New York Car Insurance

- Requirements for New York Drivers

- Minimum Auto Insurance Requirements in New York

- Are Any Auto Insurance Laws Specific to the state of New York

- Ways to Lower Your Auto Insurance in New York

- Are Requirements Different for Part-Time or Full-Time New York Residents

- New York Rates Compared to National Average

When we think of New York, we think of Times Square, Empire State Building, Niagara Falls and The Big Apple to name just a few. What we seldom think of is driving because it’s not typically a place people want to drive because of the heavy and congested traffic. However, many New Yorkers do drive through the state for either pleasure or work. For these drivers, auto insurance is necessary. Get all the facts about New York auto insurance laws and learn how to save on your premiums.

Summary of Auto Insurance in New York

New York is one of a dozen states that are no-fault insurance states. What this means is that if you’re in an accident, your damages and expenses will be paid by your insurance company regardless of who was at fault. Individuals who are covered under New York’s no-fault law include drivers, passengers, pedestrians or bicyclists who are hit by a driver in New York as long as the following criteria is met.

- Accident must occur in New York

- Vehicle must be registered in New York

- Vehicle must be one covered by the New York no-fault law (car, taxi or bus)

- Vehicle must be insured through a New York-approved insurance company

- Injured individual must be a driver or passenger of an insured vehicle.

New York implemented the no-fault insurance system to decrease the number of accident-related lawsuits. If you’re in accident, your expenses are paid by your insurance company and the other driver’s accident expenses will be paid by his or her insurance company. If you suffer severe injuries in a car accident, the state of New York allows you to step out of the no-fault system and initiate a lawsuit against the other individual’s insurance company.

There are many insurance companies throughout the state of New York. When looking for auto insurance, you’ll have more than your share from which to choose. However, most of the New York car insurance companies offer the same type of coverage.

- Collision insurance will pay to repair or replace your vehicle when it is damaged due to a collision into either another car or object. There is a deductible with collision coverage.

- Comprehensive insurance will pay to have your vehicle fixed when it’s involved in an accident that was not a collision. There is a deductible with comprehensive coverage.

- Bodily injury liability insurance pays for damages you cause to another resulting from an accident.

- Property damage liability pays for damages you do to another person’s property such as hitting into their parked car or building.

- Personal injury protection (PIP) is part of a no-fault insurance policy and it pays for injuries you sustain in an accident.

- Uninsured motorist insurance coverage protects you if you’re in an accident with a driver who has no insurance or doesn’t have enough to pay for your damages.

- Towing coverage helps you to pay your vehicle to be towed when it’s involved in an accident.

- Rental coverage helps pay for a rental vehicle while your vehicle is being repaired from accident-related damages.

Requirements for New York Drivers

New York is a no-fault insurance state and, as such, requires drivers have the following type of auto insurance.

- Bodily Injury

- Property Damage

- No-fault or Personal Injury Protection (PIP) insurance

- Uninsured motorist’s Bodily Injury

New York drivers must have an auto insurance policy from a company that’s licensed by the New York State Department of Financial Services and certified by the New York State Division of Motor Vehicles. Under no circumstances can a New York driver have auto insurance from another state if he or she is driving with a New York driver’s license.

When you purchase your car insurance in New York City, the agent will give you an insurance identification card and or and id to access it electronically. The agent will also send verification of your insurance to the DMV. You must show proof of insurance before you can register your vehicle in New York.

The name on your registration must match the name on your insurance card. Failure to have insurance on your car can result in suspension of your license and your registration. It can also result in fines from $150 to $1,500 and up to 15 days in jail.

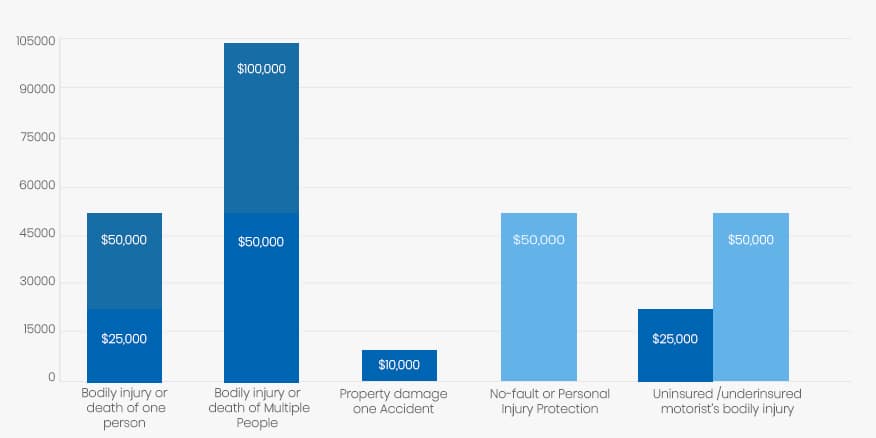

Minimum Auto Insurance Requirements in New York

New York drivers must carry the minimum amounts of liability insurance in New York.

| Coverage | Minimum |

| Bodily injury | $25,000 for bodily injury and $50,000 for death of one person |

| Bodily injury | $50,000 for bodily injury and $100,000 for death of multiple people |

| Property damage | $10,000 for one accident |

| No-fault or Personal Injury Protection (PIP) insurance | $50,000 |

| Uninsured /underinsured motorist’s bodily injury | $25,000/$50,000 (same as liability coverage) |

Drivers can also purchase supplementary uninsured/underinsured motorist (SUM) coverage for the same amount as their liability coverage. Individuals who have bodily injury liability coverage for $25,000/$500,000 must be offered SUM coverage for the same amount.

