range are Infinity, Progressive, Allstate, State Farm, and Esurance. Nationwide comes in much higher than all of the rest of the carriers for liability-only insurance for a young female driver at $4,081. Thus, she can save over $3,000 per year in insurance by choosing the cheapest insurance carrier for her liability-only insurance as opposed to the most expensive carrier.

As you can see, the female driver is charged a few hundred dollars a year less than the young male driver for liability-only insurance.

Full Coverage – A young female driver will again find Safe Auto at $2,185 and Farmers at $2,785 her two cheapest carriers for full coverage insurance. Allstate and Geico keep things in the $3,000 range. Progressive is $4,049, while State Farm, Infinity, and Esurance top $5,000 a year for full coverage in this scenario. Nationwide again comes in much higher than the rest at $6,556. Our young female driver would be well advised to save over $4,000 a year and choose the cheapest carrier over the most expensive.

In the case of this driver wanting full coverage insurance, she is still being charged a few hundred to several hundred dollars less per year than her male cohort. The clear pattern is that Safe Auto and Farmer's are charging significantly less for automobile insurance for younger drivers, while the most costly carriers for this driver demographic are Nationwide and Esurance.

| Unmarried Female | Liability Coverage |

| Allstate | $2,457 |

| Esurance | $2,908 |

| Farmers | $1,249 |

| Geico | $1,874 |

| Infinity | $2,020 |

| Nationwide | $4,081 |

| Progressive | $2,351 |

| Safe Auto | $1,016 |

| State Farm | $2,802 |

| Unmarried Female | Full Coverage |

| Allstate | $3,514 |

| Esurance | $5,300 |

| Farmers | $2,785 |

| Geico | $3,700 |

| Infinity | $5,064 |

| Nationwide | $6,556 |

| Progressive | $4,049 |

| Safe Auto | $2,185 |

| State Farm | $5,034 |

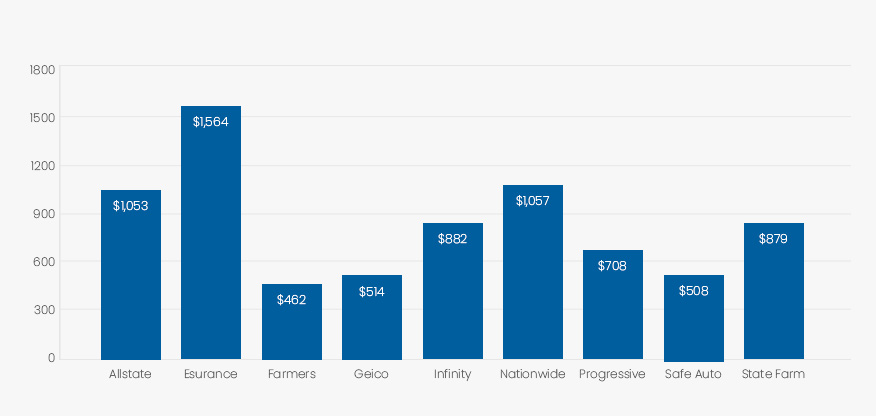

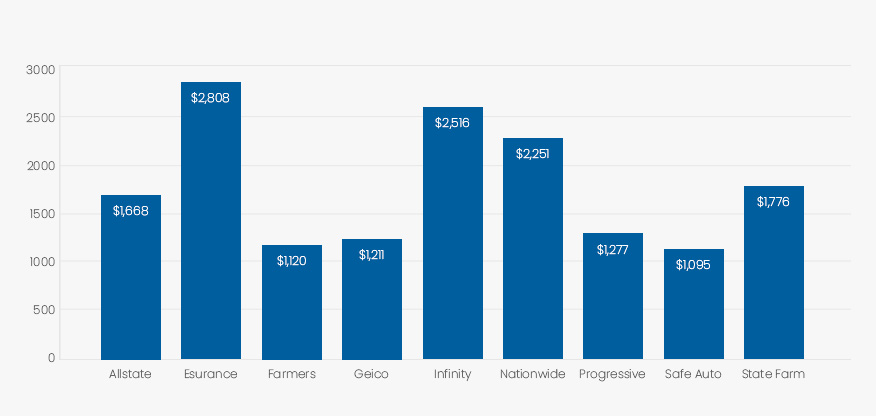

Married Couple, 65, Clean Record, +- 7,500 miles Driven Annually – Liability/Full Coverage

