Known as the “Buckeye” state, Ohio is known for many iconic foods, including the popular buckeyes, thurmanators and paw paws. As the seventh most populous state in the U.S., Ohio is also a state with many highways leading in many different directions making the need for good car insurance a necessity. Finding good auto insurance is most possible if you know what’s available and what the state requires of its drivers. You’ll also find some helpful tips on how you can save money on your premiums.

Summary of Auto Insurance in Ohio

The first thing you’ll find when shopping for car insurance is that there are many insurance companies in Ohio. Another thing you’ll discover is that they all generally offer the same type of coverage for you, your family and your vehicle. Some of the types of coverage are mandatory while others are optional. The types of car insurance coverages offered include the following.

Collision

If you collide into another car or object, this coverage helps you pay to have the car fixed or replaced if it’s a total loss.Comprehensive

If your car is damaged from a storm, animal, vandals or falling object, this coverage will pay to have it fixed or replaced if it’s a total loss.Bodily injury liability

If you’re in an at-fault accident and someone sews you for bodilyProperty Damage Liability

If you hit into someone else’s property, this coverage will pay for the damages, but will not pay for your car.Uninsured/underinsured motorist coverage

If you’re in an accident with a driver who has no insurance or an insufficient amount, this coverage kicks in to help you.Rental Coverage

This will pay the expenses of a rental car while your vehicle is being repaired.Towing Coverage

helps you pay to have your vehicle towed if it’s involved in an accident or it breaks down on the road. It’s usually part of roadside assistance coverage.

Requirements for Ohio Drivers

States are either no-fault or at-fault insurance states when determining who is responsible for damages after an accident. Ohio is an at-fault insurance state, which means they use the fault or tort system. When an accident takes place, the person who was at fault is the one that is responsible for all accident-related expenses. This includes the vehicle, medical expenses and any additional expenses. The person who is not at fault is also entitled to sue the driver who was at fault.

Ohio requires drivers carry the following types of coverage on their vehicles.

- Bodily injury

- Property damage

While uninsured/underinsured motorist coverage can be very helpful, it’s not a requirement in Ohio. Collision and comprehensive insurance may be required by your lender if you have a car loan and are using the vehicle as collateral.

There are also deductibles on collision and comprehensive coverage. The deductible is the amount you must pay on a claim before the insurance company pays anything. You have to satisfy the deductible, which may be from $250 to $1,000 or more, each time you’re in an accident.

If your car has damages that require $3000 in repairs and you have $500 deductible, your insurance company will pay $2,500 and you pay $500. You choose whatever deductible, but the lower the deductible, the higher the premium. Drivers who pay high insurance rates often choose higher deductibles to lower their premium.

Drivers in Ohio are required to show proof of financial responsibility. This means that if they’re in an accident that they caused, they have the financial means to cover expenses. While this is usually accomplished by purchasing auto insurance, the Ohio Bureau of Motor Vehicles does allow drivers to use the following alternatives.

- A certificate bond for at least $30,000 deposited with the Ohio State Treasurer

- A BMV-issued real estate bond for at least $30,000

- A certificate of self-insurance

- A $30,000 surety bond

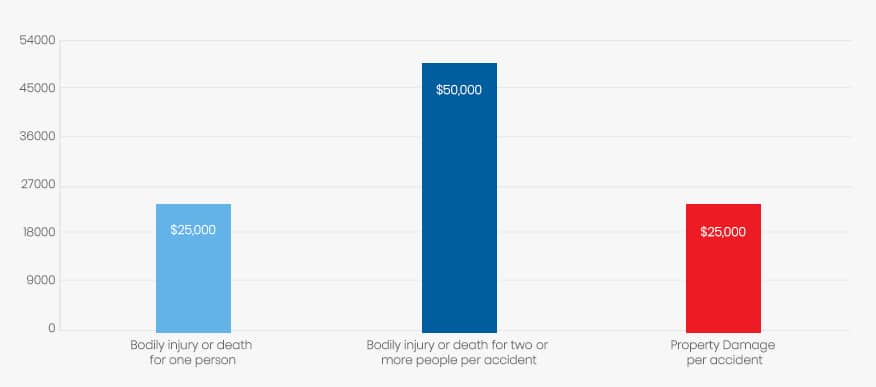

Minimum Auto Insurance Requirements in Ohio

In Ohio, drivers are required to carry at least the following amounts of car insurance.

| Coverage | Minimum |

| Bodily injury or death for one person | $25,000 |

| Bodily injury or death for two or more people per accident | $50,000 |

| Property Damage per accident | $25,000 |

This coverage will be listed on your policy as 25/50/25 or $25/000/$50,000/$25,000. Keep in mind that these are the bare minimum amounts of liability coverage you must carry. You have the option of purchasing higher amounts. In fact, the Ohio Department of Insurance recommends getting higher amounts because your assets can be exhausted quickly with a car accident or an accident-related lawsuit.

Liability insurance is usually offered at 50/100/50, 100/200/100 or even higher if requested. The higher limits you purchase, the more protection you’ll have if you were to be sued for a car accident you or a family member caused.

Are Any Auto Insurance Laws Specific to the state of Ohio?