Are Any Auto Insurance Laws Specific to the state of New York?

Drivers who have a history of claims, poor driving records or no prior driving experience may be denied coverage through the voluntary market. These drivers can purchase auto insurance through the New York Automobile Insurance Plan (NYAIP). Although the rates through the NYAIP are monitored by the Department of Financial Services, they are going to be higher than what you’d get in the voluntary market. If a driver gets his or her insurance through the NYAIP, their coverage cannot be terminated for three years.

Ways to Lower Your Auto Insurance in New York

When determining your auto insurance rates, insurance companies use several factors. While each company may have their own criteria, most of them use the following.

- Gender and age

- Driving History

- Vehicle make, model and year

- Type of Use

- Where you live

- Policy Coverage

- Marital Status

- Credit Scores

- Your Deductible

Most insurance companies offer discounts to customers who meet certain criteria. Each company does not offer the same discounts, so don’t be afraid to ask a potential agent what discounts they offer and which ones may apply to you. Knowing what each company offers can help you get the best possible coverage for the lowest price. Here are some common discounts you may get on your New York car insurance.

- Air bag or automatic seat belt discount

- Accident prevention course discount

- Anti-theft devices discount

- Combat auto theft program graduate

- Daytime running lights discount

- Accident or claims free discount

- Multi-car discount

- Credit Scores

- Driver training discount

Are Requirements Different for Part-Time or Full-Time New York Residents?

Full- and part-time residents of New York have the same requirements regarding auto insurance. The requirements are based more on your driver’s license than anything else. If you have a New York driver’s license, you must meet New York’s requirements for car insurance. Since New York is a no-fault insurance state, drivers must carry the state’s required amounts whether they’re temporary or full-time residents.

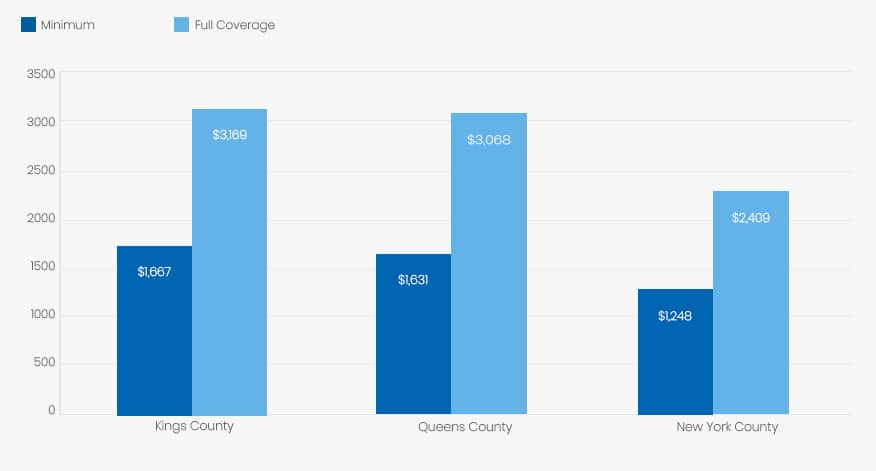

New York Rates Compared to National Average

New York car insurance is quite expensive and much higher than the national average. The average annual cost for car insurance overall in New York is about $1,200 while the national average is slightly under $900. It’s worth noting, however, that a lot has to do with where in New York you live. For instance, car insurance in New York City or Queens is substantially higher than both the national and the state average.

Average Rates in Top Three New York Counties

Car insurance premiums are generally cheaper for female and married individuals, although this may not always be the case in New York. Where you live also plays a part. Using the example of a married 45-year old woman with a good driving record, I’ve compiled the premiums from three top counties in New York for both full and liability coverage.

| City | Minimum Coverage | Full Coverage |

| Kings County | $1,667 for state minimum requirements of liability | $3,169 for full coverage |

| Queens County | $1,631 for state minimum requirements of liability | $3,068 for full coverage |

| New York County | $1,248 for state minimum requirements of liability | $2,409 for full coverage |

As stated above, some areas of New York have higher insurance rates than other areas, which is evident with the example above. A lot of this has to do with the crime rate and cost of living in these areas. Areas where more people drive and commute to work, like Brooklyn and Queens, tend to have the highest car insurance rates.

Conclusion

As you’ve noticed, auto insurance in New York can be quite costly. However, you don’t have to let high insurance premiums cast a shadow on your joy of living in this hustling and bustling state that has so much to offer. Driving safely, comparison shopping for insurance and getting the most out of your insurance company discounts can make it easy to get the lowest possible premiums.

Sources:

- http://www.dfs.ny.gov/consumer/faqs/faqs_auto

- https://dmv.ny.gov/insurance/insurance-requirements