Married couples and older drivers tend to be charged less for their automobile insurance than younger, less experienced drivers. Our driver demographic here will be a married couple who are aged 65 and have no accidents or moving violations on their record. They drive around 7,500 miles a year.

Liability-Only - The older married couple wanting to only carry liability insurance will be charged significantly less than the younger drivers. Seven of the 10 carriers come in less than $1,000. Only one carrier, Esurance, comes in over $1,500 a year for liability-only insurance for the older married couple. The cheapest carriers are Farmer's, Geico, and Safe Auto. All three are in the $450 to $500 range.

In this case, the older married couple will save over $1,100 a year by choosing the cheapest carrier over the most expensive.

Full Coverage – An older couple who opts for full coverage will find the cheapest carriers come in at just over $1,000 a year - Safe Auto, Farmer's, Geico, and Progressive. Safe Auto is the lowest at $1,095 yearly. Three more carriers come in at the $1,000 range. Three carriers - Nationwide, Infinity, and Esurance - will charge our older couple over $2,000 for their full coverage insurance. Esurance is the most expensive at $2,808 yearly. So, an older couple desiring full coverage insurance will save over $1,600 per year if they choose the cheapest carrier over the most expensive. Their insurance is substantially cheaper per year than that charged by the insurance carriers to the younger male and female drivers.