In Ohio, if you’re caught driving without proof of insurance, you can face the following penalties

- License suspension for up to 90 days (a year for repeat offenders)

- Impoundment of license plates and/or vehicle

- Reinstatement fee of at least $75

- Requirement to provide proof of responsibility through use of SR-22 form

The Ohio Bureau of Motor Vehicles randomly checks to see if drivers have insurance with the electronic verification system. You are required to show proof of car insurance if you’re randomly selected, you’re involved in a car accident or are stopped by law enforcement for a traffic infraction.

The Ohio Automobile Insurance Plan is available to drivers who cannot purchase insurance through the open market because of their driving records or history of claims. The premiums are quite a bit higher through the OAIP, but it does guarantee that drivers can have the insurance the state requires.

Ways to Lower Your Auto Insurance in Ohio

Often two friends will wonder why their auto insurance rates are so different when they’re the same age and drive the same types of vehicles. There are several factors that go into determining what drivers pay for Ohio auto insurance.

- Type of vehicle you’re driving

- Prior insurance coverage

- Miles you drive

- Your driving record

- Your age and gender

- Marital status

- Where you live

- Years you’ve been driving

- If vehicles is used for business or pleasure

Even with the most favorable factors on your side, you may still be paying more for your insurance than you’d like. Discounts are an excellent way to lower your premiums. Almost every insurance company offers discounts. It’s just a matter of finding the insurance company that offers the most discounts. Although it may vary, most auto insurance companies offered the following discounts.

- Home and car bundle discount

- Multi-car discount

- Accident free discount

- Good student discount

- Auto pay discount

- Full pay discount

- Safety device discount

Another factor that often comes into play to determine rates is how likely a vehicle is to be stolen. Some vehicles tend to be stolen more often than others are. Below is a list of the ten most stolen vehicles in Ohio in 2016.

- 2002 Dodge Caravan

- 2005 Chevrolet full size pickup

- 2004 Ford full size pickup

- 2006 Chevrolet Impala

- 2000 Honda Accord

- 2005 Chevrolet Malibu

- 2001 Jeep Cherokee/Grand Cherokee

- 2000 Honda Civic

- 2007 Toyota Camry

- 2003 Jeep Liberty

Are Requirements Different for Part-Time or Full-Time Ohio Residents?

The auto insurance requirements are the same for part-time (temporary) and full-time residents of Ohio. If you’re moving into Ohio, you’re required to register your vehicle within a certain number of days. You must show proof of insurance at this time. Part-time residents must follow the insurance requirements from the state in which their vehicle is registered.

Ohio Rates Compared to National Average

Although car insurance rates have increased in Ohio in recent years, Ohio is still the 12th cheapest state for car insurance according to the Ohio Department of Insurance. The average annual rate for Ohio drivers is about $700, which is lower than the national average of $900. Learn about the car insurance rates in Columbus, OH.

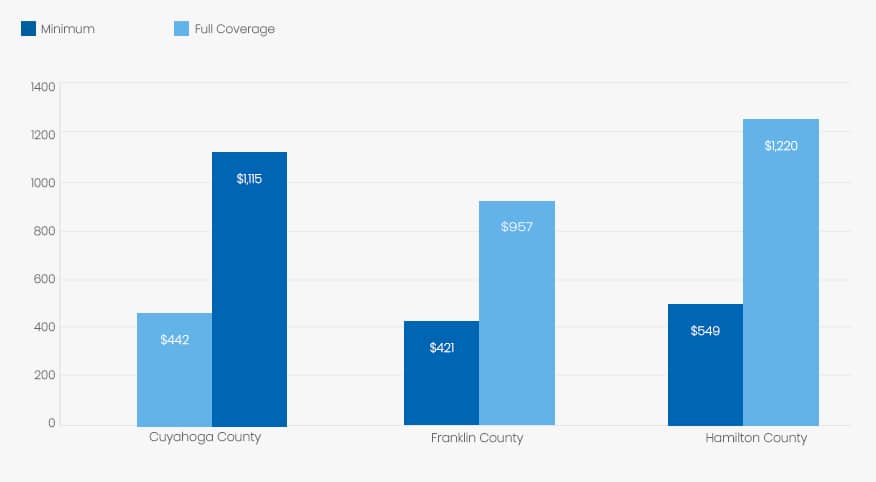

Average Rates in Top Three Ohio Counties

Auto insurance rates, while somewhat on the low side, tend to fluctuate from county to county. Below you will see some rates for a married 45-year old woman with a good driving record. I’ve listed the average annual premiums for this woman for three top counties in Ohio. While Cuyahoga and Hamilton County have similar rates, you can see that rates in Franklin Counts are quite a bit lower.

| County | Minimum Coverage | Full Coverage |

| Cuyahoga County | $442 for state minimum requirements of liability | $1,115 for full coverage |

| Franklin County | $421 for state minimum requirements of liability | $957 for full coverage |

| Hamilton County | $549 for state minimum requirements of liability | $1,220 for full coverage |

Conclusion

Shopping for Ohio auto insurance doesn’t have to be the stressful and daunting task we often make it out to be. You want the best possible coverage for your money. You want a policy that gives you the best protection against lawsuits that could wipe you out financially while also having a policy that will cover your cover from damages. The best way to get the policy you need for the best possible price is to shop around with the various auto insurance companies in Ohio.

Sources:

- http://insurance.ohio.gov/Newsroom/Pages/10182017OhioHomeAutoRates.aspx