| Married Couple | Liability Coverage |

| Allstate | $1,053 |

| Esurance | $1,564 |

| Farmers | $462 |

| Geico | $514 |

| Infinity | $882 |

| Nationwide | $1,057 |

| Progressive | $708 |

| Safe Auto | $508 |

| State Farm | $879 |

| Married Couple | Full Coverage |

| Allstate | $1,668 |

| Esurance | $2,808 |

| Farmers | $1,120 |

| Geico | $1,211 |

| Infinity | $2,516 |

| Nationwide | $2,251 |

| Progressive | $1,277 |

| Safe Auto | $1,095 |

| State Farm | $1,776 |

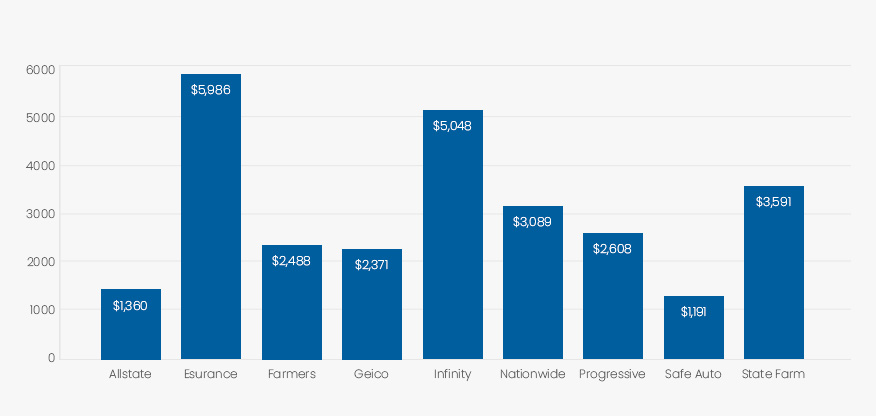

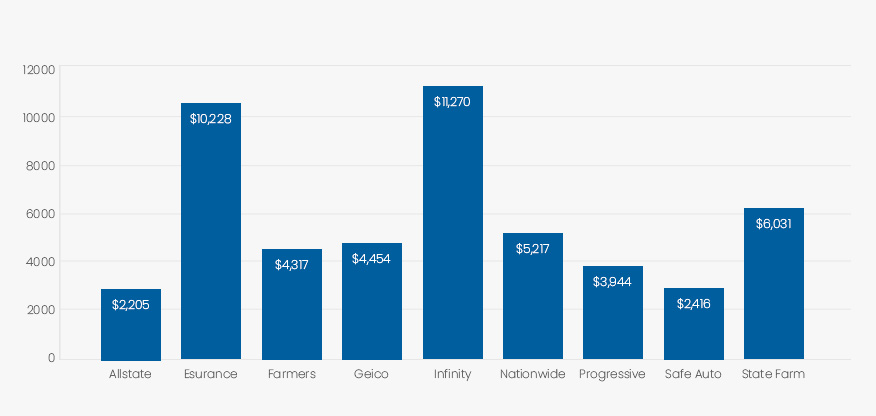

Single Mother, 35, Occasional 17-Year-Old Male Driver, Clean Records – Liability/Full Coverage

Our final driver demographic is a single mother who is 35 years of age. She has a 17-year-old son who occasionally drives the car. Neither of them has any accidents or moving violations on their driving records.

Liability-Only - The single mom will pay the least for liability-only insurance with Safe Auto at $1,190 and Allstate at $1,360 yearly. Geico, Farmer's, and Progressive all fall in the $2,000 range. Nationwide and State Farm will charge her over $3,000 yearly, while Infinity and Esurance top out at over $5,000 yearly for liability-only insurance. Esurance is just shy of $6,000.

One has to wonder if the addition of the young male's incidental driving of the family car is making the Infinity and Esurance rates so much higher than the other carrier's quotes. In this case, our single mom would save almost $5,000 a year by choosing the cheaper as opposed to the most expensive carrier. We have to remember that this is a quote for only liability coverage!

Full Coverage – Sadly, the rates charged to this single mom with occasional driving by her young male son get absolutely astronomical with full coverage insurance, especially from the most expensive carriers. The cheapest carriers are Allstate at $2,205 and Safe Auto at $2,416. Progressive, Farmer's, and Geico come in at around the $4,000 range, a big jump. Nationwide and State Farm come in at around $5,000 and $6,000 respectively. The shocking ones, though, are Esurance at over $10,000 and Infinity at $11,270. Remember that the highest price for a young male with full coverage as the only driver on a policy was around $7,000. Thus, our single mom who hopes to afford full coverage automobile insurance for her with her son only driving occasionally will save an incredible $9,000 a year by choosing the cheapest carrier over the most expensive one.

| Single Mother | Liability Coverage |

| Allstate | $1,360 |

| Esurance | $5,986 |

| Farmers | $2,488 |

| Geico | $2,371 |

| Infinity | $5,048 |

| Nationwide | $3,089 |

| Progressive | $2,608 |

| Safe Auto | $1,191 |

| State Farm | $3,591 |

| Single Mother | Full Coverage |

| Allstate | $2,205 |

| Esurance | $10,228 |

| Farmers | $4,317 |

| Geico | $4,454 |

| Infinity | $11,270 |

| Nationwide | $5,217 |

| Progressive | $3,944 |

| Safe Auto | $2,416 |

| State Farm | $6,031 |

The Difference Between Liability and Full Coverage in Atlanta

What is Liability-Only?

Liability-only coverage means coverage that only pays for the loss others incur if you are at fault in an automobile accident. These are for the medical expenses, other property damage or car repairs that you cause to another or their property in an accident.

One has the option of paying for more than the state minimum requirements outlined above for liability insurance. That is a good idea because you will be personally liable from your own finances and assets if you harm someone else or their property in an accident and your state minimum coverage levels do not fully reimburse the losses of the other party.

What is Full Coverage?

Full coverage means that you not only have adequate insurance to cover the losses of others if you are at fault in an accident. Full coverage means you have all the liability coverage you need to care for the harm to others if you have an accident and are at fault, and you have coverage for your own losses as well. There are two main kinds of other coverages that drivers purchase in order to repair their vehicles in the event of an accident they cause:

Collision – Collision insurance covers the cost of repairing your own car if you are in an accident that is your fault. A way to save money on collision insurance is to purchase it with a higher deductible. For example, it will likely be very expensive to have collision coverage on your vehicle with a $500 deductible, but a $1,500 deductible or a $2,000 deductible will save considerable money on your automobile full coverage policy.

Comprehensive – Comprehensive insurance covers the cost of repairing your vehicle for those things that were not your fault, like extreme weather that damaged your vehicle, or a deer that walked in front of you, theft, or vandalism. Comprehensive insurance tends to be much cheaper than collision. Even those with older vehicles may benefit from carrying comprehensive insurance because it is relatively cheap and will cover things like windshield replacement.

Difference Between the Two and Cost Examples

So, liability-only insurance coverage will pay for what you did to the neighbor's bumper when you backed into it while rushing to work. It will pay for the hospital visit by a bicyclist you hit who has a broken leg. Liability-only only insurance will pay for the utility panel you hit at the RV resort when you had trouble backing in.

Collision will pay for any damage you did to your own vehicle when you backed into that utility panel at the RV resort. Comprehensive will pay for the damage your vehicle suffered when a tree fell on it in intense rains that weakened the soil.

As you can see from the examples above, in our driver demographics, our unmarried young male paid $1,320 for liability-only and $2,860 for full coverage in Atlanta as his cheapest option. The young female's cheapest liability-only option was $1,016. Her full coverage best bet was $2,815 yearly. For the older married couple, they had the choice from the cheapest carrier of a liability-only policy at around $450 a year versus a full coverage policy at $1,095 yearly. The single mom with her occasionally driving adolescent son could opt for a liability-only policy of $1,190 or full coverage for $2,205 yearly. In each case, the difference is substantial – hundreds to a thousand-plus dollar differential in cost yearly.

Ways to Lower Your Auto Insurance Rates in Atlanta

-

Shop around

As you can see from the quotes, there are wildly different prices for auto insurance for the same driver demographic by carrier. We found a thousand or more dollars of difference in most cases. -

Keep your driving record clean

If you can drive really defensively, you are going to save money. People with a lot of accidents and moving violations on their record have trouble getting insured at any rate. -

Look for discounts

Most auto insurance carriers have discounts for good driving and some student discounts. Sometimes, the agent will not automatically apply the discount. Look on the website to see what discounts they offer. -

Drive an older vehicle you maintain well

Since newer vehicles usually require full coverage because you are making payments on the vehicle, you can save considerable money on insurance if you drive an older vehicle that is not worth much money. You won't need full coverage, although comprehensive insurance is advisable and cheap. This is especially true for young drivers in the family. If they drive used, well-maintained vehicles, they won't need to pay for full coverage insurance. This can amount to a savings of one or more thousands of dollars each year in insurance costs. -

Choose a higher deductible for collision insurance

A higher deductible equates to a lower rate on expensive collision insurance, since you are footing more of the bill in the event of an accident.

Factors That Affect Your Atlanta, GA Car Insurance Rate

As you can see, car insurance rates are influenced by a complex set of factors, all of them are determined by risk data for each insurance agency. How much each agency charges, though, based upon similar risk data, can vary widely. In the case of younger drivers, they can save literally thousands of dollars each year by shopping around. The insurance agencies will charge drivers different rates for their automobile insurance premiums by their age and marital status, driving record, area they live in, and whether they carry liability-only or full coverage insurance. If the customer opts for collision insurance, the carriers will charge more for a lower deductible.

Since there are so many factors to take into consideration in how much an insurance agency charges you for automobile insurance, it quite literally pays to thoroughly educate yourself about automobile insurance and to shop around for the best quote.

Helpful Atlanta, Georgia Vehicle Resources:

Live Traffic and Accidents

https://www.localconditions.com/weather-atlanta-georgia/30301/traffic.php

DMV (Find Locations, Vehicle Registration, Titles and Insurance Info)

https://dds.georgia.gov/locations/atlanta

Additional Nearby Cities in Alabama to check out:

Augusta

Columbus

Sandy Springs